- South Africa

- /

- REITS

- /

- JSE:GRT

Shareholders Will Probably Be Cautious Of Increasing Growthpoint Properties Limited's (JSE:GRT) CEO Compensation At The Moment

The disappointing performance at Growthpoint Properties Limited (JSE:GRT) will make some shareholders rather disheartened. The next AGM coming up on 16 November 2021 will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. From our analysis below, we think CEO compensation looks appropriate for now.

View our latest analysis for Growthpoint Properties

How Does Total Compensation For Leon Sasse Compare With Other Companies In The Industry?

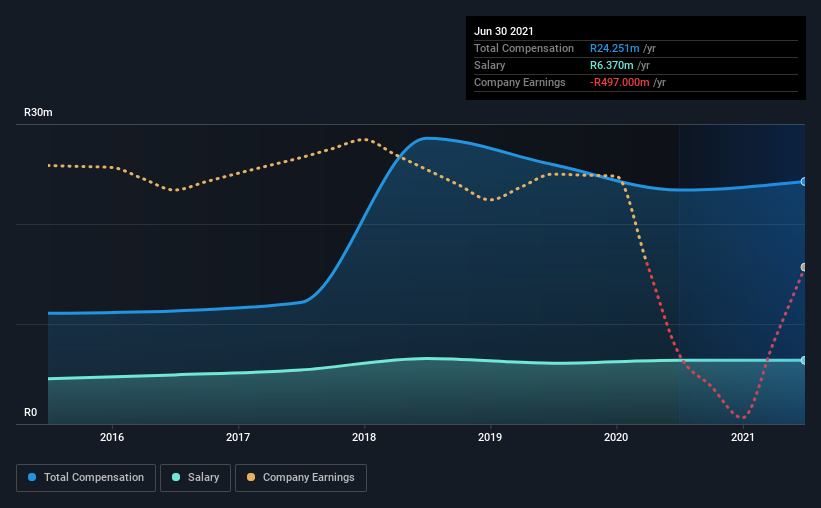

At the time of writing, our data shows that Growthpoint Properties Limited has a market capitalization of R45b, and reported total annual CEO compensation of R24m for the year to June 2021. That's a modest increase of 3.7% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at R6.4m.

For comparison, other companies in the same industry with market capitalizations ranging between R30b and R97b had a median total CEO compensation of R44m. In other words, Growthpoint Properties pays its CEO lower than the industry median. Moreover, Leon Sasse also holds R46m worth of Growthpoint Properties stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | R6.4m | R6.4m | 26% |

| Other | R18m | R17m | 74% |

| Total Compensation | R24m | R23m | 100% |

Talking in terms of the industry, salary represented approximately 71% of total compensation out of all the companies we analyzed, while other remuneration made up 29% of the pie. Growthpoint Properties sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Growthpoint Properties Limited's Growth

Growthpoint Properties Limited has reduced its funds from operations (FFO) by 10% over the last one year. In the last year, its revenue is up 6.2%.

Few shareholders would be pleased to read that FFO have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced FFO. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Growthpoint Properties Limited Been A Good Investment?

Since shareholders would have lost about 25% over three years, some Growthpoint Properties Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for Growthpoint Properties you should be aware of, and 1 of them can't be ignored.

Important note: Growthpoint Properties is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:GRT

Growthpoint Properties

Growthpoint is an international property company that provides space to thrive incorporating innovative and sustainable property solutions.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success