- South Africa

- /

- Media

- /

- JSE:CAT

This Is The Reason Why We Think Caxton and CTP Publishers and Printers Limited's (JSE:CAT) CEO Might Be Underpaid

Shareholders will be pleased by the impressive results for Caxton and CTP Publishers and Printers Limited (JSE:CAT) recently and CEO Terry Moolman has played a key role. At the upcoming AGM on 06 December 2022, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

Our analysis indicates that CAT is potentially undervalued!

How Does Total Compensation For Terry Moolman Compare With Other Companies In The Industry?

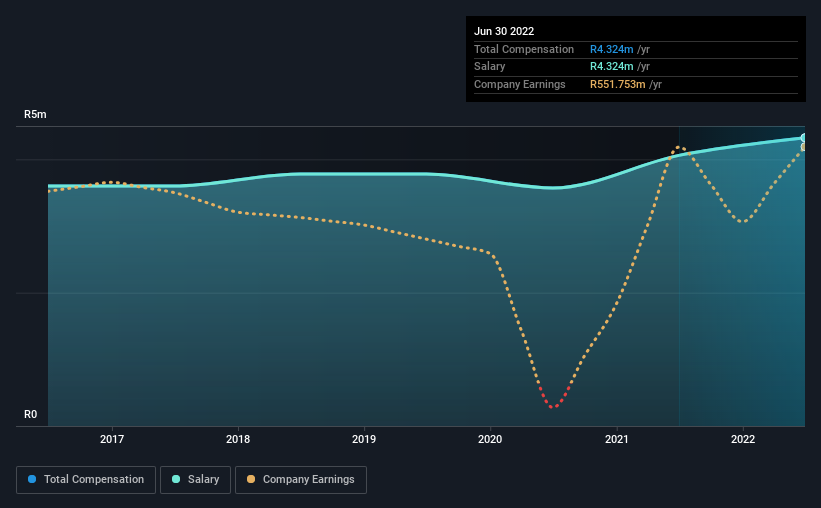

Our data indicates that Caxton and CTP Publishers and Printers Limited has a market capitalization of R3.4b, and total annual CEO compensation was reported as R4.3m for the year to June 2022. That's a modest increase of 6.5% on the prior year. Notably, the salary of R4.3m is the entirety of the CEO compensation.

For comparison, other companies in the same industry with market capitalizations ranging between R1.7b and R6.8b had a median total CEO compensation of R12m. Accordingly, Caxton and CTP Publishers and Printers pays its CEO under the industry median. Moreover, Terry Moolman also holds R1.6b worth of Caxton and CTP Publishers and Printers stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | R4.3m | R4.1m | 100% |

| Other | - | - | - |

| Total Compensation | R4.3m | R4.1m | 100% |

On an industry level, around 87% of total compensation represents salary and 13% is other remuneration. On a company level, Caxton and CTP Publishers and Printers prefers to reward its CEO through a salary, opting not to pay Terry Moolman through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Caxton and CTP Publishers and Printers Limited's Growth

Caxton and CTP Publishers and Printers Limited has seen its earnings per share (EPS) increase by 21% a year over the past three years. Its revenue is up 15% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Caxton and CTP Publishers and Printers Limited Been A Good Investment?

Most shareholders would probably be pleased with Caxton and CTP Publishers and Printers Limited for providing a total return of 35% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Caxton and CTP Publishers and Printers rewards its CEO solely through a salary, ignoring non-salary benefits completely. Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Caxton and CTP Publishers and Printers that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:CAT

Caxton and CTP Publishers and Printers

Caxton and CTP Publishers and Printers Limited publishes and prints newspapers and magazines in South Africa.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026