- South Africa

- /

- Metals and Mining

- /

- JSE:IMP

We Think Some Shareholders May Hesitate To Increase Impala Platinum Holdings Limited's (JSE:IMP) CEO Compensation

CEO Nico Muller has done a decent job of delivering relatively good performance at Impala Platinum Holdings Limited (JSE:IMP) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 12 October 2022. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for Impala Platinum Holdings

Comparing Impala Platinum Holdings Limited's CEO Compensation With The Industry

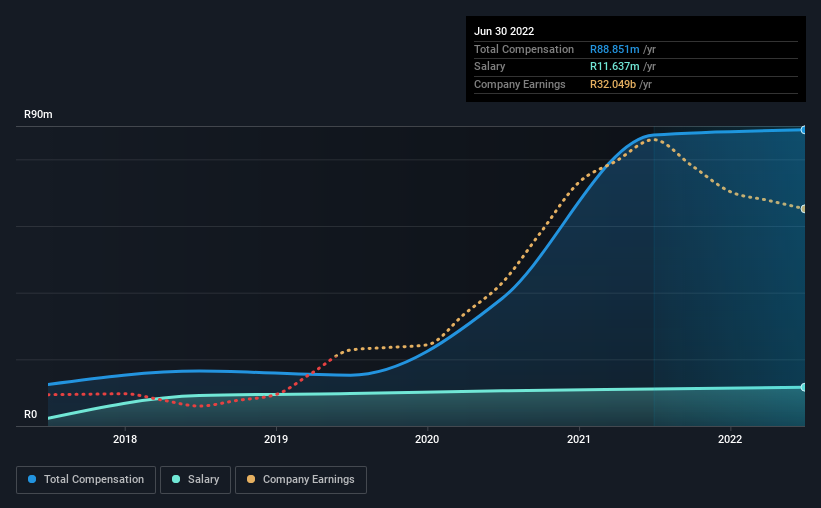

According to our data, Impala Platinum Holdings Limited has a market capitalization of R156b, and paid its CEO total annual compensation worth R89m over the year to June 2022. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at R12m.

On comparing similar companies from the same industry with market caps ranging from R71b to R214b, we found that the median CEO total compensation was R32m. This suggests that Nico Muller is paid more than the median for the industry. What's more, Nico Muller holds R53m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | R12m | R11m | 13% |

| Other | R77m | R76m | 87% |

| Total Compensation | R89m | R87m | 100% |

Speaking on an industry level, nearly 43% of total compensation represents salary, while the remainder of 57% is other remuneration. It's interesting to note that Impala Platinum Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Impala Platinum Holdings Limited's Growth Numbers

Over the past three years, Impala Platinum Holdings Limited has seen its earnings per share (EPS) grow by 164% per year. In the last year, its revenue is down 8.7%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Impala Platinum Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with Impala Platinum Holdings Limited for providing a total return of 119% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 4 warning signs (and 1 which can't be ignored) in Impala Platinum Holdings we think you should know about.

Important note: Impala Platinum Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:IMP

Impala Platinum Holdings

Engages in the mining, processing, concentrating, refining, and sale of platinum group metals (PGMs) and associated base metals.

Flawless balance sheet with reasonable growth potential.