- South Africa

- /

- Metals and Mining

- /

- JSE:HAR

3 Stocks Estimated To Be Trading At Discounts Ranging From 28.7% To 49%

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators, U.S. stocks have reached new highs, buoyed by the onset of earnings season and encouraging corporate performance. Despite some economic headwinds such as modestly higher inflation and rising jobless claims, opportunities remain for discerning investors to identify undervalued stocks that may be trading at significant discounts. In this environment, a good stock is often one that demonstrates resilience and potential for growth even amid broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$31.65 | HK$63.20 | 49.9% |

| Triple Point Social Housing REIT (LSE:SOHO) | £0.659 | £1.31 | 49.8% |

| California Resources (NYSE:CRC) | US$51.90 | US$103.73 | 50% |

| Atlanticus Holdings (NasdaqGS:ATLC) | US$36.28 | US$72.49 | 50% |

| On the Beach Group (LSE:OTB) | £1.538 | £3.06 | 49.7% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7480.00 | ₩14823.30 | 49.5% |

| ChromaDex (NasdaqCM:CDXC) | US$3.56 | US$7.11 | 50% |

| Innovent Biologics (SEHK:1801) | HK$44.85 | HK$89.63 | 50% |

| Loungers (AIM:LGRS) | £2.68 | £5.34 | 49.8% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.376 | €0.75 | 49.8% |

Let's dive into some prime choices out of the screener.

Gold Fields (JSE:GFI)

Overview: Gold Fields Limited is a gold producer with reserves and resources in Chile, South Africa, Ghana, Canada, Australia, and Peru, and has a market cap of ZAR259.61 billion.

Operations: The company's revenue from mine operations amounts to $4.36 billion.

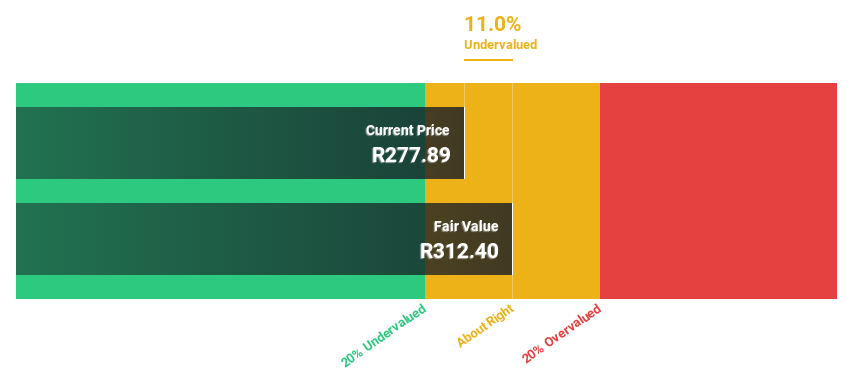

Estimated Discount To Fair Value: 28.7%

Gold Fields is trading at a significant discount to its estimated fair value, with the stock priced at ZAR290.06 compared to a fair value estimate of ZAR407.1. Despite recent earnings declines due to operational challenges, the company's earnings are forecasted to grow significantly, outpacing both its past performance and the ZA market average. The appointment of Phillip Anthony Murnane as CFO could strengthen financial management, potentially enhancing cash flow efficiency and supporting future growth prospects.

- Our earnings growth report unveils the potential for significant increases in Gold Fields' future results.

- Delve into the full analysis health report here for a deeper understanding of Gold Fields.

Harmony Gold Mining (JSE:HAR)

Overview: Harmony Gold Mining Company Limited is involved in the exploration, extraction, and processing of gold with a market cap of ZAR115.02 billion.

Operations: The company's revenue is primarily derived from gold, amounting to ZAR61.38 billion.

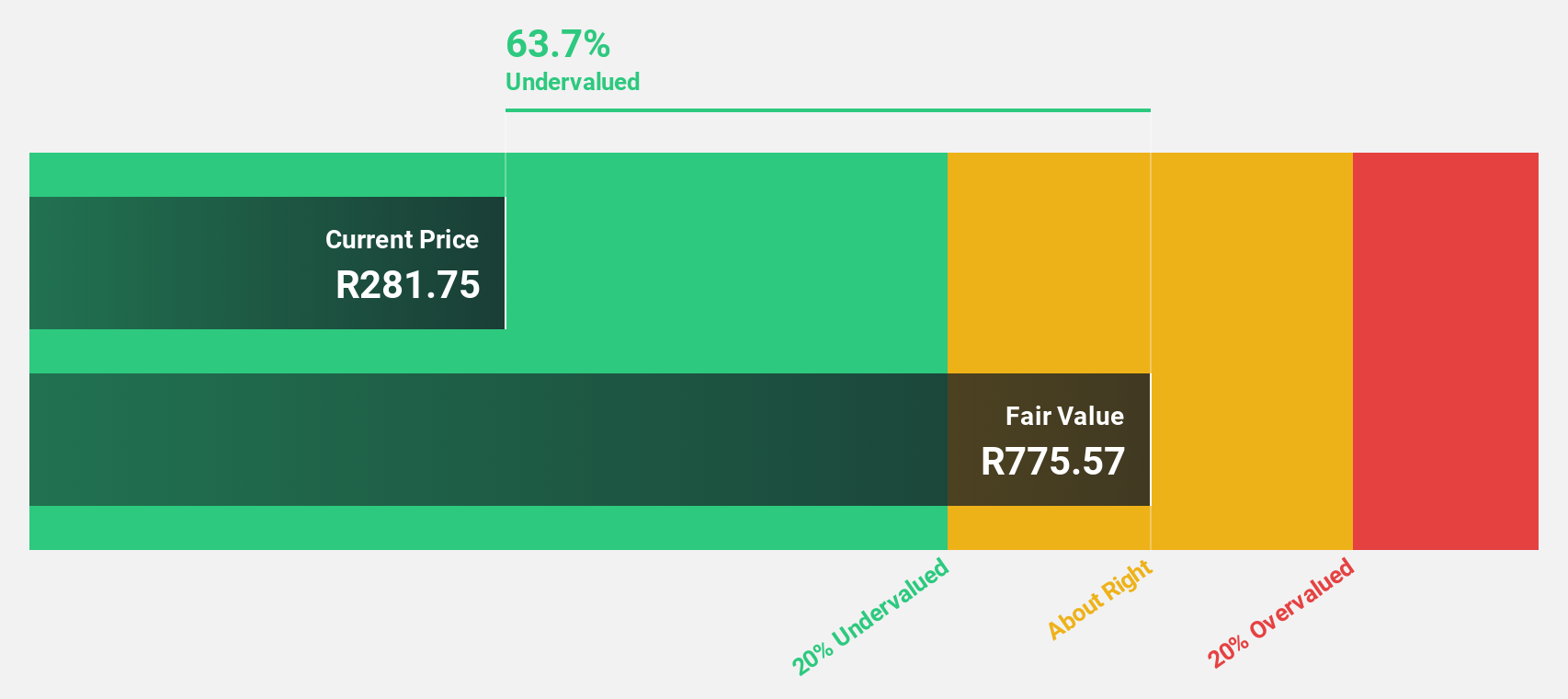

Estimated Discount To Fair Value: 49%

Harmony Gold Mining is currently trading at a significant discount, with its share price at ZAR185.54 compared to an estimated fair value of ZAR363.96. The company reported robust financial performance for the fiscal year ending June 30, 2024, with net income rising to ZAR8.59 billion from ZAR4.82 billion the previous year and earnings per share nearly doubling. Despite recent volatility in its share price, Harmony's earnings are forecasted to grow significantly above the market average over the next three years.

- According our earnings growth report, there's an indication that Harmony Gold Mining might be ready to expand.

- Take a closer look at Harmony Gold Mining's balance sheet health here in our report.

Pinnacle Financial Partners (NasdaqGS:PNFP)

Overview: Pinnacle Financial Partners, Inc. is a bank holding company for Pinnacle Bank, offering a range of banking products and services to individuals, businesses, and professional entities in the United States with a market cap of $7.69 billion.

Operations: Pinnacle Financial Partners generates revenue through its comprehensive suite of banking products and services tailored for individuals, businesses, and professional entities across the United States.

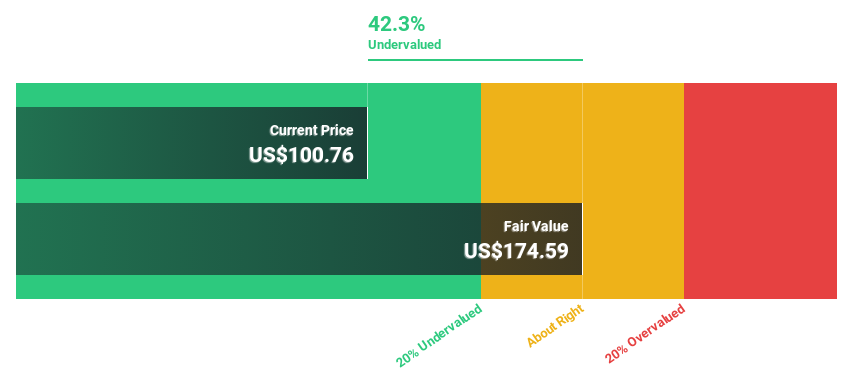

Estimated Discount To Fair Value: 43.8%

Pinnacle Financial Partners' stock is trading at US$105.47, significantly below its estimated fair value of US$187.65, suggesting potential undervaluation based on cash flows. The company's earnings are projected to grow 23.7% annually, outpacing the broader U.S. market's growth rate of 15.2%. Recent earnings showed an increase in net interest income to US$351.5 million for Q3 2024, with net income rising to US$146.69 million from a year ago.

- Our expertly prepared growth report on Pinnacle Financial Partners implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Pinnacle Financial Partners with our comprehensive financial health report here.

Key Takeaways

- Access the full spectrum of 967 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmony Gold Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About JSE:HAR

Harmony Gold Mining

Engages in the exploration, extraction, and processing of mineral properties in South Africa, Papua New Guinea, and Australasia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives