- South Africa

- /

- Insurance

- /

- JSE:OUT

OUTsurance Group Limited's (JSE:OUT) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Most readers would already be aware that OUTsurance Group's (JSE:OUT) stock increased significantly by 19% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Specifically, we decided to study OUTsurance Group's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for OUTsurance Group

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for OUTsurance Group is:

29% = R4.5b ÷ R15b (Based on the trailing twelve months to June 2024).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each ZAR1 of shareholders' capital it has, the company made ZAR0.29 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

OUTsurance Group's Earnings Growth And 29% ROE

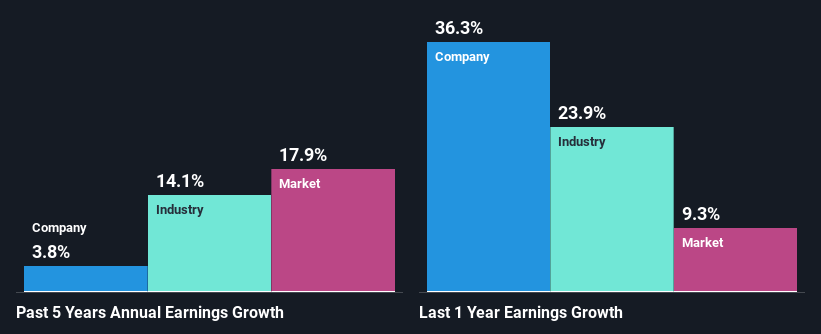

To start with, OUTsurance Group's ROE looks acceptable. On comparing with the average industry ROE of 14% the company's ROE looks pretty remarkable. Despite this, OUTsurance Group's five year net income growth was quite low averaging at only 3.8%. This is generally not the case as when a company has a high rate of return it should usually also have a high earnings growth rate. A few likely reasons why this could happen is that the company could have a high payout ratio or the business has allocated capital poorly, for instance.

We then compared OUTsurance Group's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 14% in the same 5-year period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about OUTsurance Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is OUTsurance Group Making Efficient Use Of Its Profits?

With a high three-year median payout ratio of 66% (or a retention ratio of 34%), most of OUTsurance Group's profits are being paid to shareholders. This definitely contributes to the low earnings growth seen by the company.

Additionally, OUTsurance Group has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 75%. Accordingly, forecasts suggest that OUTsurance Group's future ROE will be 34% which is again, similar to the current ROE.

Conclusion

In total, it does look like OUTsurance Group has some positive aspects to its business. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return. Investors could have benefitted from the high ROE, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:OUT

OUTsurance Group

A financial services company, provides insurance and investment products in South Africa, Australia, and Ireland.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives