The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like OUTsurance Group (JSE:OUT). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for OUTsurance Group

How Fast Is OUTsurance Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. OUTsurance Group's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 54%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

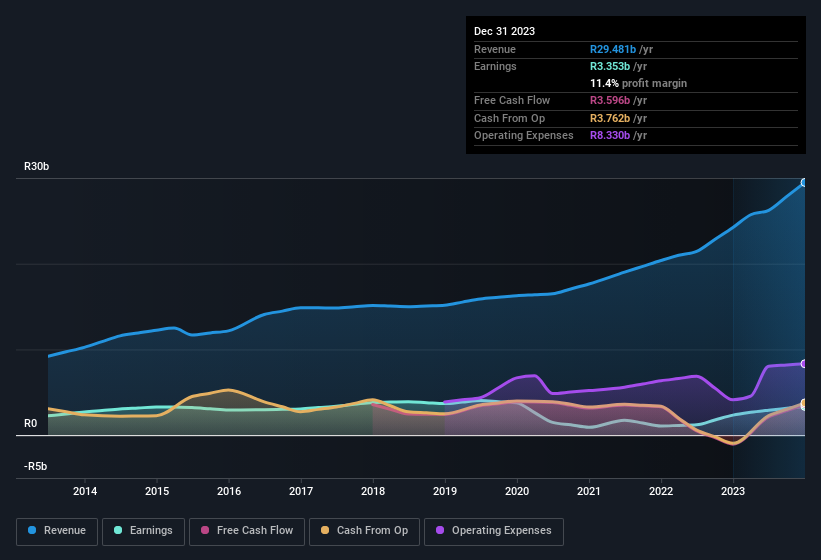

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that OUTsurance Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note OUTsurance Group achieved similar EBIT margins to last year, revenue grew by a solid 22% to R29b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of OUTsurance Group's forecast profits?

Are OUTsurance Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's pleasing to note that insiders spent R25m buying OUTsurance Group shares, over the last year, without reporting any share sales whatsoever. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director Marthinus Visser for R15m worth of shares, at about R39.66 per share.

The good news, alongside the insider buying, for OUTsurance Group bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at R274m. That's a lot of money, and no small incentive to work hard. Despite being just 0.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is OUTsurance Group Worth Keeping An Eye On?

OUTsurance Group's earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest OUTsurance Group belongs near the top of your watchlist. Of course, just because OUTsurance Group is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Keen growth investors love to see insider activity. Thankfully, OUTsurance Group isn't the only one. You can see a a curated list of South African companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:OUT

OUTsurance Group

A financial services company, provides insurance and investment products in South Africa, Australia, and Ireland.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives