- South Africa

- /

- Capital Markets

- /

- JSE:AFH

Alexander Forbes Group Holdings Limited's (JSE:AFH) CEO Compensation Looks Acceptable To Us And Here's Why

CEO Dawie de Villiers has done a decent job of delivering relatively good performance at Alexander Forbes Group Holdings Limited (JSE:AFH) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 03 September 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for Alexander Forbes Group Holdings

Comparing Alexander Forbes Group Holdings Limited's CEO Compensation With the industry

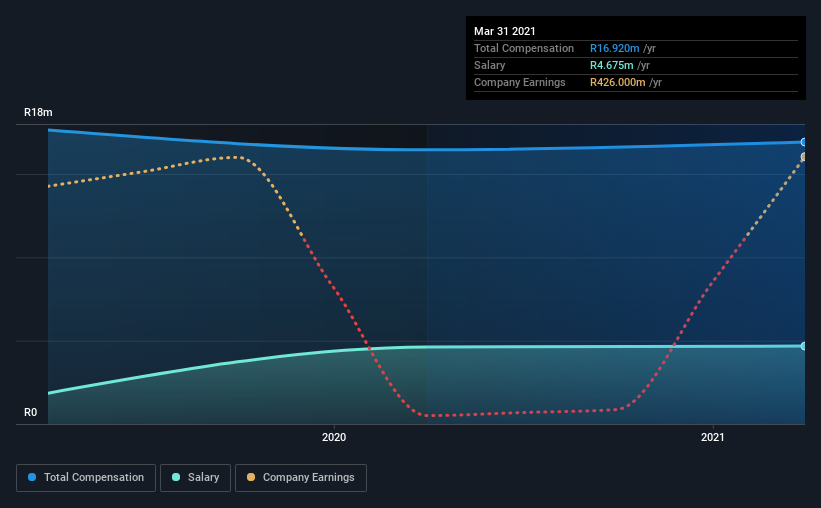

At the time of writing, our data shows that Alexander Forbes Group Holdings Limited has a market capitalization of R5.0b, and reported total annual CEO compensation of R17m for the year to March 2021. That's mostly flat as compared to the prior year's compensation. While we always look at total compensation first, our analysis shows that the salary component is less, at R4.7m.

For comparison, other companies in the same industry with market capitalizations ranging between R3.0b and R12b had a median total CEO compensation of R13m. This suggests that Alexander Forbes Group Holdings remunerates its CEO largely in line with the industry average. What's more, Dawie de Villiers holds R1.5m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | R4.7m | R4.6m | 28% |

| Other | R12m | R12m | 72% |

| Total Compensation | R17m | R16m | 100% |

On an industry level, around 44% of total compensation represents salary and 56% is other remuneration. Alexander Forbes Group Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Alexander Forbes Group Holdings Limited's Growth

Over the last three years, Alexander Forbes Group Holdings Limited has not seen its earnings per share change much, though there is a slight positive movement. In the last year, its revenue changed by just 0.3%.

We'd prefer higher revenue growth, but we're happy with the modest EPS growth. So there are some positives here, but not enough to earn high praise. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Alexander Forbes Group Holdings Limited Been A Good Investment?

With a total shareholder return of 5.7% over three years, Alexander Forbes Group Holdings Limited has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Alexander Forbes Group Holdings (of which 1 doesn't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:AFH

Alexander Forbes Group Holdings

A financial services company, provides employee benefits, retirement and healthcare consulting, investment, and wealth management solutions to corporate clients and individuals.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives