- South Africa

- /

- Food and Staples Retail

- /

- JSE:KAL

I Built A List Of Growing Companies And Kaap Agri (JSE:KAL) Made The Cut

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Kaap Agri (JSE:KAL). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Kaap Agri

Kaap Agri's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Kaap Agri managed to grow EPS by 7.8% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

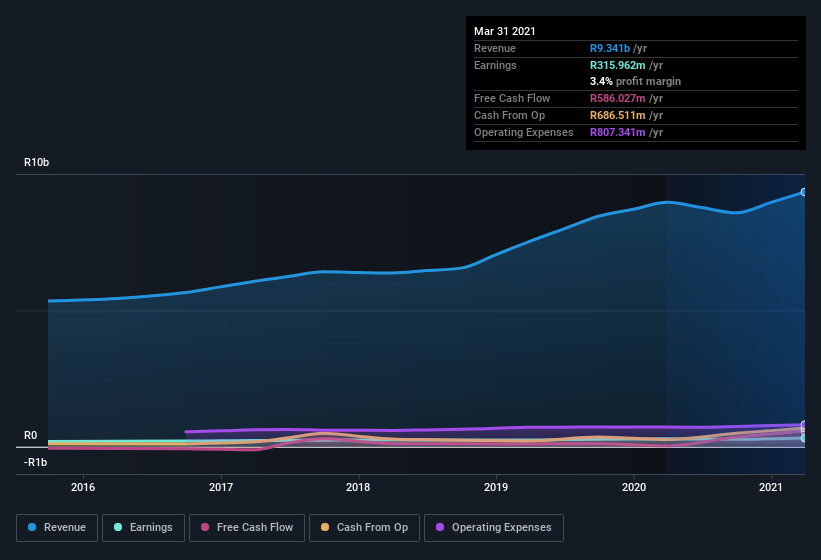

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Kaap Agri's EBIT margins were flat over the last year, revenue grew by a solid 4.2% to R9.3b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Kaap Agri is no giant, with a market capitalization of R3.2b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Kaap Agri Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Kaap Agri insiders spent R2.4m on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. It is also worth noting that it was Independent Non-Executive Director Chris Otto who made the biggest single purchase, worth R2.3m, paying R39.00 per share.

I do like that insiders have been buying shares in Kaap Agri, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations between R1.5b and R6.0b, like Kaap Agri, the median CEO pay is around R7.7m.

Kaap Agri offered total compensation worth R5.9m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Kaap Agri Worth Keeping An Eye On?

One important encouraging feature of Kaap Agri is that it is growing profits. Like chocolate chips in vanilla ice cream, the insider buying, and modest CEO pay, make it better. If that doesn't automatically earn it a spot on your watchlist then I'd posit it warrants a closer look at the very least. You should always think about risks though. Case in point, we've spotted 1 warning sign for Kaap Agri you should be aware of.

As a growth investor I do like to see insider buying. But Kaap Agri isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if KAL Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:KAL

KAL Group

Operates as a diversified trader and retailer in the agricultural, manufacturing, retail, and fuel and convenience markets in South Africa and Namibia.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives