- South Africa

- /

- Consumer Durables

- /

- JSE:BWN

Shareholders May Be More Conservative With Balwin Properties Limited's (JSE:BWN) CEO Compensation For Now

Key Insights

- Balwin Properties' Annual General Meeting to take place on 27th of August

- Total pay for CEO Steve Brookes includes R6.89m salary

- The total compensation is 313% higher than the average for the industry

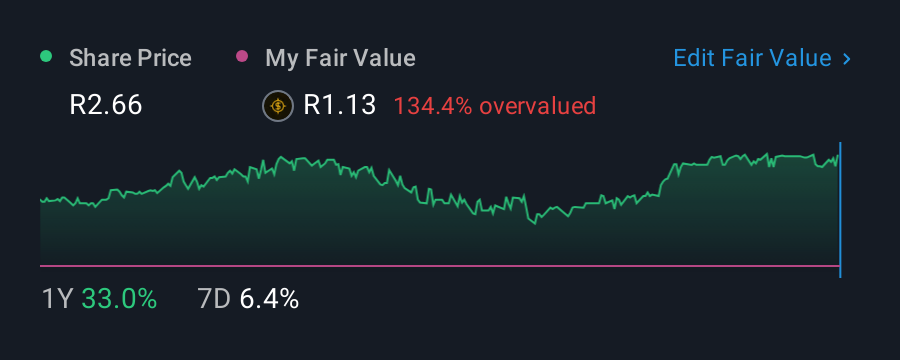

- Balwin Properties' total shareholder return over the past three years was 9.8% while its EPS was down 14% over the past three years

Despite Balwin Properties Limited's (JSE:BWN) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 27th of August. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for Balwin Properties

Comparing Balwin Properties Limited's CEO Compensation With The Industry

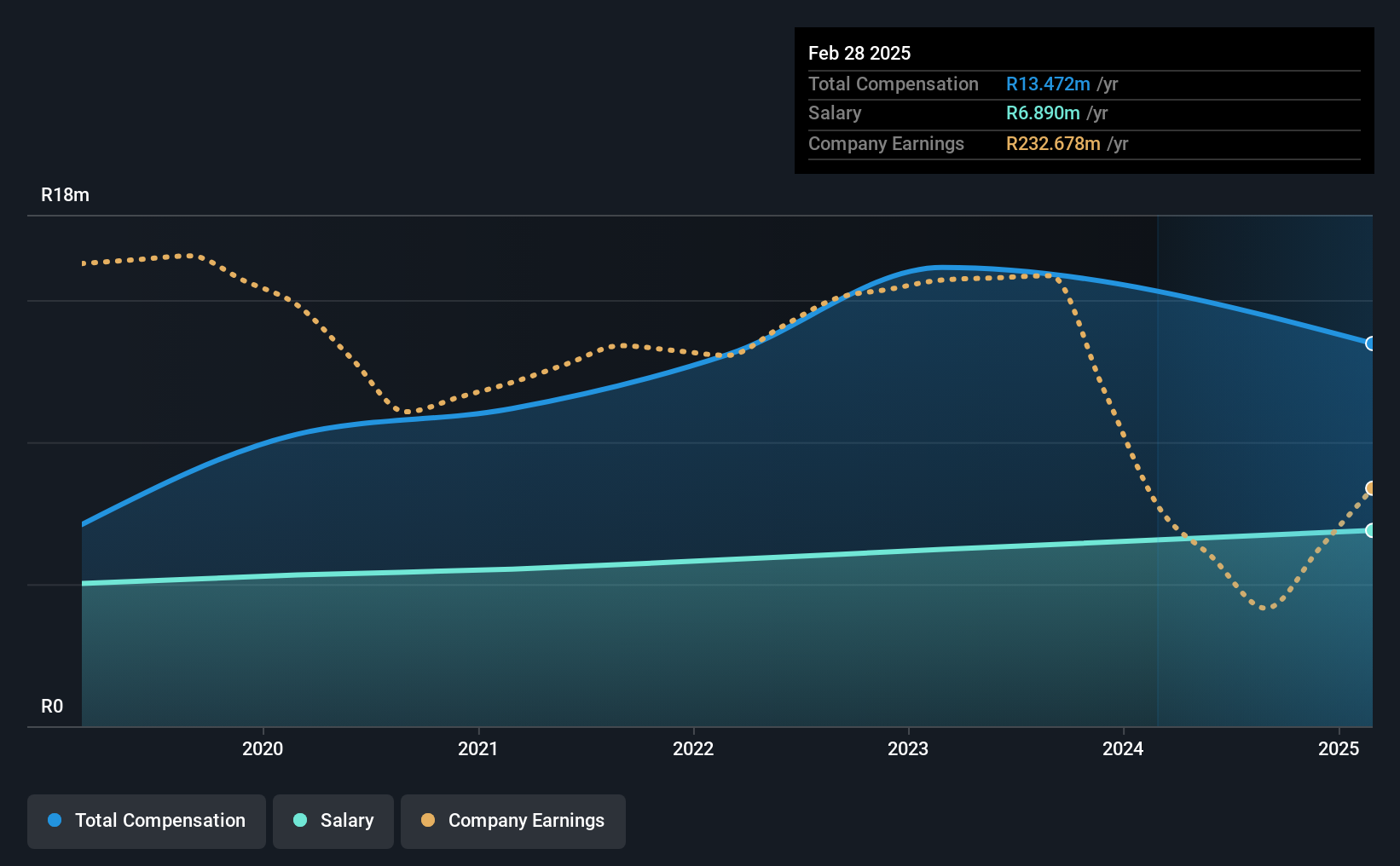

At the time of writing, our data shows that Balwin Properties Limited has a market capitalization of R1.2b, and reported total annual CEO compensation of R13m for the year to February 2025. This was the same amount the CEO received in the prior year. We note that the salary of R6.89m makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the South Africa Consumer Durables industry with market capitalizations under R3.5b, the reported median total CEO compensation was R3.3m. This suggests that Steve Brookes is paid more than the median for the industry. What's more, Steve Brookes holds R450m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2025 | Proportion (2025) |

| Salary | R6.9m | R6.9m | 51% |

| Other | R6.6m | R6.6m | 49% |

| Total Compensation | R13m | R13m | 100% |

On an industry level, roughly 62% of total compensation represents salary and 38% is other remuneration. Balwin Properties pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Balwin Properties Limited's Growth Numbers

Balwin Properties Limited has reduced its earnings per share by 14% a year over the last three years. It saw its revenue drop 5.9% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Balwin Properties Limited Been A Good Investment?

Balwin Properties Limited has not done too badly by shareholders, with a total return of 9.8%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for Balwin Properties (of which 2 are a bit unpleasant!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Balwin Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:BWN

Balwin Properties

Engages in the development and sale of residential properties in South Africa.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)