- United States

- /

- Other Utilities

- /

- NYSE:WEC

Is WEC Energy Group (WEC) Undervalued After Its Recent Share Price Pullback?

Reviewed by Simply Wall St

WEC Energy Group (WEC) has been quietly grinding higher this year, and the stock’s recent pullback is giving investors a chance to revisit the story with fresh eyes. Let us unpack what the numbers suggest.

See our latest analysis for WEC Energy Group.

At a share price of $108.09, WEC’s recent 7 day share price pullback sits against a stronger year to date share price return of 15 percent and a solid 5 year total shareholder return of 37.76 percent. This suggests momentum is cooling rather than reversing.

If this more defensive utilities name has your attention, it can be useful to compare it with other resilient dividend payers across the sector and beyond, especially alongside fast growing stocks with high insider ownership.

With steady earnings growth, a premium valuation, and a modest discount to analyst targets, the key question now is whether WEC is quietly undervalued after this pullback or if the market has already priced in its future growth.

Most Popular Narrative: 11.8% Undervalued

With WEC Energy Group last closing at $108.09 against a narrative fair value of $122.50, the story leans toward upside grounded in steady growth assumptions.

Substantial grid and infrastructure modernization, including $28 billion in capex over five years, positions WEC to capitalize on federal and state infrastructure priorities and meet the needs of an aging U.S. power system; this supports predictable earnings growth and rate recovery.

Curious how disciplined revenue growth, fatter margins, and a punchy future earnings multiple are all stitched together into that fair value number, without looking like a high flying tech bet on paper? The projections are hiding in plain sight, but the real surprise is how far out the earnings ramp has to run to make the math work. Want to see exactly which profit and valuation assumptions power this target and how sensitive the outcome is to even small changes in growth expectations?

Result: Fair Value of $122.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends heavily on smooth regulatory approvals and disciplined capex execution. Setbacks or rising financing costs could quickly erode that valuation support.

Find out about the key risks to this WEC Energy Group narrative.

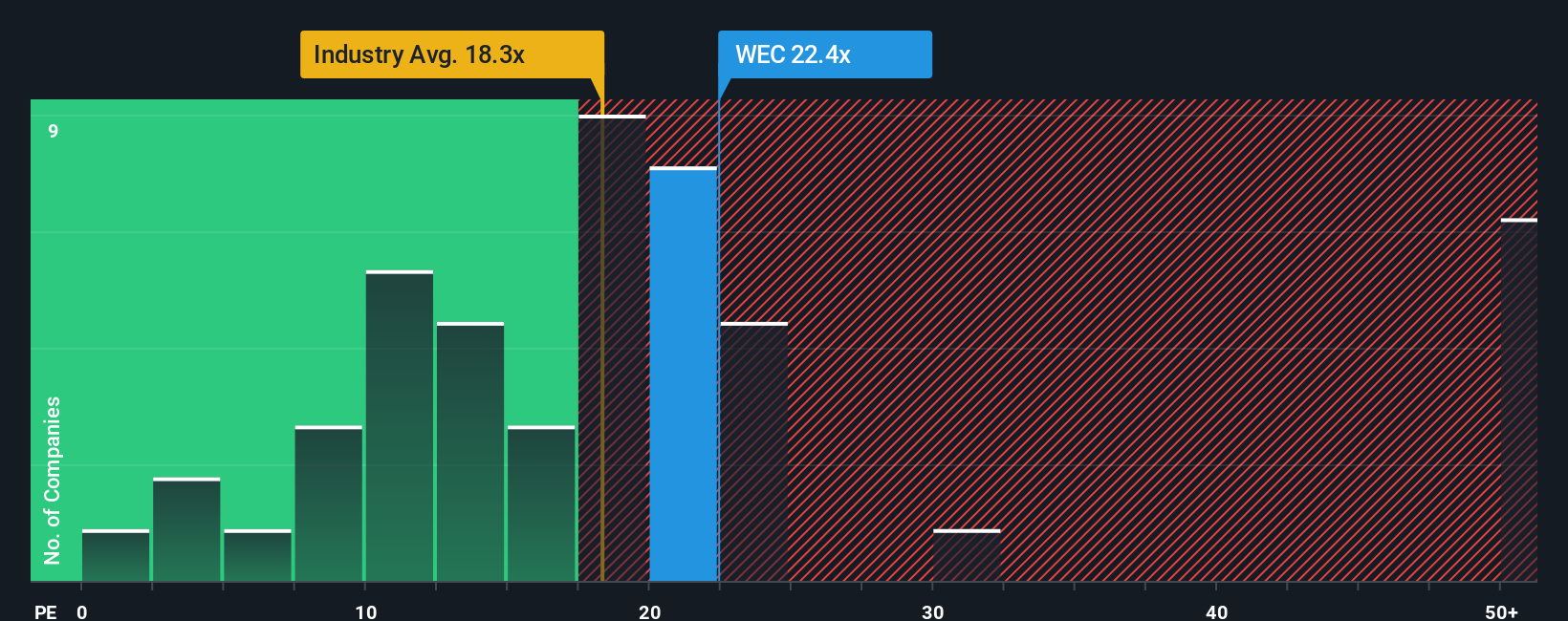

Another View, Market Multiples Look Less Generous

On traditional valuation, WEC screens as pricey. It trades at 20.8 times earnings, richer than both the global integrated utilities average of 18 times and its peer average of 20 times, even though its fair ratio sits higher at 23.1 times. That gap hints at upside, but also raises the risk that any wobble in earnings or sentiment could compress the multiple quickly. Are you being paid enough for that premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WEC Energy Group Narrative

If you see things differently or would rather dig into the numbers yourself, you can shape a complete story in just a few minutes: Do it your way.

A great starting point for your WEC Energy Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with one opportunity when Simply Wall Street’s Screener can quickly surface more stocks that fit your strategy and help you stay ahead of the crowd.

- Capture potential mispricings by targeting companies that look cheap on cash flow using these 930 undervalued stocks based on cash flows before the wider market catches on.

- Explore structural trends in automation and data by focusing on innovation leaders through these 24 AI penny stocks with strong growth characteristics.

- Identify income-focused businesses via these 14 dividend stocks with yields > 3% that offer yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEC Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEC

WEC Energy Group

Through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026