- United States

- /

- Other Utilities

- /

- NYSE:WEC

Is WEC Energy Group Fairly Priced After 23% Climb and Renewable Energy Headlines?

Reviewed by Bailey Pemberton

Thinking about whether to buy, sell, or simply hold WEC Energy Group stock? You’re definitely not alone. WEC has been a staple for many portfolios, and its share price reflects that consistency. Over the last year, the stock has climbed 23.3%. For longer-term investors, the gains are even more solid, with a 40.8% increase over the last three years and 35.9% over five years. Even its performance year to date hasn’t gone unnoticed, jumping 23.2%. That said, the past week brought a modest 0.9% dip, possibly a short-term pause in a mostly upward trend.

Recent headlines around renewable energy investments and regulatory changes have kept WEC in the spotlight, highlighting both growth opportunities and the ongoing challenges of transitioning to a greener energy grid. These developments shape not just how investors view the company’s prospects, but also how they weigh its current valuation.

It’s worth noting that, by the numbers, WEC’s valuation score comes in at 0 out of 6 checks for being undervalued. This suggests that, at least by traditional benchmarks, WEC is not trading below its fair value right now. However, those scores do not always tell the full story. Up next, we’ll walk through which valuation approaches matter most, and wrap up by looking at an even more insightful way to think about what WEC is actually worth.

WEC Energy Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: WEC Energy Group Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a popular valuation method for income-focused stocks. It estimates a company’s intrinsic value based on its expected future dividend payments, discounted back to their present value. This approach helps investors gauge whether a stock’s price reflects its underlying dividend potential and growth rates, which is key for utilities like WEC Energy Group, known for consistent payouts.

According to the latest data, WEC’s annual dividend per share sits at $3.97, with a payout ratio of about 69.2%. The company maintains a healthy return on equity (ROE) of 11.84%, suggesting solid overall profitability. For valuation, forecasted dividend growth is capped at 3.08% per year, slightly below the historical average. This reflects analyst caution about future expansion given industry pressures and a transition to renewable energy.

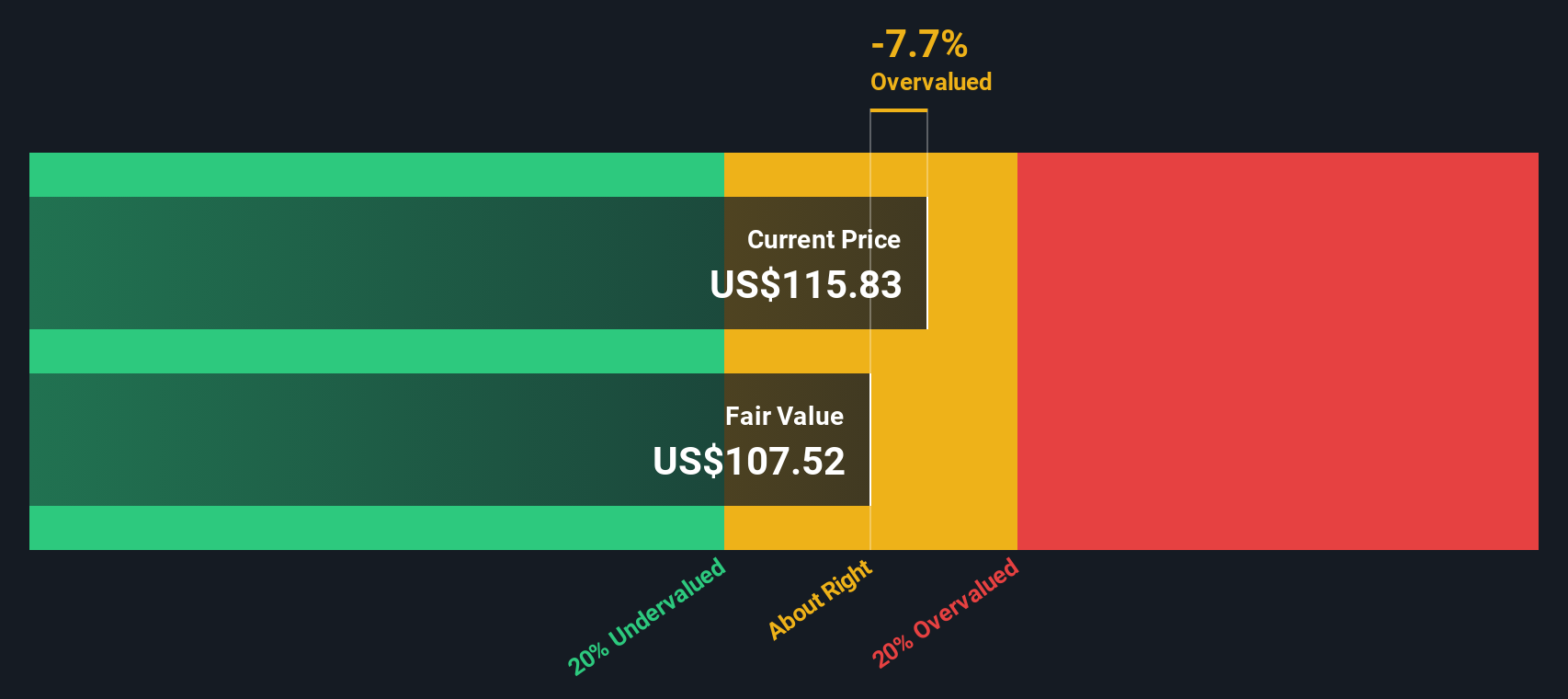

Applying the DDM, WEC’s intrinsic value is estimated at $107.52 per share. Based on the current market price, this signals the stock is approximately 7.7% overvalued. While not drastically out of range, it indicates investors may be paying a slight premium for WEC’s reliability and projected stability.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out WEC Energy Group's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: WEC Energy Group Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for established, consistently profitable companies like WEC Energy Group. It gives a snapshot of how much investors are willing to pay for each dollar of the company’s earnings, making it especially relevant for utility businesses with stable bottom lines.

It’s important to recognize that “fair” PE ratios are not universal. They depend on factors like growth expectations, industry characteristics, and risk profiles. Companies with higher growth rates or lower risk typically command higher PE ratios, while slower growers or riskier stocks are valued at a discount.

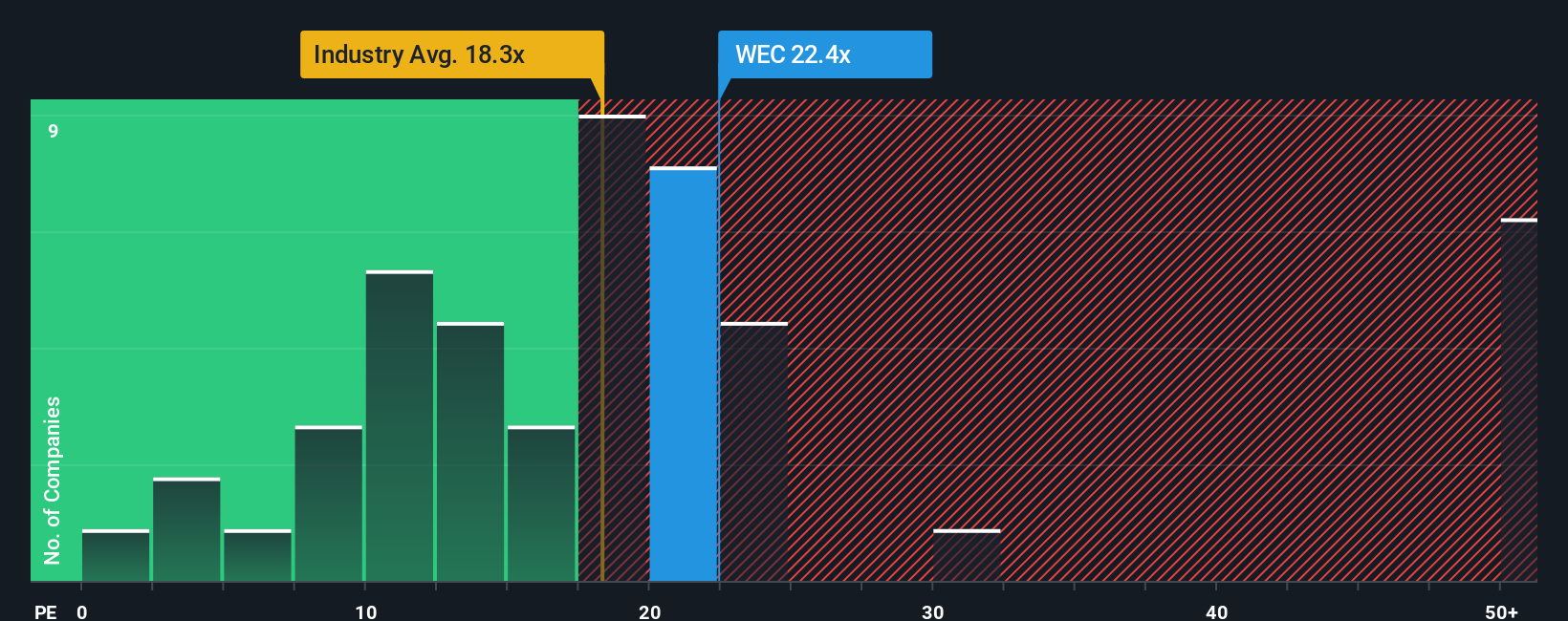

WEC Energy Group currently trades at a PE ratio of 22.4x. For context, this is slightly higher than the average among its industry peers, which sits at 21.9x, and notably above the broader integrated utilities industry average of 18.3x. The Simply Wall St “Fair Ratio” for WEC, however, is 20.7x. Unlike plain peer or industry comparisons, this proprietary metric is tailored to WEC’s unique growth outlook, risk profile, margins, industry dynamics, and market size. This makes it a more complete yardstick for gauging value.

Since the difference between the current PE (22.4x) and the Fair Ratio (20.7x) is greater than 0.10, WEC shares appear slightly overvalued by this measure. Investors might be paying a bit extra for the company’s reputation for stability and reliability.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your WEC Energy Group Narrative

Earlier we mentioned that there is an even better way to assess valuation, so let’s introduce you to Narratives, a new, smarter way to invest that goes beyond just the numbers. A Narrative is your chance to shape a story around WEC Energy Group’s future, connecting your perspectives on its long-term prospects, projected revenue and profit growth, and your estimate of fair value. Rather than relying solely on formulas like PE or dividend models, Narratives help you link your outlook on company catalysts, risks, opportunities, and forecasts directly to a fair value estimate. This makes the investment case both more personal and informed.

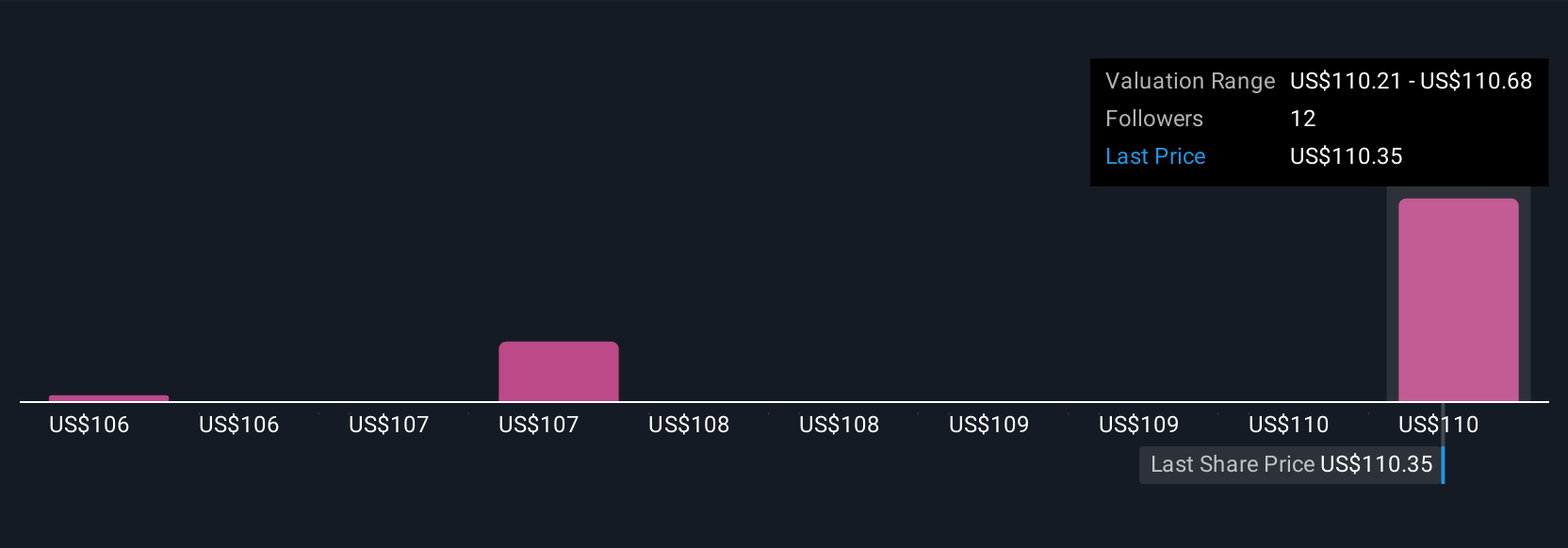

Narratives are easy to use and available right on the Simply Wall St Community page, where millions of investors share their views. Not only do Narratives help you decide whether WEC’s current price is above or below your own calculated fair value, but they update automatically as new information such as earnings releases or regulatory news emerges. For example, some investors in the Community see strong upside in WEC from rapid data center expansion, assigning a fair value as high as $118.54. Others, cautious about rising costs and regulatory risks, place fair value closer to $109.73. Narratives let you see and compare these perspectives at a glance, so you are always equipped to make smarter, more timely investment decisions.

Do you think there's more to the story for WEC Energy Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WEC Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEC

WEC Energy Group

Through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)