- United States

- /

- Other Utilities

- /

- NYSE:WEC

Is AI-Driven Power Demand Shifting the Investment Case for WEC Energy Group (WEC)?

Reviewed by Sasha Jovanovic

- Ladenburg Thalmann recently upgraded WEC Energy Group from Neutral to Buy, reflecting increased optimism around the utility’s growth prospects linked to artificial intelligence and data center demand.

- This shift highlights how new technologies and the resulting surge in power needs are influencing utility sector outlooks and analyst sentiment toward infrastructure providers.

- With analysts focusing on rising data center energy requirements, we'll assess how this development shapes WEC Energy Group's future investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

WEC Energy Group Investment Narrative Recap

To own shares in WEC Energy Group, you need to believe that large-scale investment in grid infrastructure, capitalizing on surging data center and AI-driven electricity demand, will drive consistent growth that offsets regulatory and cost headwinds. The Ladenburg Thalmann upgrade reflects rising optimism about these demand catalysts, but does not materially change the fact that the largest short term catalyst remains the pace of major data center buildouts, while the biggest risk is continued exposure to regulatory approval delays or unexpected project postponements.

One recent quarterly earnings announcement stands out because it reaffirmed annual EPS guidance in the $5.17 to $5.27 range, suggesting the company remains confident in its 2025 performance outlook despite changing market conditions and ongoing spending on growth initiatives. This guidance is particularly important as it provides a near-term touchstone for analyst optimism as well as scrutiny surrounding projected returns from infrastructure investments.

However, investors should also consider the potential impact of rising financing costs if interest rates remain high or equity offerings become less attractive...

Read the full narrative on WEC Energy Group (it's free!)

WEC Energy Group's narrative projects $10.8 billion revenue and $2.1 billion earnings by 2028. This requires 5.1% yearly revenue growth and a $0.4 billion earnings increase from $1.7 billion.

Uncover how WEC Energy Group's forecasts yield a $113.12 fair value, a 3% downside to its current price.

Exploring Other Perspectives

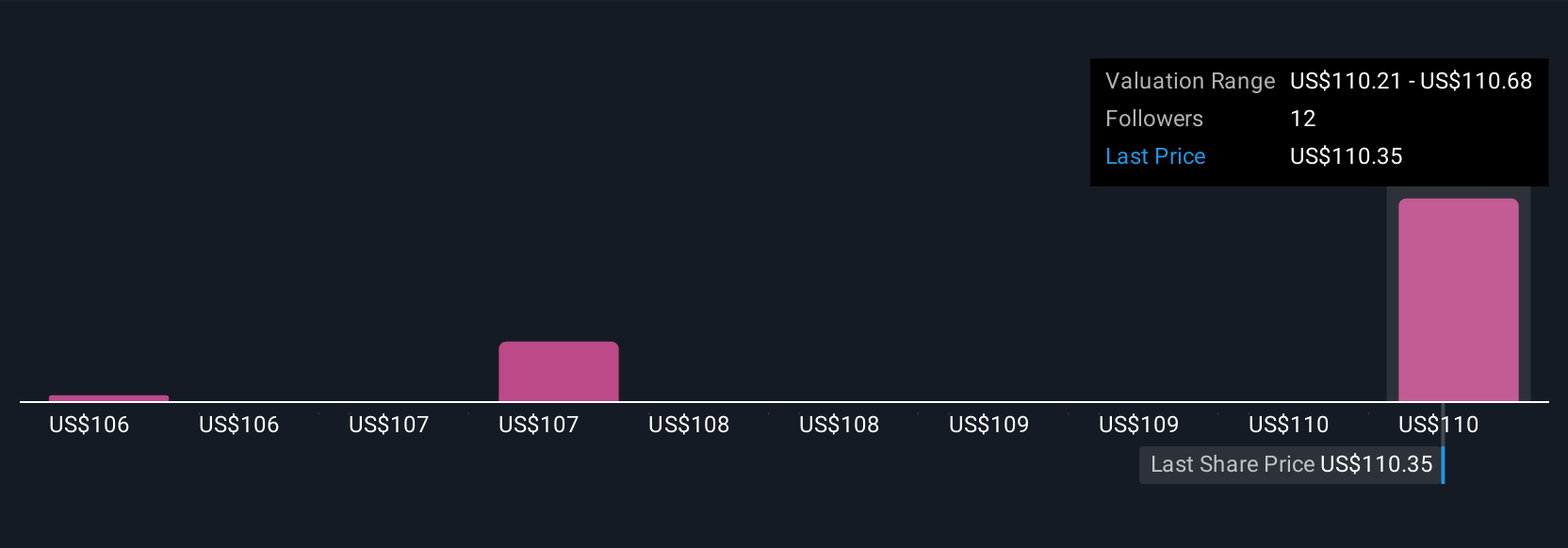

Four Simply Wall St Community members posted fair value estimates for WEC Energy Group, ranging from US$106 to US$121 per share. While consensus optimism has focused on accelerating utility demand from data centers, market participants should weigh how regulatory and project timing risks could affect outcomes and seek out alternative views.

Explore 4 other fair value estimates on WEC Energy Group - why the stock might be worth 9% less than the current price!

Build Your Own WEC Energy Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WEC Energy Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WEC Energy Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WEC Energy Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEC Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEC

WEC Energy Group

Through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives