- United States

- /

- Renewable Energy

- /

- NYSE:VST

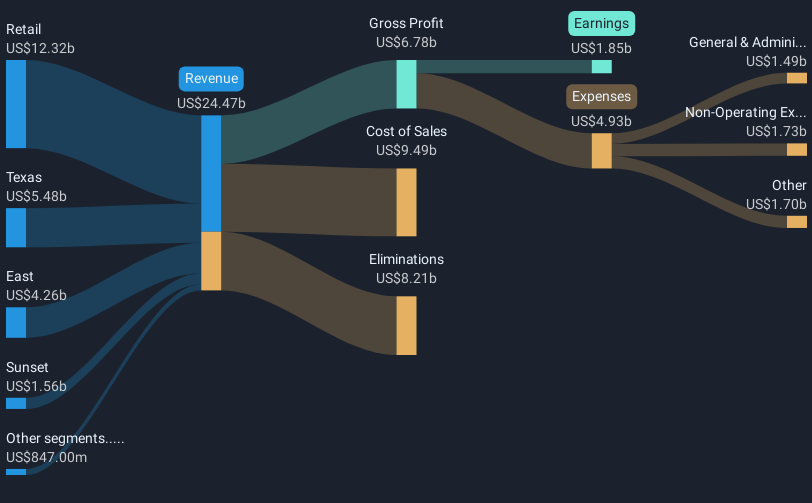

Vistra (NYSE:VST) Reports Higher Q1 Sales at US$3,933 Million Despite Net Loss

Reviewed by Simply Wall St

Vistra (NYSE:VST) recently reported a substantial 47% share price increase over the past month. Despite reporting robust sales growth in their latest earnings announcement, the company faced a widening net loss, which could pose challenges if not addressed efficiently. Moreover, Vistra's decision to increase dividends may have positively influenced investor sentiment, possibly driving confidence in its long-term strategy. These developments occurred amid a mixed broader market backdrop, where investors remained attentive to data such as the Federal Reserve's interest rate decisions. This combination of company-specific factors and market conditions may have supported Vistra's impressive share price performance.

Vistra has 2 warning signs we think you should know about.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

The recent developments surrounding Vistra (NYSE:VST), including a significant 47% share price increase, have implications for its long-term narrative, notably in relation to planned gas capacity additions and strategic acquisitions. These factors, combined with an increase in dividends, might suggest a strengthening of investor confidence. Over the past five years, Vistra's total shareholder returns, encompassing both share price appreciation and dividends, have been very large at 805.35%. This impressive performance contrasts with the 7.2% return of the US market and the 25.6% return of the US Renewable Energy industry over the past year, highlighting Vistra's capability to outperform its peers over longer horizons.

Vistra's current revenue and earnings forecasts, with expected growth in revenue at 9.1% annually and an increase in earnings to US$2.9 billion by 2028, could be influenced by its ongoing investments in renewables and gas capacity. This could enhance their ability to meet rising demand and improve net margins. Despite this positive trajectory, the widening net loss presents an area that could affect profitability if not managed effectively. Furthermore, the contrast between the current share price of US$129.33 and the consensus price target of US$163.28 indicates a 20.8% potential upside, reflecting market optimism regarding Vistra's future operational and financial strategies. Investors are encouraged to weigh these projections against potential regulatory and legislative uncertainties.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Solid track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives