- United States

- /

- Renewable Energy

- /

- NYSE:VST

Is KeyBanc’s AI-Focused Coverage Reshaping the Investment Case For Vistra (VST)?

Reviewed by Sasha Jovanovic

- Recently, Vistra drew fresh attention as KeyBanc initiated coverage, emphasizing the company’s scale, diversified generation mix, and exposure to rising AI-driven electricity demand across its roughly 44 gigawatts of nuclear, fossil, solar, and storage assets.

- While many investors are enthusiastic about Vistra’s role in powering energy-hungry AI data centers, some observers argue its current valuation already reflects much of this optimism, prompting closer scrutiny of how its fundamentals justify the premium.

- We’ll now examine how KeyBanc’s upbeat coverage, centered on AI data center demand and electrification, reshapes Vistra’s existing investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Vistra Investment Narrative Recap

To own Vistra, you need to believe that rising electricity demand from AI data centers and electrification can support strong cash generation across its roughly 44 GW fleet, while debt and fossil exposure remain manageable. KeyBanc’s upbeat initiation reinforces the AI-demand story but does not materially change the near term tension between elevated valuation multiples and execution risks around growth projects and market volatility.

Among recent announcements, Vistra’s 20 year PPA tied to 1,200 MW of carbon free output from Comanche Peak stands out, because it connects directly to the AI and reliability themes highlighted in KeyBanc’s report. By locking in long duration, contracted nuclear capacity, Vistra is leaning into stable, carbon free supply that could underpin earnings as it pursues growth in renewables, storage, and gas peakers.

Yet while enthusiasm around AI powered demand is high, investors should also be aware of Vistra’s elevated leverage and reliance on fossil assets...

Read the full narrative on Vistra (it's free!)

Vistra's narrative projects $24.5 billion revenue and $3.4 billion earnings by 2028. This requires 9.8% yearly revenue growth and a $1.2 billion earnings increase from $2.2 billion today.

Uncover how Vistra's forecasts yield a $230.71 fair value, a 34% upside to its current price.

Exploring Other Perspectives

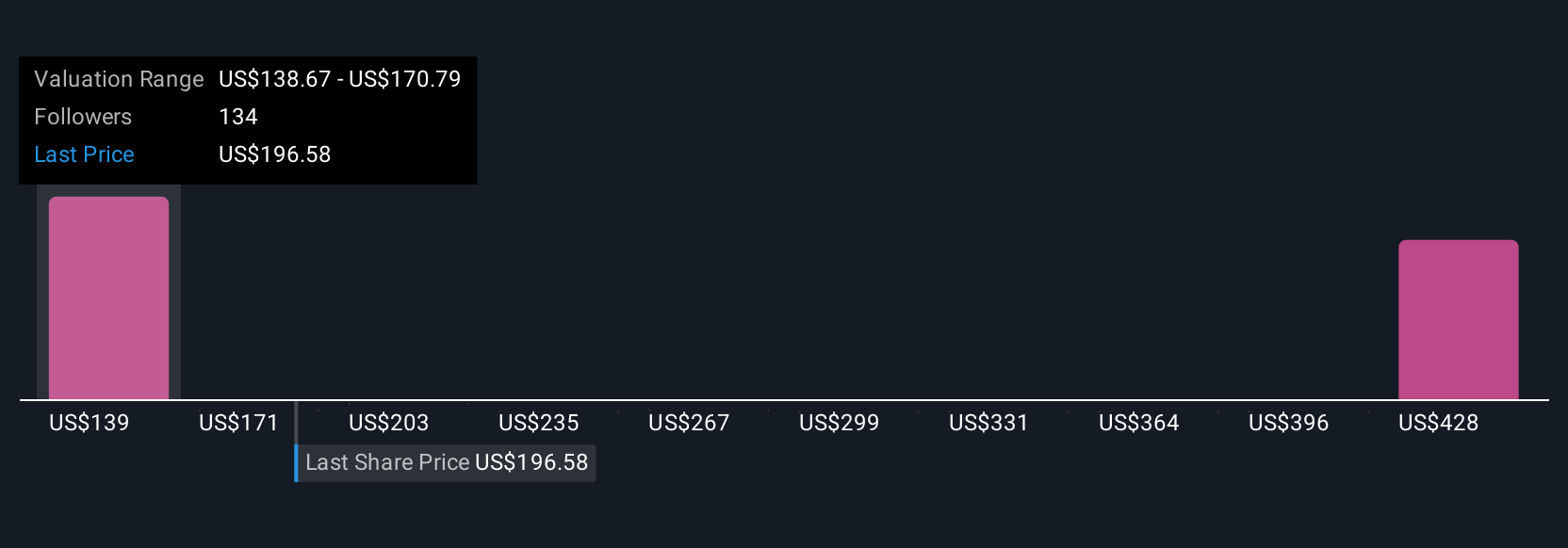

Thirteen fair value estimates from the Simply Wall St Community span roughly US$142 to US$388 per share, underscoring how far apart individual views can be. Set this against Vistra’s reliance on acquisitions and fossil assets, which ties future performance to integration, regulation, and commodity risks that readers may want to explore from several angles.

Explore 13 other fair value estimates on Vistra - why the stock might be worth 18% less than the current price!

Build Your Own Vistra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vistra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vistra's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VST

Vistra

Operates as an integrated retail electricity and power generation company in the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026