- United States

- /

- Gas Utilities

- /

- NYSE:UGI

Will UGI's (UGI) Hazleton Gas Main Upgrade Alter the Company's Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- In September 2025, UGI Utilities began replacing a gas main in Hazleton as part of its commitment to upgrade infrastructure for safe and reliable service, impacting several city streets with temporary road closures, detours, and service interruptions through mid-November.

- This project offers homes and businesses along the route the potential to convert to natural gas, highlighting UGI's ongoing efforts to modernize its energy network and increase customer access.

- We'll examine how this infrastructure upgrade and expansion potential shapes UGI's investment narrative and long-term outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

UGI Investment Narrative Recap

For shareholders, the core case for UGI rests on the company's ability to modernize its utility network and unlock customer growth, while managing costs and regulatory headwinds. The Hazleton gas main replacement signals a commitment to infrastructure investment and new customer conversions, yet does not materially shift near-term earnings drivers or address the key risk of ongoing demand erosion in LPG and propane segments.

Among recent updates, UGI's August 2025 announcement of a new $300 million senior secured revolving loan facility stands out, reinforcing the company's focus on capital flexibility to fund obligations and ongoing infrastructure projects like Hazleton. Access to financing supports near-term investment and operational continuity, both important for utility network expansion and reliability.

But on the other hand, investors should be alert to persistent volume declines in key segments that could undermine...

Read the full narrative on UGI (it's free!)

UGI's narrative projects $9.0 billion revenue and $794.3 million earnings by 2028. This requires 7.0% yearly revenue growth and an increase of $376.3 million in earnings from $418.0 million currently.

Uncover how UGI's forecasts yield a $41.00 fair value, a 23% upside to its current price.

Exploring Other Perspectives

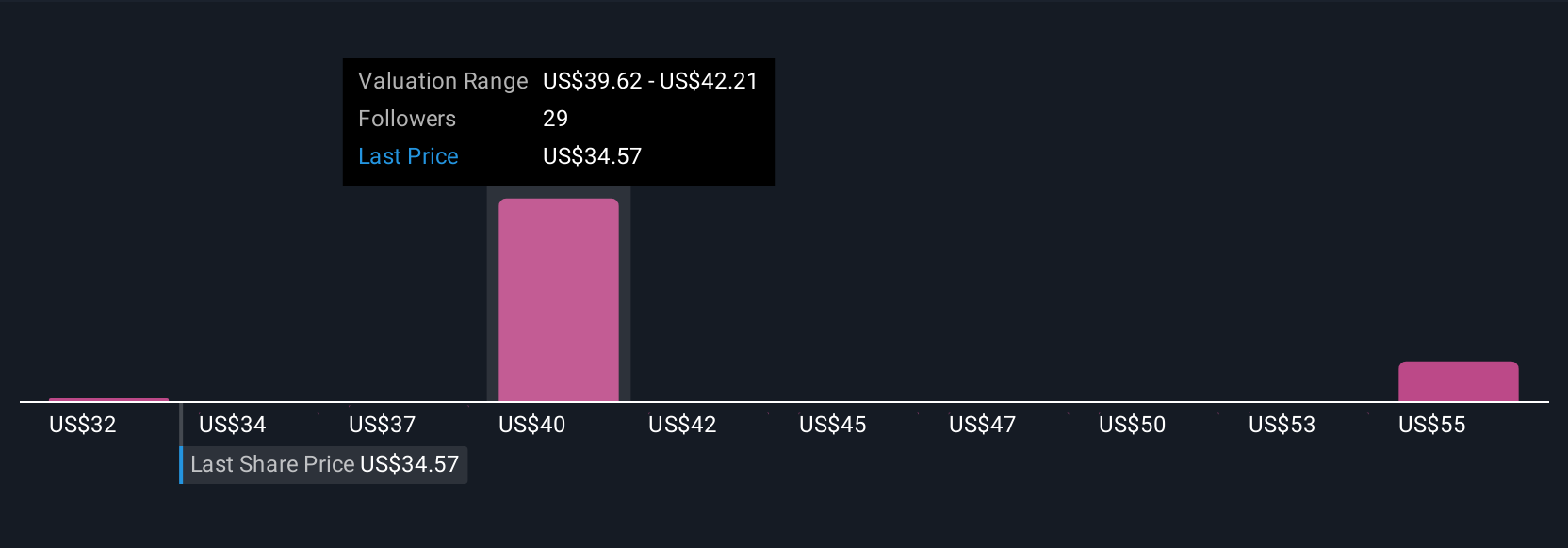

Simply Wall St Community members provided five independent fair value estimates for UGI, spanning a wide range between US$31.87 and US$56.86 per share. While some expect meaningful upside, the ongoing shift away from fossil-based fuels remains a critical factor influencing future company performance, so consider multiple viewpoints when assessing this stock.

Explore 5 other fair value estimates on UGI - why the stock might be worth just $31.87!

Build Your Own UGI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UGI research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UGI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UGI's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UGI

UGI

Engages in the distribution, storage, transportation, and marketing of energy products and related services in the United States and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives