- United States

- /

- Gas Utilities

- /

- NYSE:UGI

UGI (UGI) Valuation Update Following New Credit Facility and Strengthened Financial Position

Reviewed by Simply Wall St

Most Popular Narrative: Narrative: 13.9% Undervalued

According to community narrative, UGI is currently trading at a 13.9% discount to its estimated fair value, suggesting the stock is meaningfully undervalued based on analyst assumptions for growth and profitability over the next several years.

"Strategic investments in renewable natural gas (RNG) projects, bonus depreciation potential, and stronger regulatory incentives through recent legislation (for example, the One Big Beautiful Bill Act) are expected to drive long-term EBITDA growth and improve net margins."

Curious what is fueling this undervaluation call? Analysts are betting on a mix of innovative energy projects and significant legislative tailwinds, along with a roadmap for profitability that many might not anticipate. How ambitious are those growth projections? Learn what is underpinning this consensus and where the next leap could come from.

Result: Fair Value of $41.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing customer attrition at AmeriGas and persistent demand decline for LPG in Europe could weigh on UGI's long-term revenue growth.

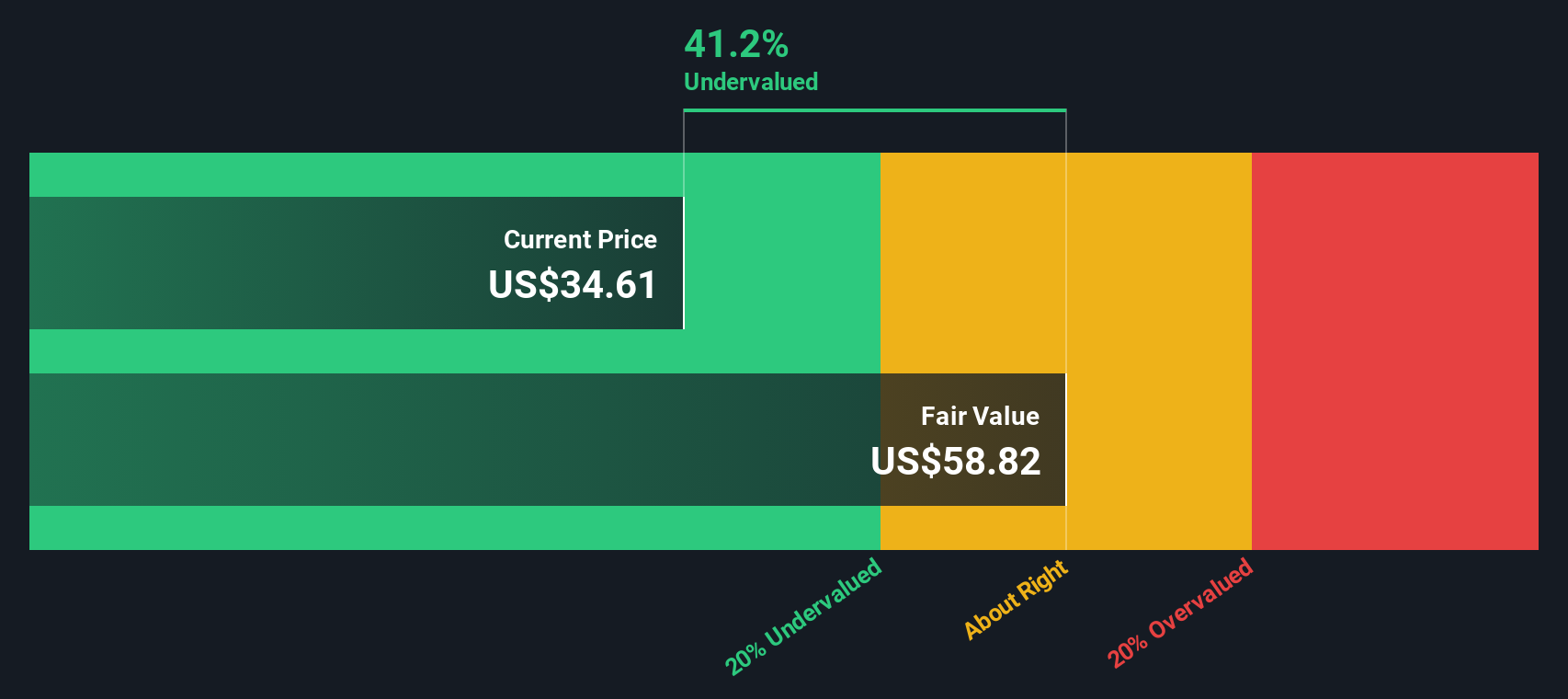

Find out about the key risks to this UGI narrative.Another View: Discounted Cash Flow Perspective

Beyond industry multiples, our DCF model also points to UGI being undervalued. This suggests there may be more potential than traditional price metrics show. Which valuation better captures UGI's true prospects?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UGI Narrative

If you are interested in taking a different perspective or want to investigate the data yourself, you can craft your own independent view in just a few minutes. So why not do it your way?

A great starting point for your UGI research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Staying ahead means widening your horizons. Don’t miss out on other standout stocks and themes that are ready to shape tomorrow’s market. Check out these handpicked ideas and give yourself an edge for your next move:

- Strengthen your portfolio by spotting companies with reliable dividend stocks with yields > 3%. These can deliver regular income even when markets are volatile.

- Tap into fast-growing sectors by checking out AI penny stocks. These are making advancements in artificial intelligence and are redefining the tech landscape.

- Uncover hidden gems by searching for undervalued stocks based on cash flows. These are trading at a discount to their intrinsic value and could give you a head start on tomorrow’s opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UGI

UGI

Engages in the distribution, storage, transportation, and marketing of energy products and related services in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives