- United States

- /

- Other Utilities

- /

- NYSE:SRE

Sempra (NYSE:SRE) Stock Dips 14% Following Revised Earnings Guidance

Reviewed by Simply Wall St

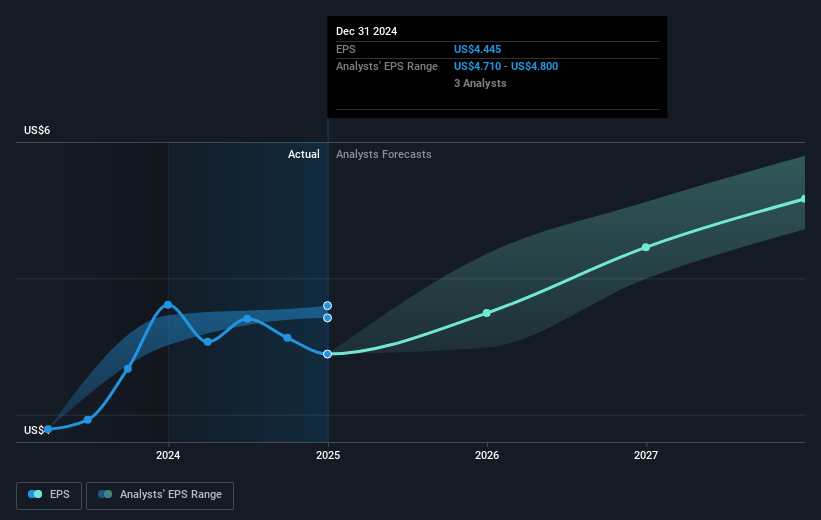

Sempra (NYSE:SRE) has recently experienced significant developments including revised earnings guidance and an earnings announcement, aligning with broader market trends that have shown economic concerns. Despite revising its earnings guidance for 2025 and 2026, and reporting fourth-quarter sales growth, Sempra reported a decline in net income compared to the previous year. The company's diverse moves included declaring increased dividends and appointing new board members with extensive industry experience. However, these efforts did not seem to sway market sentiment positively as the company’s stock fell 14% over the last month. This price movement occurred amid a broader market downturn, evidenced by declines in major indices like the Dow Jones, which fell 1% last month due to economic uncertainties and disappointing manufacturing data. These broader trends might have compounded the impact of Sempra's individual financial and strategic adjustments on its stock performance.

Get an in-depth perspective on Sempra's performance by reading our analysis here.

Over the last five years, Sempra’s total shareholder returns, including share price and dividends, reached 31.93%. During this period, the company experienced various dynamics affecting its long-term performance. Notably, Sempra's quarterly dividend saw an increase to US$0.645 per share in early 2025, reflecting its commitment to enhancing shareholder value. In late 2024, a follow-on equity offering worth US$3 billion was filed, potentially impacting share price by diluting existing holdings. Additionally, the appointment of experienced board members like Anya Weaving and Kevin Sagara in March 2025 may signal governance strengthening, influencing investor confidence.

Despite these efforts and a 12.9% annual growth in earnings over the five years, Sempra recently reported a year-on-year net income decline, which contrasts the positive long-term trends. In the past year alone, Sempra underperformed compared to the US market and the Integrated Utilities industry, which might have influenced the recent adjustments seen in stock performance.

- Get the full picture of Sempra's valuation metrics and investment prospects—click to explore.

- Analyze the downside risks for Sempra and understand their potential impact—click to learn more.

- Are you invested in Sempra already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRE

Sempra

Operates as an energy infrastructure company in the United States and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives