- United States

- /

- Electric Utilities

- /

- NYSE:SO

Bowyer Research Advises Against Proposal on Energy Assumptions at Southern (NYSE:SO)

Reviewed by Simply Wall St

Bowyer Research recently recommended shareholders vote against a proposal requiring Southern (NYSE:SO) to disclose assumptions on its fossil fuel reliance, to be discussed at the 2025 annual meeting. Over the last week, Southern's stock saw a 6% rise. This movement contrasts with the broader market where the S&P 500 slipped due to rising Treasury yields amidst legislative tax discussions. The momentum in Southern’s shares might reflect a mix of internal dynamics and broader investor sentiment, creating distinct movement amid general market fluctuations. Notably, the market remains up 11% over the past year, highlighting an optimistic economic outlook.

The recent recommendation by Bowyer Research against the proposal for Southern (NYSE:SO) to disclose its fossil fuel reliance highlights existing tensions between sustainability and traditional energy practices. This could influence both short-term investor sentiment and long-term strategic direction. The share price increase of 6% over the past week reflects such sentiment and internal dynamics, setting it apart from the broader market that experienced a decline amid rising Treasury yields.

Over a longer period, Southern's total shareholder return, including dividends, has reached 101.93% over five years. This is contextualized by the recent market fluctuations, as the US Electric Utilities industry saw a 12.9% return over the past year, with Southern matching this performance. Compared to the broader market, Southern exceeded the US market's 11.1% return in the past year.

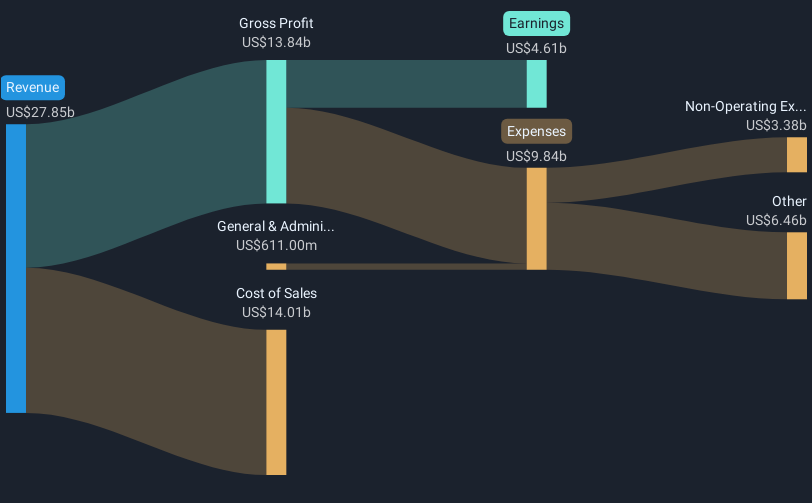

The potential impact of recent developments on future revenue and earnings forecasts is nuanced. Southern anticipates robust growth through energy infrastructure upgrades and increasing demand in its large load pipeline. However, potential regulatory and policy uncertainties might temper these prospects. Southern’s current share price of US$91.22 shows a minor discount to the average analyst price target of US$92.54, indicating analysts see it as fairly priced. Although the consensus depicts moderate growth, any substantial deviations in assumed earnings could shift these projections notably. Investors are advised to assess these factors alongside evolving market conditions and their individual expectations.

Learn about Southern's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SO

Southern

Through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives