- United States

- /

- Electric Utilities

- /

- NYSE:PCG

PG&E (PCG): Evaluating Undervaluation Potential After Recent Share Price Movements

Reviewed by Simply Wall St

PG&E (PCG) stock has experienced some movement over the past month, catching the interest of investors who track utility sector trends. Shares are up 5% in the past month, even though the year-to-date return has been softer.

See our latest analysis for PG&E.

Despite a recent pullback, with a one-day share price return of -2.23% and a 7-day drop of nearly 5%, PG&E’s shares have climbed 4.65% over the past month. However, the year-to-date share price return sits firmly in the red. In a broader context, long-term shareholders have enjoyed a 58% total return over five years, but momentum lately is mixed as the stock recovers from earlier declines.

If you’re weighing your next move and want to spot more opportunities, now might be the perfect moment to discover fast growing stocks with high insider ownership

With shares trading well below analysts’ average price target, but recent performance mixed, the key question for investors is clear: is PG&E undervalued right now, or is the market fully pricing in any future growth?

Most Popular Narrative: 25.8% Undervalued

With the narrative’s fair value set at $21.23 and the most recent closing price at $15.76, PG&E stands out as a potential bargain in the eyes of market watchers, provided the forecast assumptions play out as projected.

Expanding opportunities for capital investment in grid modernization, wildfire mitigation, and resilience, fueled by both regulatory mandates and the need to serve new electrification and decarbonization requirements, position PG&E to grow its rate base and regulated earnings steadily over the next decade.

What's behind this compelling gap? Analysts are betting on a wave of infrastructure upgrades, new earnings highs, and a sharply different margin profile just a few years out. The twists in their model could surprise you; find out exactly which bold profit forecasts are driving this valuation.

Result: Fair Value of $21.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent legislative uncertainty and increasing wildfire hazards in California could quickly shift the outlook and reduce confidence in future earnings.

Find out about the key risks to this PG&E narrative.

Another View: What Does the SWS DCF Model Say?

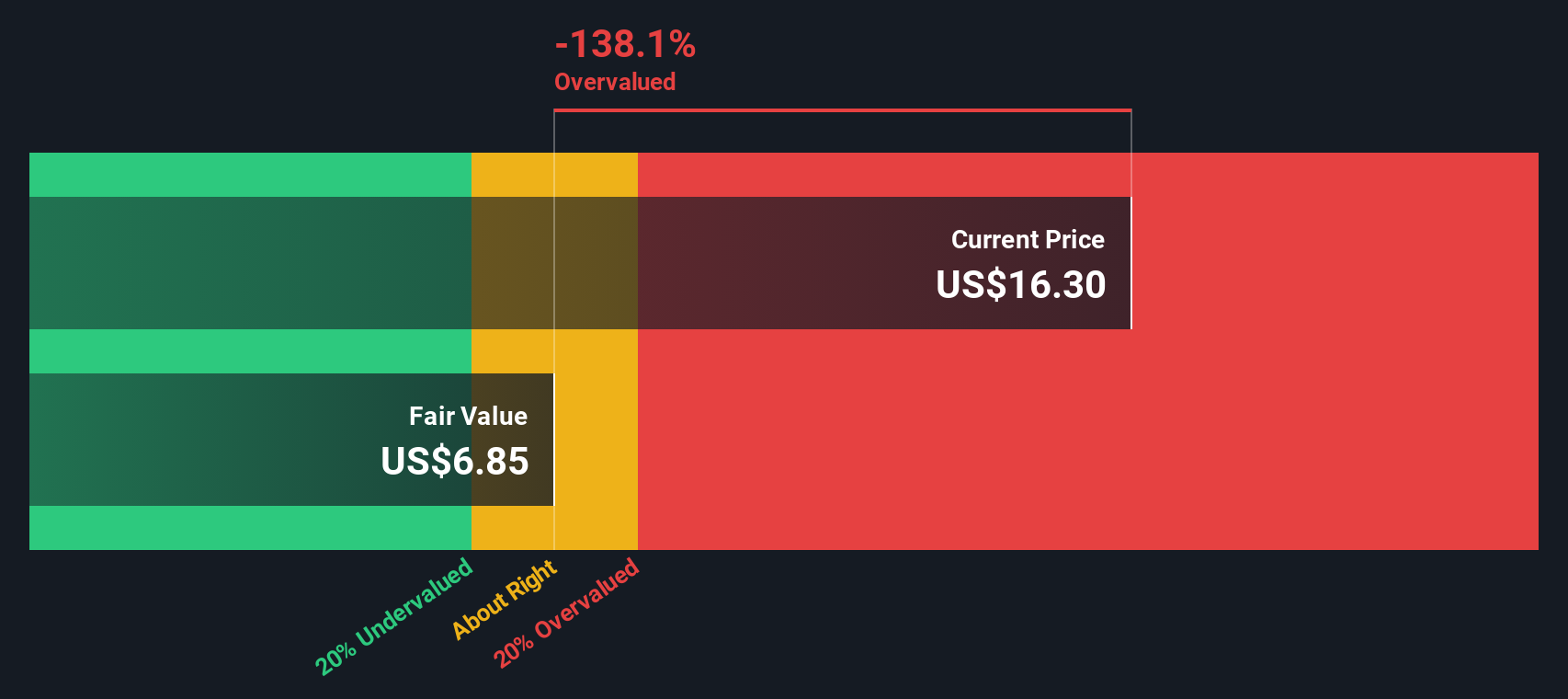

While the analyst consensus sees strong upside, our SWS DCF model takes a more cautious approach. According to this method, PG&E stock currently trades above its estimated fair value. This suggests the market may be factoring in more growth than the cash flow model supports. Is this a warning sign, or simply a temporary disconnect that could close as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PG&E for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PG&E Narrative

If you want a different perspective or would rather dive into the numbers yourself, you can shape your own investment view in just minutes: Do it your way

A great starting point for your PG&E research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that standing still means missing out. Strengthen your portfolio today by widening your search beyond a single stock and targeting game-changing sectors and emerging opportunities.

- Stay ahead of trends and uncover companies leveraging artificial intelligence breakthroughs by checking out these 26 AI penny stocks and discover those making waves in automation and innovation.

- Boost your potential for passive income by exploring these 21 dividend stocks with yields > 3% which offer solid yields and reliable growth, ideal for building financial security.

- Ride the momentum of rapid price swings and capture high-upside potential among these 3583 penny stocks with strong financials that are reshaping the investment landscape right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)