- United States

- /

- Renewable Energy

- /

- NYSE:ORA

Ormat Technologies (ORA): Evaluating Valuation After Texas Storage Project Launch and Strategic Tax Equity Deal

Reviewed by Simply Wall St

If you are tracking Ormat Technologies (NYSE:ORA), this week’s news might grab your attention. The company just flipped the switch on its 60MW/120MWh Lower Rio energy storage facility in Texas, marking a significant step for its U.S. growth playbook. Ormat also secured a hybrid tax equity partnership with Morgan Stanley Renewables, turning clean energy tax credits into an immediate $25 million cash infusion. Together, these moves highlight both expansion and smart financial structuring as the company continues to focus on energy storage.

This progress comes as Ormat’s share price has climbed 27% over the past year and 31% year-to-date, reflecting strong momentum after some challenging years. In recent months, Ormat announced a technology partnership with Sage Geosystems for next-generation geothermal projects and has reported consistent annual revenue and net income growth. With the Lower Rio project now online, Ormat’s total storage capacity in the U.S. reaches 350MW, reinforcing its strategy to establish a leading position in energy storage alongside geothermal and solar assets.

With this progress and new strategic milestones, some may be asking whether Ormat is still trading at an appealing valuation, or if all the expected growth is already reflected in its stock price.

Most Popular Narrative: 4.2% Undervalued

According to the most widely followed narrative, Ormat Technologies is considered modestly undervalued based on future growth expectations. The analysis points to a fair value estimate that is just above the current share price, reflecting optimism about earnings growth and upcoming catalysts.

*Recent federal permitting reforms and policy support have significantly expedited geothermal project development timelines in the U.S. This has enabled Ormat to accelerate greenfield expansion and release more projects for construction, which could drive faster revenue growth and increased long-term cash flows. Extension of production and investment tax credits (PTC/ITC) for geothermal and energy storage projects through at least 2033 reduces capital costs, de-risks new project development, and boosts net margins and earnings over the next decade.*

Curious about what is really powering this valuation? Surging clean power demand, aggressive U.S. policy tailwinds, and bold topline projections are at play. What does the narrative see that the market might miss? Uncover the numbers and debates that could shape Ormat’s next big leap in the full assessment.

Result: Fair Value of $94.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing reliance on Chinese batteries and uncertainty around future U.S. policy could challenge Ormat’s growth and put pressure on its long-term margins.

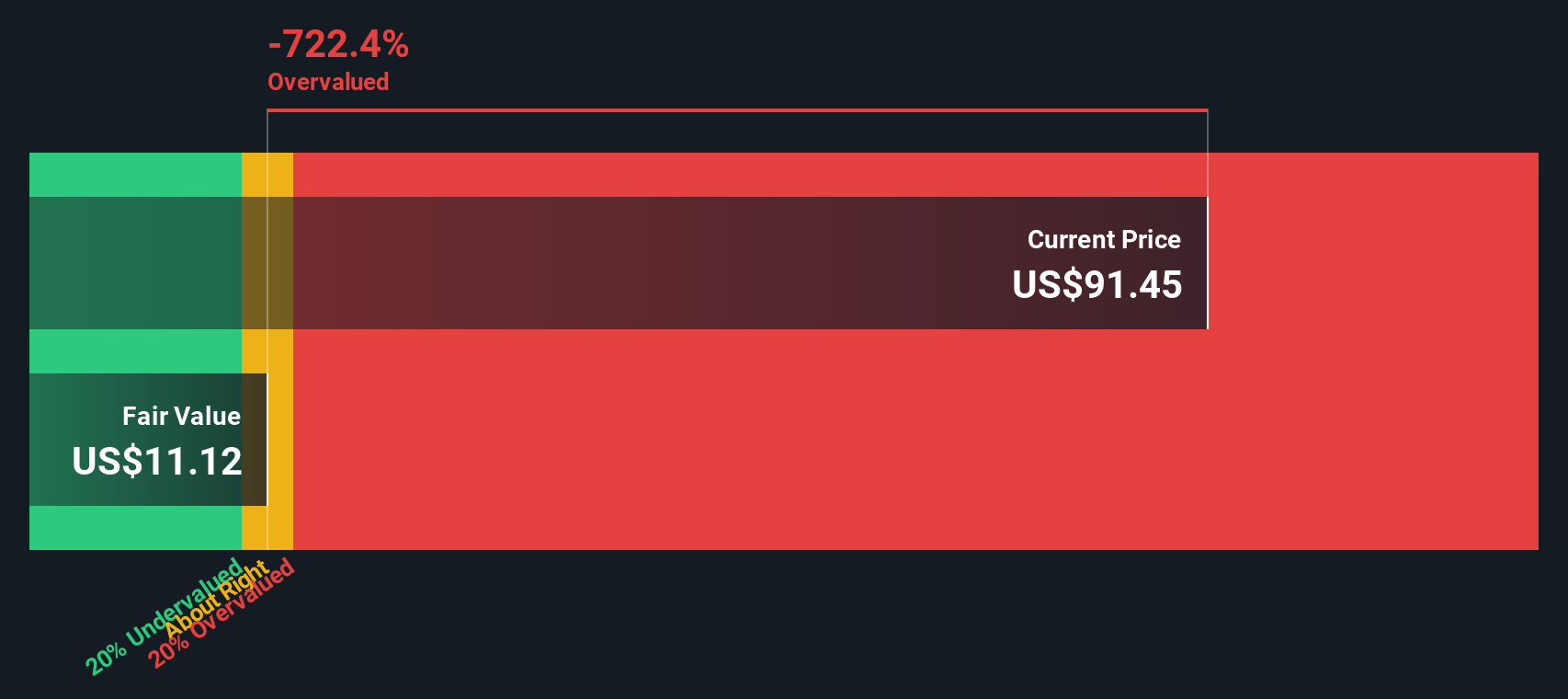

Find out about the key risks to this Ormat Technologies narrative.Another View: Our DCF Model Points the Other Way

While multiples suggest Ormat Technologies may be undervalued, our DCF model tells a very different story and questions whether the current price is justified by future cash flows. Which view will prove right?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Ormat Technologies to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Ormat Technologies Narrative

If you want to dig into the details or chart your own path through Ormat Technologies' outlook, you can build a personal narrative in just a few minutes. Do it your way

A great starting point for your Ormat Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still. Level up your research by searching for stocks with powerful trends, income potential, or disruptive technology using specially curated investment themes below. If you want to give your portfolio an edge, start now and don’t miss these opportunities:

- Uncover stocks that are trading at attractive prices and maximize your growth potential with undervalued stocks based on cash flows built to spotlight truly undervalued opportunities.

- Find companies making real breakthroughs with artificial intelligence by using the AI penny stocks to see where technology meets future profits.

- Secure steady income and stability by targeting shares offering robust yields through our dividend stocks with yields > 3%, perfect for those seeking reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ORA

Ormat Technologies

Engages in the geothermal and recovered energy power business in the United States, Indonesia, Kenya, Turkey, Chile, Guatemala, Guadeloupe, New Zealand, Honduras, France, Indonesia, the Philippines, and internationally.

Proven track record with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)