- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Should Strategic Partnerships and Regulatory Progress Prompt Action From Oklo (OKLO) Investors?

Reviewed by Simply Wall St

- Over the past week, Oklo Inc. has announced a series of strategic partnerships, including collaborations with Liberty Energy and Vertiv, and made regulatory headway by passing the NRC's pre-application readiness assessment for its advanced Aurora nuclear powerhouses at Idaho National Laboratory.

- This suite of developments highlights Oklo's increasing integration into the power and data center sectors, supported by significant progress toward commercial deployment of its advanced nuclear technology.

- We'll explore how Oklo's alliance with Liberty Energy to bridge natural gas and nuclear energy solutions shapes its investment narrative.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is Oklo's Investment Narrative?

To be an Oklo shareholder is to buy into the idea that advanced nuclear can become a transformative player in the future of large-scale power and data center infrastructure. The latest flurry of announcements, particularly the alliances with Liberty Energy and Vertiv, are designed to position Oklo as a crucial part of the clean energy transition, targeting customers with significant, fast-growing electricity demands. Given Oklo just passed a key NRC licensing milestone and secured new construction partnerships, the short-term catalyst remains regulatory progress toward first commercial deployment. These collaborations may speed up commercialization or further validate Oklo’s offering, but with zero current revenue and ongoing losses, execution risk is high. Still, the recent price surge suggests some investors see the news as a positive step. However, operational, regulatory, and dilution risks remain considerable until meaningful revenue materializes.

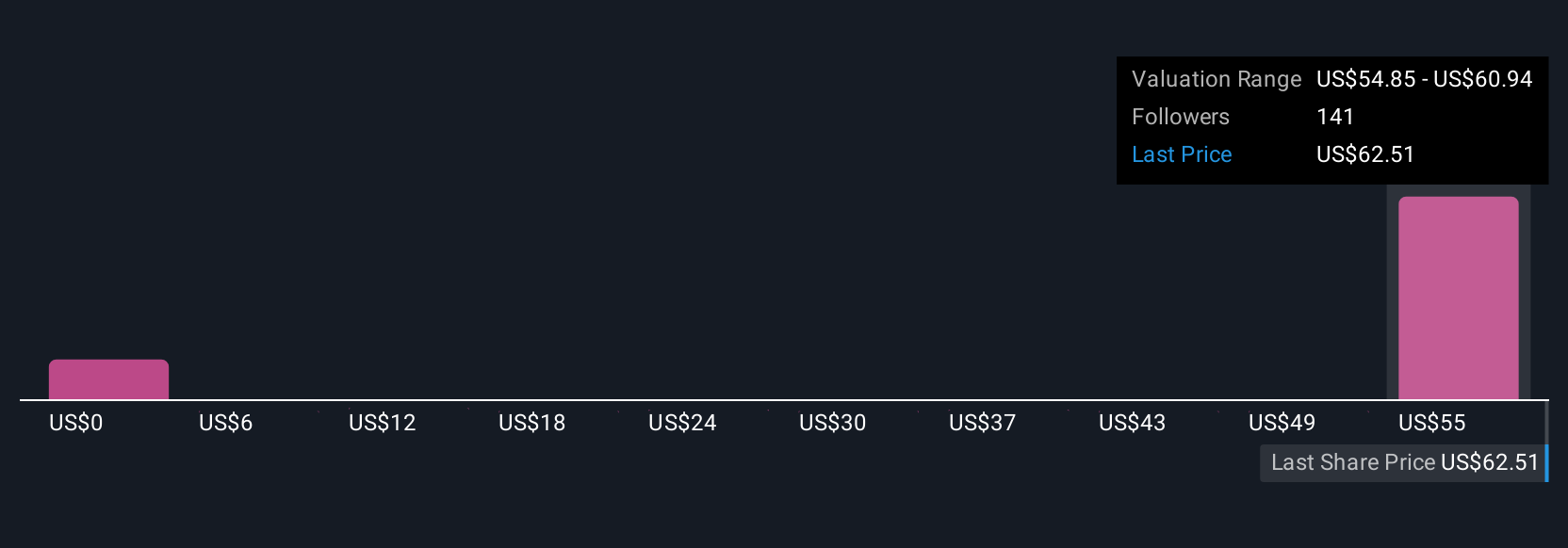

But amid the excitement, the absence of revenue remains a key risk for would-be investors. The analysis detailed in our Oklo valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Build Your Own Oklo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oklo research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oklo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oklo's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives