- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (OKLO) Is Up 7.2% After DOE Taps Firm for Advanced Nuclear Fuel Projects – What's Changed

Reviewed by Sasha Jovanovic

- Oklo Inc. announced that it was selected by the U.S. Department of Energy, alongside three other companies, to build and operate three advanced nuclear fuel-fabrication facilities as part of the DOE's Advanced Nuclear Fuel Line Pilot Projects, aimed at accelerating licensing and strengthening America's domestic fuel supply for next-generation reactors.

- This milestone underscores Oklo's increasingly prominent role in government-backed efforts to revitalize the U.S. nuclear industry and foster innovation in clean energy infrastructure.

- We'll examine how Oklo's upcoming DOE-supported fuel facilities enhance its investment narrative as attention shifts to domestic nuclear supply chains.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Oklo's Investment Narrative?

Owning shares in Oklo means buying into a long-term vision where advanced nuclear technology can address the growing need for clean, reliable energy, especially as AI data centers and electrification surge ahead. The recent Department of Energy award to build and operate three advanced fuel-fabrication facilities marks a genuine milestone. This move not only strengthens Oklo’s position in the domestic nuclear supply chain but also enhances its credibility and visibility, which could potentially shift short-term catalysts in the company’s favor, at least in terms of investor sentiment and regulatory momentum. However, despite these positives, Oklo remains pre-revenue and unprofitable, and has yet to demonstrate commercial-scale deployment or revenue generation. Risks associated with valuation, insider selling, leadership changes, and potential future fundraising remain front and center, making the path ahead highly dependent on continued execution and the ability to move from promise to actual production.

But despite the buzz, questions about Oklo’s ability to achieve profitability any time soon remain critical for investors.

Exploring Other Perspectives

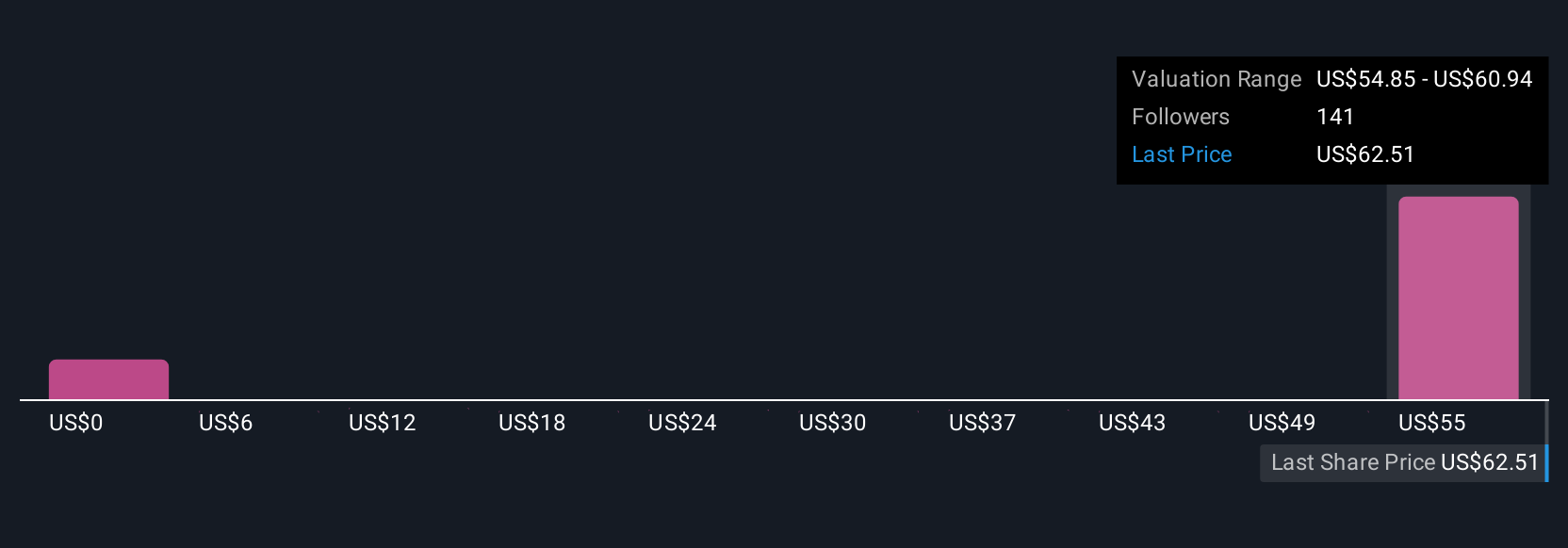

Explore 64 other fair value estimates on Oklo - why the stock might be worth less than half the current price!

Build Your Own Oklo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oklo research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oklo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oklo's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives