- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (NYSE:OKLO) Soars 46% After Forming Clean Energy Partners

Reviewed by Simply Wall St

Oklo (NYSE:OKLO) experienced significant changes last quarter with a 46% increase in share price. This performance coincides with several key developments, including Christopher Wright's appointment as the U.S. Secretary of Energy and his subsequent resignation from Oklo's board. This prompted the company to address compliance issues with the NYSE regarding its Audit Committee composition. Despite receiving a notice of non-compliance, trading of Oklo's shares remained unaffected, indicating investor confidence. During the same period, Oklo formed important partnerships with Lightbridge and RPower, fostering progress in clean energy initiatives. These alliances likely bolstered investor sentiment amid a broader market environment marked by a 2.5% downturn due to new U.S. tariffs impacting investor outlook. However, Oklo's growth prospects in nuclear energy and strategic alliances countered market trends, contributing to its robust quarterly performance.

Get an in-depth perspective on Oklo's performance by reading our analysis here.

Over the past three years, Oklo's total shareholder return was an impressive 202.57%, distinguishing it amidst industry challenges. This robust performance occurred as Oklo consistently exceeded the one-year returns of both the US Electric Utilities industry and the broader market. Key drivers included strategic partnerships and significant regulatory milestones. The December 2023 agreement with Siemens Energy strengthened Oklo’s position as it tapped into advanced reactor technology, and the 2024 environmental compliance for its Idaho facility paved the way for anticipated operational capabilities. Additionally, the company’s ongoing collaboration with Atomic Alchemy Inc. underscored its commitment to nuclear fuel innovations.

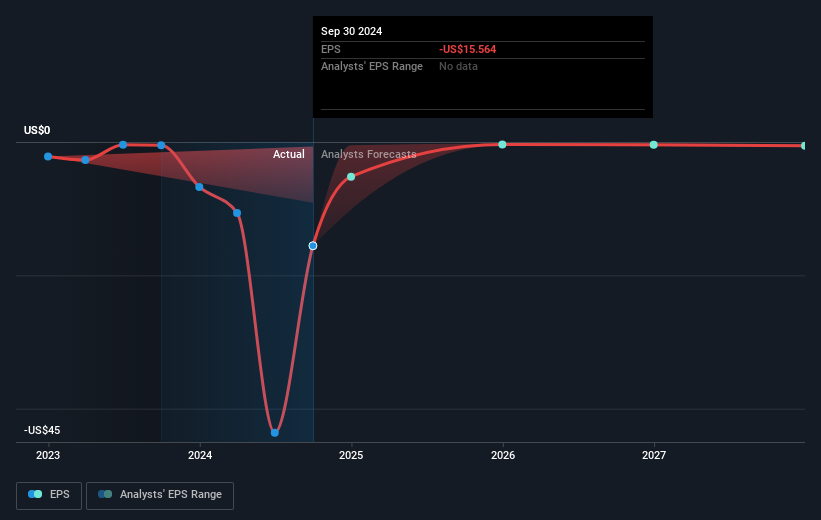

Despite financial challenges, such as the higher net losses reported throughout 2024, Oklo's focus on innovative energy solutions likely maintained investor interest. The January 2025 collaboration with RPower to power data centers demonstrates Oklo’s proactive approach in aligning with market needs, further supporting its long-term growth and solidifying confidence among shareholders.

- Understand the fair market value of Oklo with insights from our valuation analysis—click here to learn more.

- Discover the key vulnerabilities in Oklo's business with our detailed risk assessment.

- Have a stake in Oklo? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Designs and develops fission power plants to provide reliable and commercial-scale energy to customers in the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives