- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (NYSE:OKLO) Reports Q1 2025 Earnings With Reduced Net Loss

Reviewed by Simply Wall St

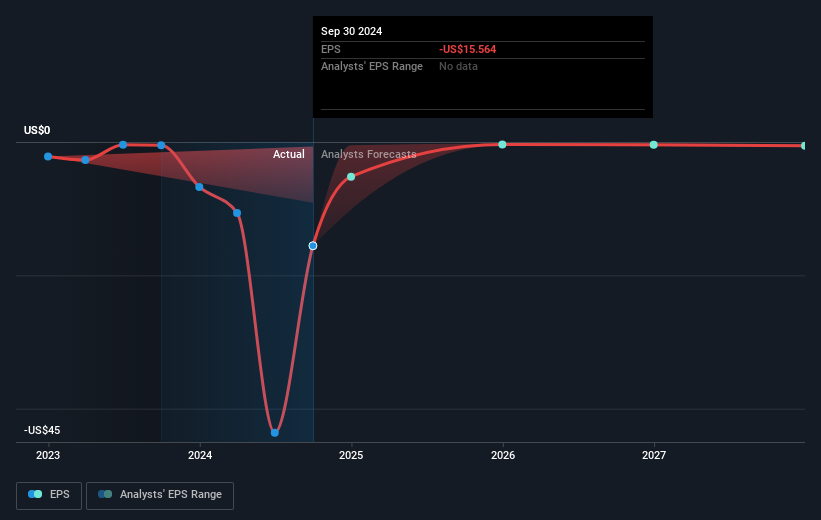

Oklo (NYSE:OKLO) reported a notable 71% increase in share price over the past month, a period marked by successful developments and strategic changes. The company's Q1 2025 earnings report highlighted a reduction in net loss, which may have bolstered investor sentiment. The completion of borehole drilling at the Idaho National Laboratory for its Aurora Powerhouse further reinforced progress in its projects. These advancements came amidst a broader market recovery where major indexes posted gains for three of the last four weeks. Oklo's developments appear to align with the broader optimistic market trends, reflecting investor confidence.

Oklo has 4 weaknesses (and 1 which is a bit concerning) we think you should know about.

Oklo's shares have skyrocketed over the last year, delivering a total return of 386.08%, a performance that surpasses both the overall US market, which returned 11.9%, and the US Electric Utilities industry, which returned 13.5%. These impressive gains provide a broader context to the company's recent month-long share price increase of 71%, suggesting a sustained investor confidence in Oklo's potential.

The recent developments highlighted in the introduction, such as the reduction in net loss and the advancements at Idaho National Laboratory, are key factors influencing investor sentiment and potentially impacting future earnings forecasts. While the company's revenue remains at zero, the progress in projects like the Aurora Powerhouse could enhance future revenue prospects. With the current share price reflecting a 24.36% discount to the consensus analyst price target of US$46.91, the market appears to hold optimistic expectations about Oklo’s growth trajectory.

Explore Oklo's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives