- United States

- /

- Electric Utilities

- /

- NYSE:OGE

The Bull Case for OGE Energy (OGE) Could Change Following Proposed Customer Charges for Project Costs

Reviewed by Sasha Jovanovic

- In recent weeks, OGE Energy requested regulatory approval to charge customers for construction work in progress on new energy projects, reaching a settlement with stakeholders that includes certain consumer protections though final approval is still pending.

- The company’s proposal has sparked debate among advocacy groups and highlights the impact of infrastructure investments and regulatory decisions on utilities’ operations and customers.

- We'll assess how the requested rate increase and customer protections could influence OGE Energy’s overall investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

OGE Energy Investment Narrative Recap

To own OGE Energy, investors need to believe that demand for reliable electricity and regulatory support for infrastructure investment will continue to drive steady growth, even as debates over rate increases and construction costs become more prominent. The recent customer charge proposal reflects ongoing tension between cost recovery for large projects and protecting customer interests; while this development raises headline risk, the settlement’s built-in consumer protections help reduce potential near-term impact, leaving the long-term growth outlook largely intact for now.

Among recent company initiatives, the proposed $100 million rate increase tied to construction of natural gas generators at the Horseshoe Lake Power Plant closely relates to the short-term catalyst of accelerated asset deployment and faster cost recovery. As regulatory decisions shape OGE’s ability to recoup investment and manage customer impacts, these outcomes remain integral to the utility’s investment story and could influence the timing of future returns.

Yet, in contrast to the pace of new infrastructure investment, investors should also stay mindful of the risks that emerge if cost overruns or higher interest rates start to pressure margins...

Read the full narrative on OGE Energy (it's free!)

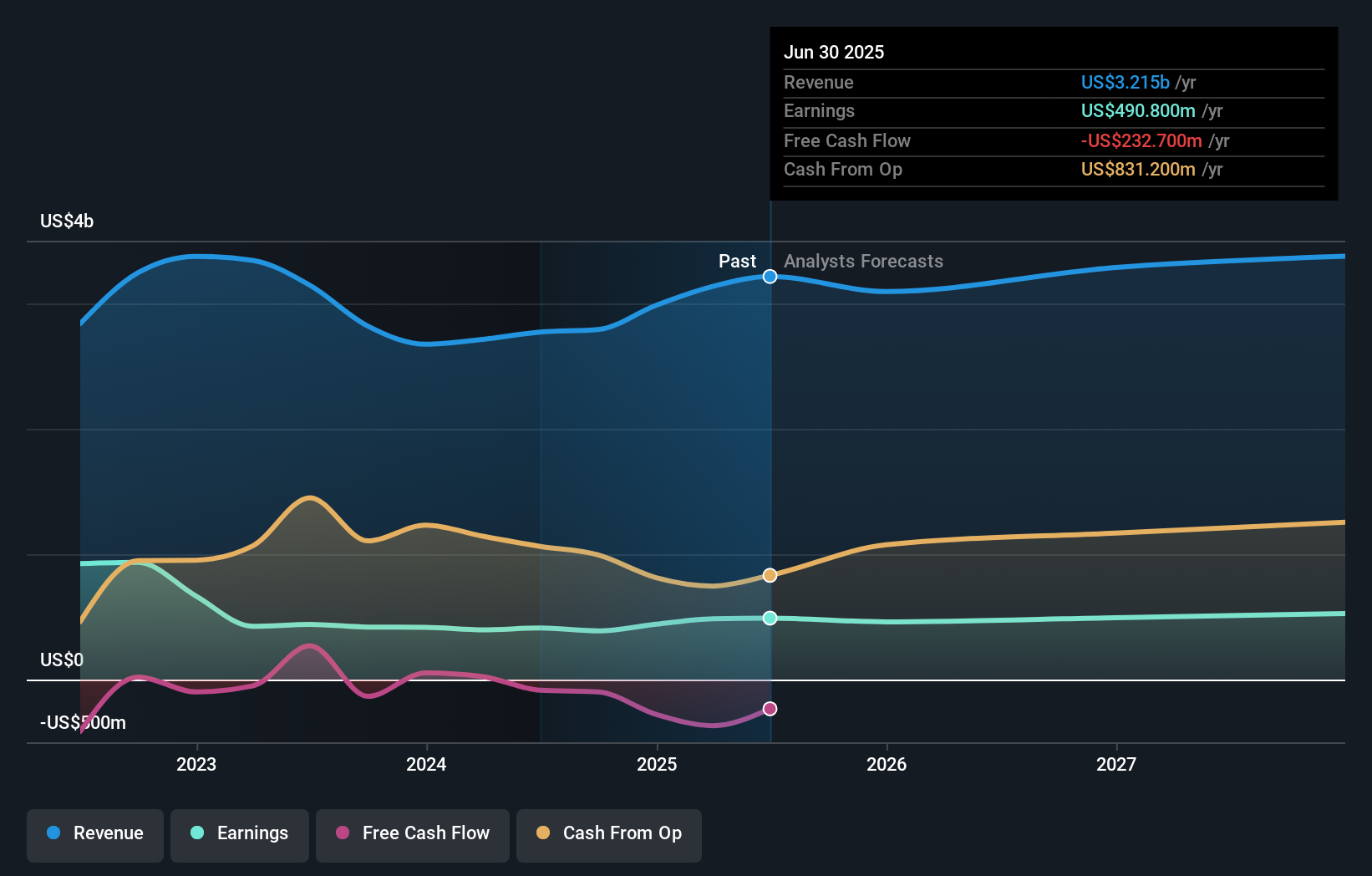

OGE Energy's outlook anticipates $3.5 billion in revenue and $545.7 million in earnings by 2028. This is based on an expected annual revenue growth rate of 2.7% and a $54.9 million increase in earnings from the current $490.8 million level.

Uncover how OGE Energy's forecasts yield a $45.94 fair value, in line with its current price.

Exploring Other Perspectives

Community members on Simply Wall St provided a single fair value estimate at US$45.94, suggesting limited variation in retail outlook. While opinions may converge, OGE’s ability to balance infrastructure growth and regulatory scrutiny could have far-reaching effects outside these figures. Explore several viewpoints for a broader perspective.

Explore another fair value estimate on OGE Energy - why the stock might be worth just $45.94!

Build Your Own OGE Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OGE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OGE Energy's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGE

OGE Energy

Through its subsidiary, operates as an energy services provider in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives