- United States

- /

- Gas Utilities

- /

- NYSE:NJR

Amy B. Mansue Joins New Jersey Resources (NJR) Board Strengthening Leadership Team

Reviewed by Simply Wall St

New Jersey Resources (NJR) recently announced the election of Amy B. Mansue to its Board of Directors, marking a significant addition to the company’s governance. Over the past quarter, NJR shares moved up by 4%, partially reflecting broader market trends where indexes like the Dow Jones reached record highs amid expectations of interest rate cuts from the Federal Reserve. While NJR’s financial adjustments and board changes during this period could have subtly influenced investor sentiment, the share price movement remains closely aligned with the positive momentum seen in major stock indexes.

The appointment of Amy B. Mansue to New Jersey Resources' Board of Directors could reinforce investor confidence in the company’s governance, potentially strengthening its strategic direction towards clean energy and infrastructure modernization. Over the past five years, NJR shares delivered a total return of 99.23%, reflecting significant long-term value for shareholders. However, over the past year, the company underperformed both the broader US market, which returned 20%, and the US Gas Utilities industry, which returned 12.8%.

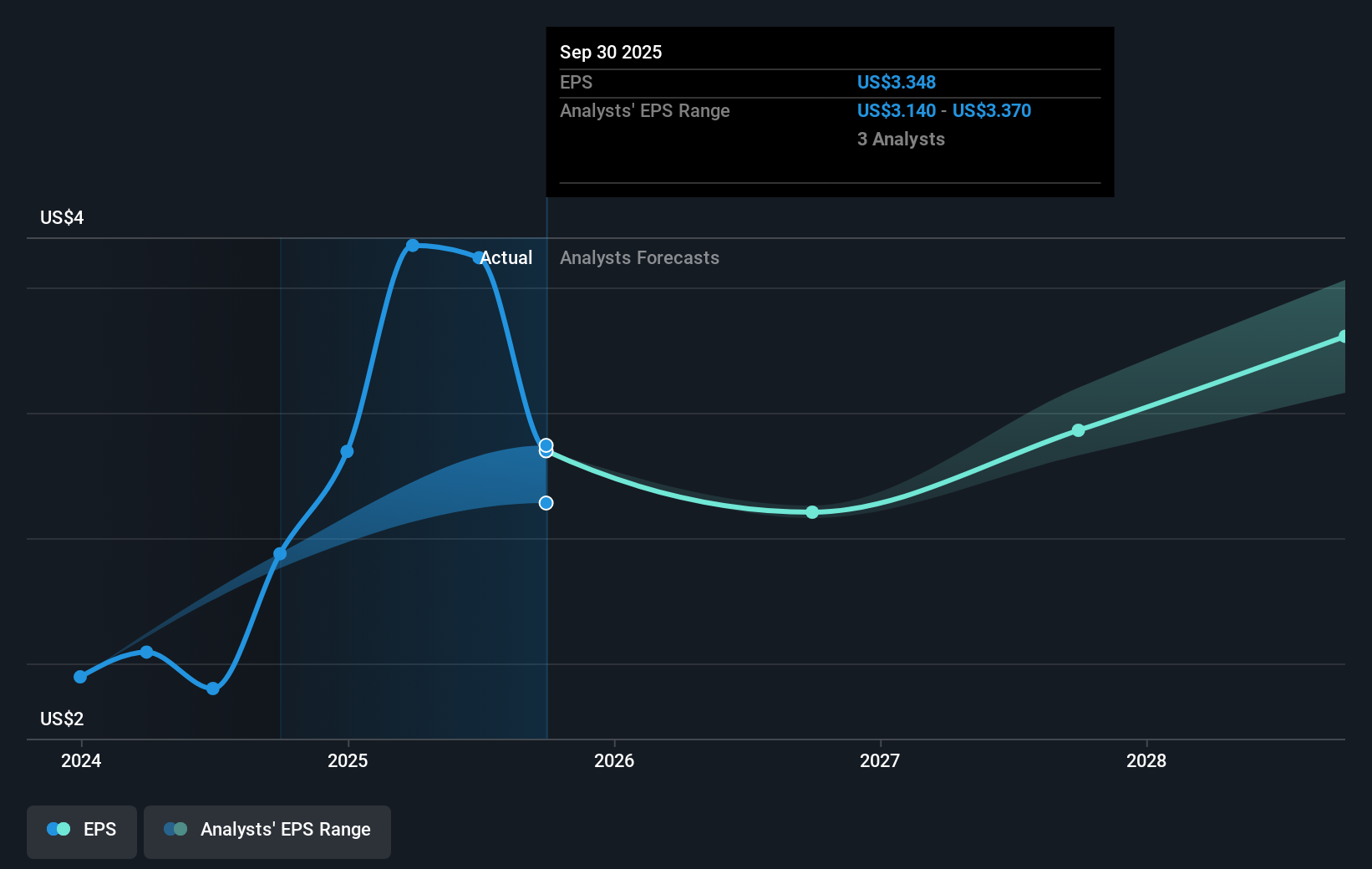

The recent share price increase positions NJR at a 13.2% discount to the consensus price target of US$53.57, suggesting analysts believe there is upside potential despite expectations of slightly declining revenue and profit margins over the coming years. The consensus target implies a future PE ratio of 16.7x, which remains below the current average for the US Gas Utilities industry. While the new board appointment may signal positive governance changes, challenges remain, particularly due to the heavy reliance on natural gas operations amidst shifts towards renewable energy strategies. Adjustments in revenue and earnings forecasts could occur as the company navigates regulatory dynamics and market trends influenced by its modernization efforts.

Gain insights into New Jersey Resources' future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if New Jersey Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NJR

New Jersey Resources

An energy services holding company, distributes natural gas.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)