- United States

- /

- Other Utilities

- /

- NYSE:NI

NiSource (NYSE:NI) Reports US$474 Million Q1 Net Income With US$2.1 Billion Sales

Reviewed by Simply Wall St

NiSource (NYSE:NI) recorded a 5.75% increase in its stock price over the past month. This upward movement aligns with NiSource's robust first-quarter earnings report, which highlighted a notable rise in sales, revenue, and net income. The market experienced mixed activity as investors anticipated the Fed's interest rate decision, and major indices showed only marginal changes. Within this landscape, NiSource's earnings performance provided additional support against broader market indecisiveness. Despite external influences like tariff discussions and interest rate expectations, NiSource's financial strength stood out, contributing positively to its stock movement.

Find companies with promising cash flow potential yet trading below their fair value.

NiSource's recent stock price increase aligns well with its strong earnings report, showcasing resilience amid market uncertainties such as interest rate changes and tariff discussions. This solid performance not only bolstered investor confidence but also hints at the potential for sustained revenue and earnings growth, driven by strategic initiatives like data center development and AI integration. Such technological and operational enhancements are projected to enhance net margins and operational efficiency, further supporting NiSource's growth trajectory.

Over the long term, NiSource stock has appreciated significantly, with a total shareholder return of over 105% over the past five years. This performance outpaced the US Integrated Utilities industry, which returned 15.9% over the past year, and also exceeded the US market's 8.2% return. This highlights the company's strong performance relative to broader indices and its industry peers.

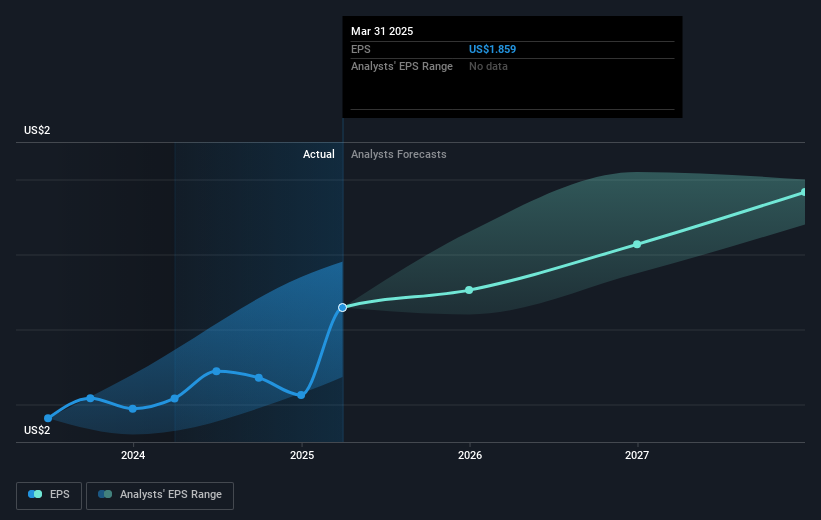

Analysts forecast NiSource's revenue to grow by approximately 8% annually in the coming years, with earnings projected to rise to US$1.1 billion by 2028. However, achieving these targets depends on overcoming regulatory challenges and successful project execution. The stock's recent price movement towards an analyst consensus price target of US$42.23 — a 5.9% potential upside from its present level of US$39.72 — suggests analysts perceive the company to be fairly valued at present. Investors should consider these forecasts and risks carefully when assessing NiSource's valuation and future prospects.

Examine NiSource's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NiSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NI

NiSource

An energy holding company, operates as a regulated natural gas and electric utility company in the United States.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives