- United States

- /

- Gas Utilities

- /

- NYSE:NFG

Does NFG’s Profit Rebound Without New Buybacks Change The Bull Case For National Fuel Gas (NFG)?

Reviewed by Sasha Jovanovic

- From July 1 to September 30, 2025, National Fuel Gas repurchased no additional shares under its existing buyback, leaving the previously completed 1,974,979-share, US$118.29 million program unchanged.

- More importantly for investors, the company’s latest quarter showed higher revenue and a swing back to profitability from a prior-year net loss, prompting analysts to maintain their Hold stance while acknowledging the improved performance.

- With National Fuel Gas returning to profitability, we’ll now assess how this earnings improvement affects the company’s investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

National Fuel Gas Investment Narrative Recap

To own National Fuel Gas, you need to believe in long term natural gas demand and the company’s ability to grow earnings despite mounting decarbonization and electrification pressures in its core Northeast markets. The latest quarter’s return to profitability supports that thesis, but it does not materially change the biggest near term swing factor, which remains execution on capital intensive pipeline and production projects versus the risk of tightening environmental rules that could slow or reshape those plans.

The recent confirmation that National Fuel Gas completed its 1,974,979 share, US$118.29 million buyback without additional repurchases in the latest quarter ties directly into this story, because it underscores a shift toward preserving capital after a year of heavy spending and earnings volatility. When you combine that with higher revenue and a swing back to profit, the key question becomes whether future cash flows will comfortably fund both growth projects and the dividend as decarbonization policies evolve.

But investors should also be aware that rising capital expenditure needs and potential stranded asset risks could...

Read the full narrative on National Fuel Gas (it's free!)

National Fuel Gas’ narrative projects $3.3 billion revenue and $1.1 billion earnings by 2028. This requires 14.9% yearly revenue growth and an earnings increase of about $0.9 billion from $243.5 million today.

Uncover how National Fuel Gas' forecasts yield a $102.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

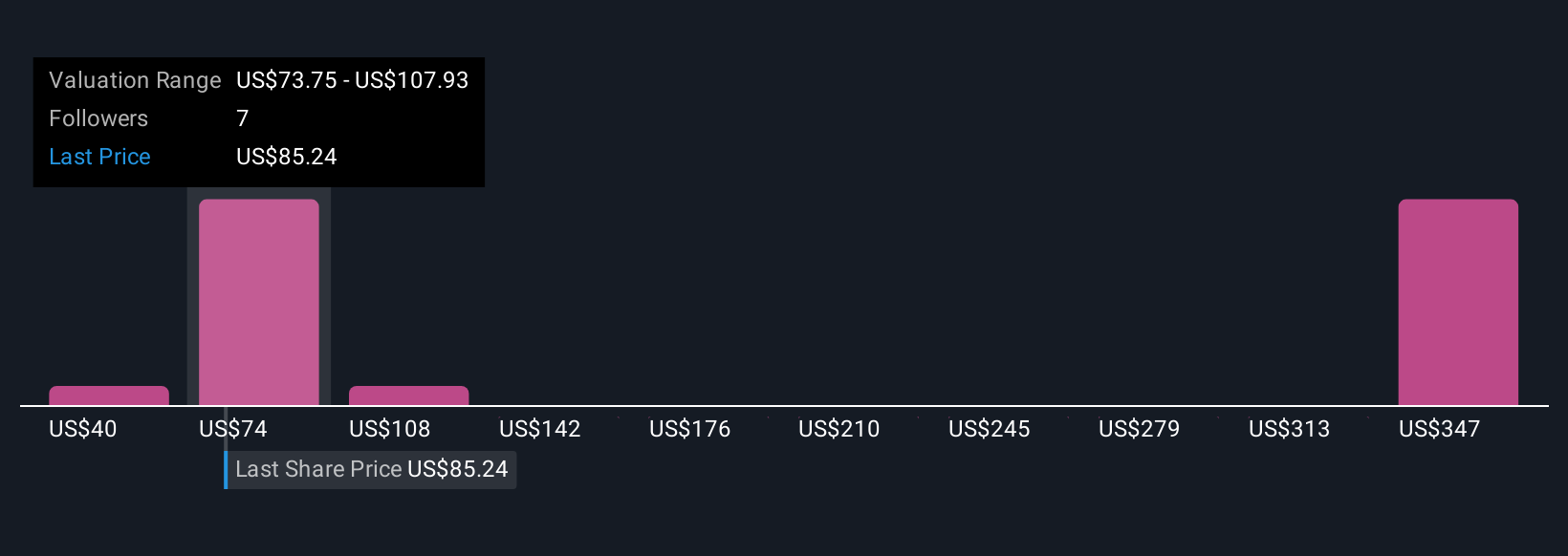

Four members of the Simply Wall St Community see fair value for National Fuel Gas anywhere between US$39.58 and US$152.74, highlighting very different expectations. Set those views against the company’s capital intensive pipeline and production growth plans, and you can see how opinions on long term returns and risk can diverge widely, inviting you to weigh several alternative viewpoints before forming your own.

Explore 4 other fair value estimates on National Fuel Gas - why the stock might be worth as much as 85% more than the current price!

Build Your Own National Fuel Gas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Fuel Gas research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National Fuel Gas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Fuel Gas' overall financial health at a glance.

No Opportunity In National Fuel Gas?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Fuel Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NFG

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026