- United States

- /

- Gas Utilities

- /

- NYSE:NFG

Did Rising Data Center Demand and Efficiency Gains Just Shift NFG's Investment Narrative?

Reviewed by Sasha Jovanovic

- National Fuel Gas recently raised its fiscal 2025 earnings guidance to US$6.80–US$6.95 per share, citing a 30% improvement in capital efficiency since 2023 along with expanded production and progress in its regulated businesses.

- Prominent investor Mario Gabelli highlighted the company's key role in supporting the infrastructure behind artificial intelligence, emphasizing the sustained demand potential for its natural gas reserves as data center energy needs rise.

- We will explore how improved capital efficiency and long-term energy demand expectations for data centers influence National Fuel Gas’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

National Fuel Gas Investment Narrative Recap

To own shares in National Fuel Gas, you need to believe that demand for natural gas, especially for power-hungry data centers, will remain durable despite rising momentum in decarbonization policies across its core Northeast markets. The company’s updated fiscal 2025 earnings guidance reinforces the production growth and capital efficiency story, but it does not materially change the short-term risk posed by tightening regulatory pressure on fossil fuel infrastructure investment.

The most relevant recent announcement is National Fuel Gas’s raised earnings guidance to US$6.80–US$6.95 per share for 2025, citing a 30% boost in capital efficiency since 2023 and greater regulated business growth. This news ties directly to the ongoing catalyst of improved operational execution, underpinning both increased production and continued margin support.

However, investors should also be aware that, while expectations are rising for data center energy consumption, the possibility of stricter emissions constraints in New York and Pennsylvania could...

Read the full narrative on National Fuel Gas (it's free!)

National Fuel Gas is projected to reach $3.3 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes annual revenue growth of 14.9% and an earnings increase of $856.5 million from the current $243.5 million.

Uncover how National Fuel Gas' forecasts yield a $98.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

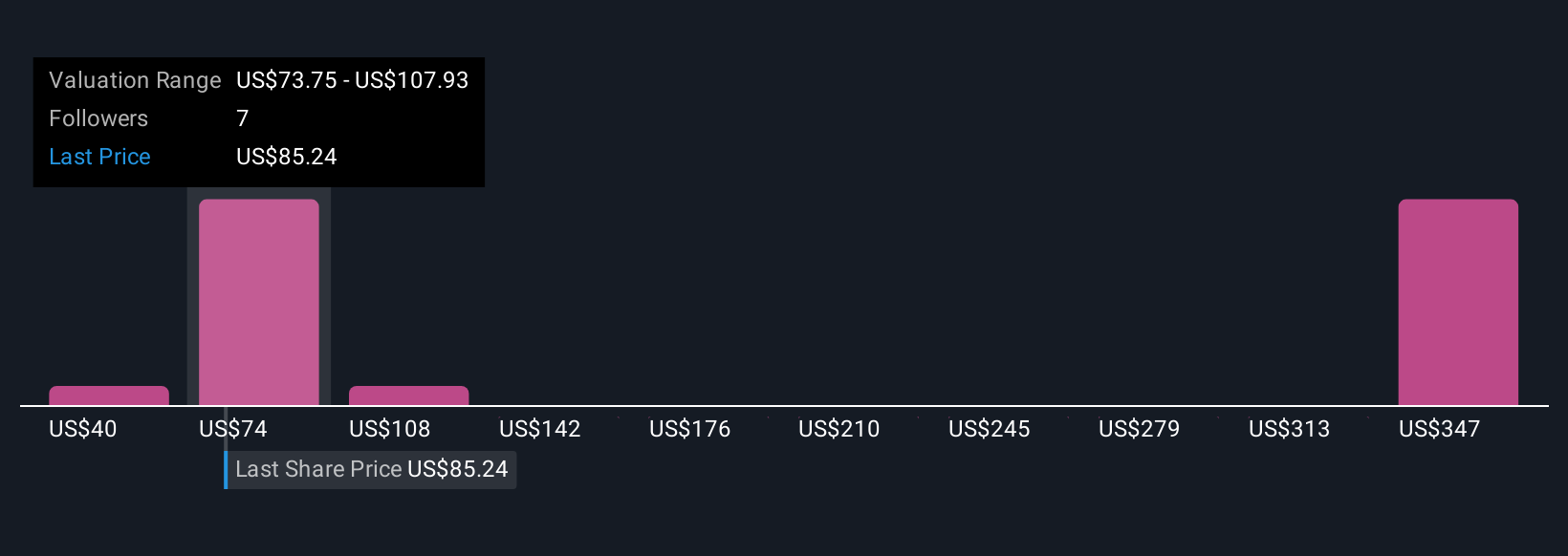

Simply Wall St Community members estimate National Fuel Gas's fair value to range from US$39.58 to US$381.33, based on four unique perspectives. While many predict continued demand from AI-driven energy needs, you can see just how much opinions diverge, explore several alternatives to inform your view.

Explore 4 other fair value estimates on National Fuel Gas - why the stock might be worth over 4x more than the current price!

Build Your Own National Fuel Gas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Fuel Gas research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free National Fuel Gas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Fuel Gas' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Fuel Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NFG

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026