- United States

- /

- Electric Utilities

- /

- NYSE:FE

FirstEnergy's (NYSE:FE) Dividend Will Be Increased To $0.425

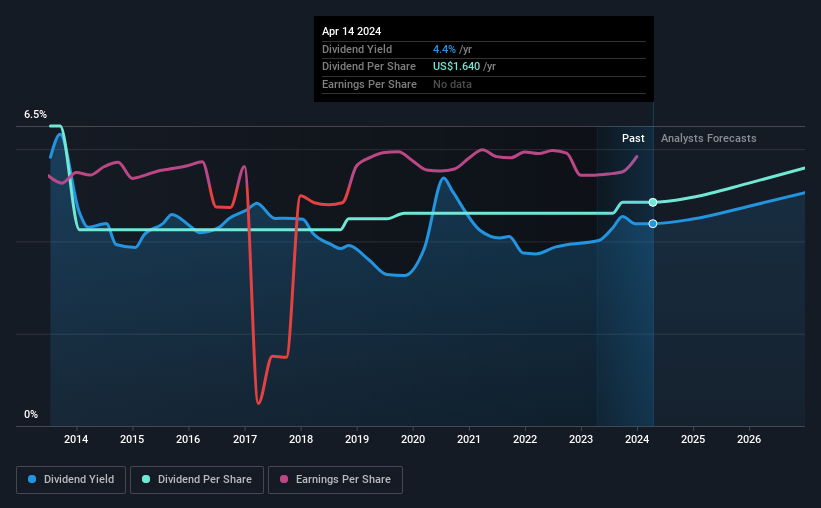

FirstEnergy Corp.'s (NYSE:FE) dividend will be increasing from last year's payment of the same period to $0.425 on 1st of June. This will take the annual payment to 4.4% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for FirstEnergy

FirstEnergy's Earnings Easily Cover The Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before this announcement, FirstEnergy was paying out 81% of earnings, but a comparatively small 68% of free cash flows. This leaves plenty of cash for reinvestment into the business.

The next year is set to see EPS grow by 57.4%. If the dividend continues along recent trends, we estimate the payout ratio will be 52%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was $2.20 in 2014, and the most recent fiscal year payment was $1.64. This works out to be a decline of approximately 2.9% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

We Could See FirstEnergy's Dividend Growing

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. FirstEnergy has impressed us by growing EPS at 7.9% per year over the past five years. Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 2 warning signs for FirstEnergy you should be aware of, and 1 of them is a bit concerning. Is FirstEnergy not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FE

FirstEnergy

Through its subsidiaries, generates, transmits, and distributes electricity in the United States.

Proven track record second-rate dividend payer.