- United States

- /

- Electric Utilities

- /

- NYSE:FE

FirstEnergy (NYSE:FE) Stock Dips 4% As 2024 Earnings Show Sales Rise But Net Income Falls

Reviewed by Simply Wall St

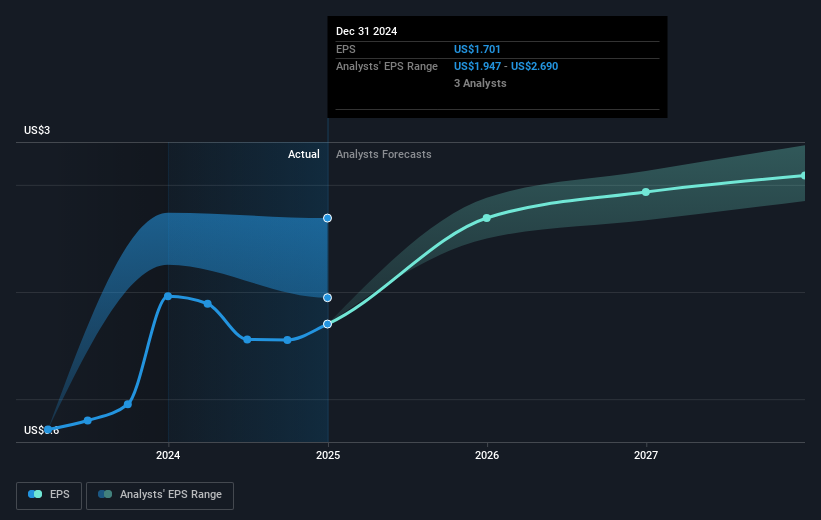

FirstEnergy (NYSE:FE) recently reported its earnings for FY 2024, showing an increase in sales and revenue but a decline in net income and earnings per share. Despite providing guidance for core earnings per share to grow in 2025 and maintaining its dividend outlook, the company's stock fell by 3.67% over the last month. This decline occurs alongside broader market fluctuations, including a 1.9% dip in the market over the same period, influenced by concerns surrounding new U.S. tariffs and volatility in tech stocks. With the broader market affected by these tariff concerns and slowing growth, FirstEnergy's stock movement reflects a challenging economic landscape. While its sales and revenue improved, the company's reduced net income and EPS could have contributed to investor apprehension. Additionally, the ongoing market sell-off in tech stocks and trade tensions might have overshadowed the generally positive corporate guidance, affecting FirstEnergy's performance on the stock market.

Navigate through the intricacies of FirstEnergy with our comprehensive report here.

```html

Over the past five years, FirstEnergy (NYSE:FE) achieved a total shareholder return of 10.50%, reflecting both share price performance and dividend contributions. In contrast to more recent years, this period saw growth in earnings of 0.4% annually, although net profit margins have decreased. The regulatory environment brought challenges, as seen with the settlement of legal proceedings with the Ohio Attorney General in August 2024, impacting investor sentiment. Additionally, executive changes in late 2024, including the appointment of Brian X. Tierney as Chair, signaled a leadership transition. These factors collectively influenced FirstEnergy’s long-term performance.

Despite these changes, FirstEnergy underperformed compared to both the US market and the broader Electric Utilities industry over the past year, where the market achieved a 13.1% return and the industry reached 25.7%. The company secured US$50 million in federal funding in November 2024 to enhance electric service reliability, which could bolster long-term improvements, yet immediate returns remained modest.

```- See whether FirstEnergy's current market price aligns with its intrinsic value in our detailed report

- Gain insight into the risks facing FirstEnergy and how they might influence its performance—click here to read more.

- Hold shares in FirstEnergy? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade FirstEnergy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FE

FirstEnergy

Through its subsidiaries, generates, transmits, and distributes electricity in the United States.

Fair value second-rate dividend payer.