- United States

- /

- Electric Utilities

- /

- NYSE:FE

FirstEnergy (FE): Assessing Valuation After Major West Virginia Power Generation and Grid Investment Plans

Reviewed by Kshitija Bhandaru

FirstEnergy (FE) has unveiled an ambitious long-term plan that features investments in a new natural gas power plant, the continued operation of coal facilities, and efforts to modernize the electric grid in West Virginia.

See our latest analysis for FirstEnergy.

FirstEnergy’s announcement of major new investment in West Virginia, including a future natural gas plant and modernized grid technology, has added fresh momentum to the stock. The 1-month share price return of 7.2% and 90-day gain of 16.2% suggest investors are getting more comfortable with the company’s long-term vision, especially after several positive headlines on resilience and infrastructure upgrades. With a solid 1-year total shareholder return of 13.4% and 44.3% over three years, momentum appears to be building for FE’s shares.

If you’re encouraged by FirstEnergy’s renewed growth focus, it’s also worth exploring the utility sector’s hidden stars. Broaden your outlook and discover fast growing stocks with high insider ownership

With shares not far from analysts’ price targets and years of steady gains behind it, the key question for investors is whether FirstEnergy is still trading below its true potential or if the market has already recognized and priced in future growth.

Most Popular Narrative: Fairly Valued

With FirstEnergy closing at $46.97, the consensus narrative fair value of $46.92 lands almost perfectly in line with the latest trading price. This highlights a finely balanced market view. Investors looking for strong conviction will want to understand what drives this razor-thin gap.

Large-scale infrastructure modernization and grid hardening initiatives, including the $28 billion investment plan through 2029 and a 15% CAGR in transmission rate base, enable higher returns on equity, improved reliability, and ultimately enhance net margins and earnings growth.

Which bold financial assumptions are hiding in plain sight? The narrative leans heavily on aggressive infrastructure spending forecasts, transformation of the profit profile, and upgraded market positioning. Wondering which deep quantitative bets anchor this precise fair value? Take a look behind the curtain; the numbers shaping this view might surprise you.

Result: Fair Value of $46.92 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory investigations and potential increases in interest rates could threaten FirstEnergy’s future earnings predictability and ability to expand margins.

Find out about the key risks to this FirstEnergy narrative.

Another View: Looking Beyond Fair Value

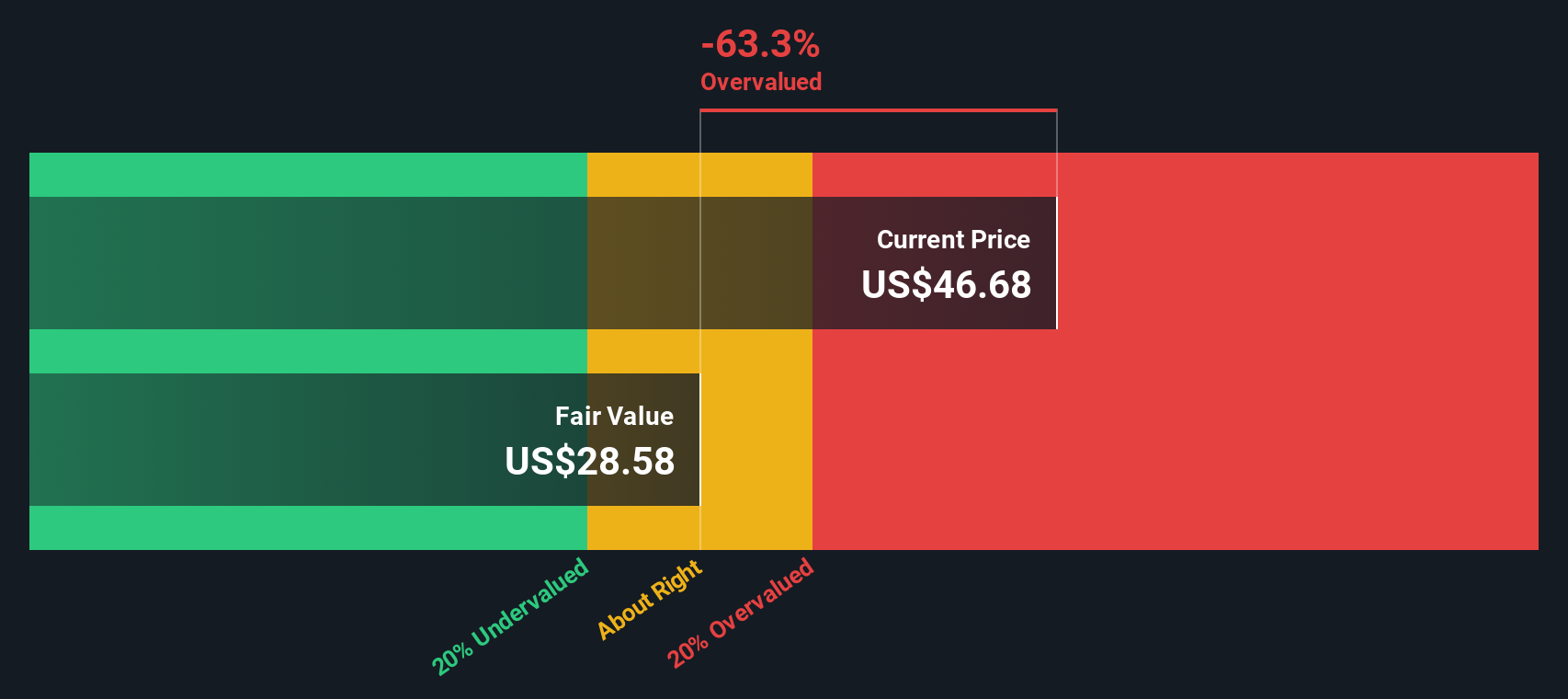

While the consensus view pegs FirstEnergy as fairly valued, our own SWS DCF model tells a different story. This model values the company at $28.58 per share, which is far below its current market price. This signals potential overvaluation if those long-term cash flow projections prove right. But are these DCF assumptions too conservative, or is the market really too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FirstEnergy Narrative

If you think there’s more to the FirstEnergy story, or want to dive deeper into the numbers yourself, you can build your own narrative from scratch in just a few minutes. Do it your way

A great starting point for your FirstEnergy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay ahead of the crowd, don’t settle for ordinary picks when smarter opportunities are within reach. Use the Simply Wall Street Screener to find investment angles you won’t see elsewhere.

- Capitalize on future growth by checking out these 25 AI penny stocks, which are reshaping entire industries with artificial intelligence solutions.

- Tap into reliable income streams by scanning these 18 dividend stocks with yields > 3%, offering attractive yields and strong dividend histories above 3%.

- Get ahead of the curve with these 26 quantum computing stocks, pushing boundaries in quantum computing for the next wave of tech disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FE

FirstEnergy

Engages in the generation, distribution, and transmission of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives