- United States

- /

- Electric Utilities

- /

- NYSE:ETR

Entergy (ETR) Valuation Check After Recent Pullback and Strong One-Year Share Price Run

Reviewed by Simply Wall St

Entergy stock performance and recent moves

Entergy (ETR) has quietly pulled back about 3% over the past month, even though shares are still up roughly 28% over the past year, so the setup now looks more interesting for patient income investors.

See our latest analysis for Entergy.

That recent 1 month share price dip contrasts with a much stronger year to date share price return and a 1 year total shareholder return close to 28%, signaling that momentum is cooling but the longer term trend still looks constructive.

If Entergy’s run has you reassessing your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for other compelling stories taking shape.

With Entergy now trading about 12% below consensus targets but still boasting a powerful multi year run, investors face a key question: is there still upside left to capture, or has the market already priced in its future growth?

Most Popular Narrative: 11.3% Undervalued

Entergy's most followed narrative points to a fair value above the recent 92.35 closing price, framing the current pullback as a potential discount window.

Capital investment of $40 billion over four years (with an expanded pipeline for renewables, grid modernization, and resilience upgrades) is expected to grow the company's rate base and support above-average EPS and earnings growth for several years.

Expedited regulatory frameworks and legislative support for economic development, storm cost recovery, and infrastructure riders (especially in Arkansas, Louisiana, and Texas) are likely to accelerate cash flow and enhance earnings consistency, limiting regulatory lag and improving overall credit metrics.

Curious how steady demand growth, rising margins, and a richer future earnings multiple all combine into that higher fair value line? Unlock the full playbook behind the premium rating and see which assumptions really carry the model.

Result: Fair Value of $104.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat case could stumble if regulatory decisions cap returns or if extreme Gulf weather drives higher costs and more volatile earnings.

Find out about the key risks to this Entergy narrative.

Another Angle on Valuation

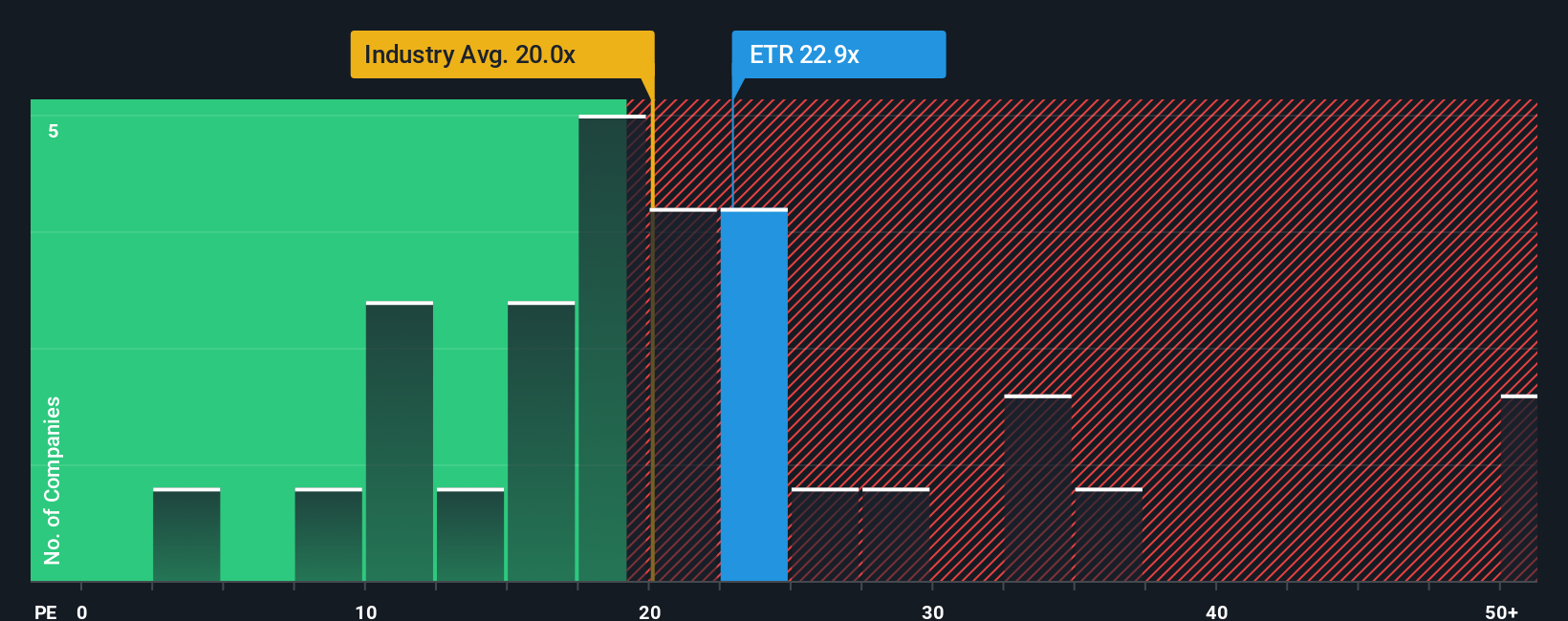

While the narrative points to an 11.3% upside, the earnings multiple paints a tougher picture. Entergy trades on 23.1 times earnings, richer than the US electric utilities sector at about 20 times and peers at 18.5 times, even if its 25.2 times fair ratio suggests some room to run. Is that premium really secure if growth disappoints?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entergy Narrative

If this perspective does not quite align with your own, or you would rather lean on your own analysis, you can build a custom view in minutes: Do it your way.

A great starting point for your Entergy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you log off, put your cash to work by scanning fresh opportunities on Simply Wall St’s screener so you do not miss tomorrow’s quiet outperformers.

- Capitalize on mispriced businesses by targeting quality companies trading below intrinsic value through these 908 undervalued stocks based on cash flows.

- Ride structural tech shifts by zeroing in on innovators leading artificial intelligence breakthroughs via these 26 AI penny stocks.

- Lock in potential cash flow today by focusing on reliable payers screened in these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Entergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETR

Entergy

Engages in the production and retail distribution of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)