- United States

- /

- Other Utilities

- /

- NYSE:ED

Is Now The Time To Put Consolidated Edison (NYSE:ED) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Consolidated Edison (NYSE:ED). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Consolidated Edison

Consolidated Edison's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Consolidated Edison has grown EPS by 19% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Consolidated Edison reported flat revenue and EBIT margins over the last year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

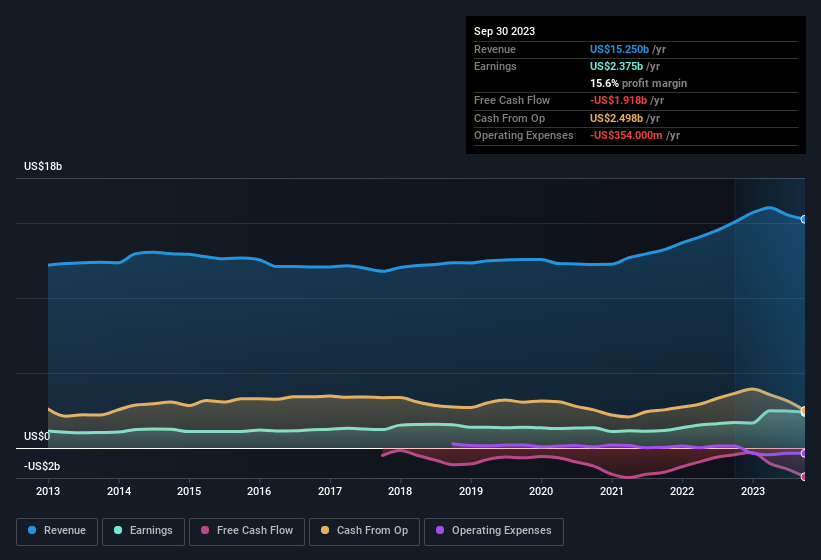

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Consolidated Edison's future profits.

Are Consolidated Edison Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Shareholders in Consolidated Edison will be more than happy to see insiders committing themselves to the company, spending US$255k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. Zooming in, we can see that the biggest insider purchase was by Senior VP & CFO Robert Hoglund for US$13k worth of shares, at about US$85.53 per share.

Along with the insider buying, another encouraging sign for Consolidated Edison is that insiders, as a group, have a considerable shareholding. To be specific, they have US$20m worth of shares. This considerable investment should help drive long-term value in the business. Even though that's only about 0.06% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Tim Cawley is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations over US$8.0b, like Consolidated Edison, the median CEO pay is around US$12m.

Consolidated Edison offered total compensation worth US$9.6m to its CEO in the year to December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Consolidated Edison To Your Watchlist?

You can't deny that Consolidated Edison has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. Still, you should learn about the 4 warning signs we've spotted with Consolidated Edison (including 2 which make us uncomfortable).

The good news is that Consolidated Edison is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ED

Consolidated Edison

Through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives