- United States

- /

- Other Utilities

- /

- NYSE:ED

Consolidated Edison (NYSE:ED) Reports US$593 Million Sales Increase But Sees US$699 Million Drop In Net Income

Reviewed by Simply Wall St

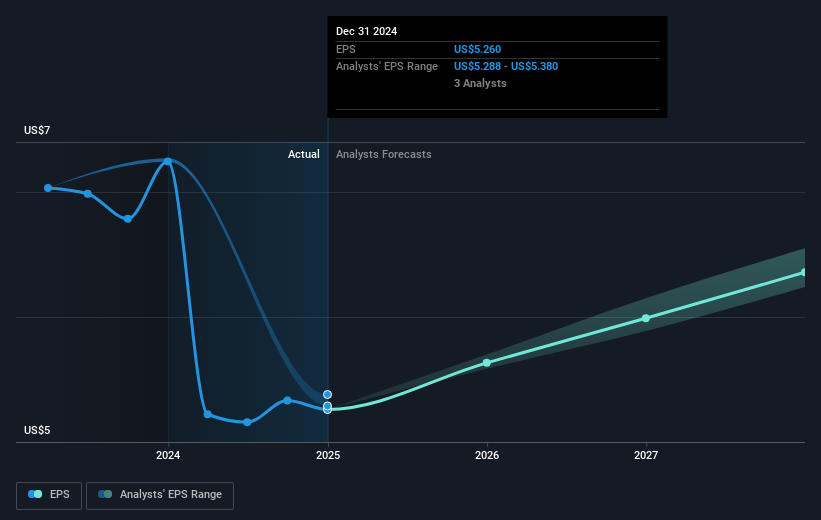

Consolidated Edison (NYSE:ED) recently announced its full-year earnings for 2024, highlighting an increase in sales to USD 15,256 million from USD 14,663 million in 2023, with stable revenue growth. However, the company's net income declined to USD 1,820 million from USD 2,519 million, and earnings per share showed a significant drop. Over the past month, the stock's price moved by 2.74%, which could be partially attributed to these mixed earnings results. During the same period, broader market trends showed a decline in the Dow Jones, led by stocks like UnitedHealth, affecting overall investor sentiment. This market backdrop might have influenced investor perception and contributed to Consolidated Edison's share price performance, despite the S&P 500 recently reaching record highs. This context of mixed company performance and market fluctuations might provide insights into the company’s price movement over the past month.

See the full analysis report here for a deeper understanding of Consolidated Edison.

Over the last five years, Consolidated Edison has achieved a total return of 38.43%, including both share price appreciation and dividends. Amidst this longer-term performance, several key developments have taken place. The appointment of Kirkland B. Andrews as Chief Financial Officer in July 2024 and a significant equity offering in December 2024, which raised US$676.62 million, played roles in shaping investor confidence and capital structure. However, ongoing pressure has been apparent as the company underperformed the US market and the Integrated Utilities industry over the past year, indicating challenges in keeping pace with broader benchmarks.

Dividend announcements, such as the increase to an annualized US$3.40 per share declared in January 2025, underscore Consolidated Edison's continuous commitment to returning value to shareholders. Nevertheless, notable financial constraints remain due to dividends not being well covered by free cash flows. Despite good relative value in terms of price-to-earnings ratios compared to peers, low returns on equity and slower forecasted growth in revenue and earnings than the broader US market pose ongoing challenges for sustained outperformance.

- Understand the fair market value of Consolidated Edison with insights from our valuation analysis—click here to learn more.

- Explore the potential challenges for Consolidated Edison in our thorough risk analysis report.

- Have a stake in Consolidated Edison? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ED

Consolidated Edison

Through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives