- United States

- /

- Other Utilities

- /

- NYSE:D

Dominion Energy (NYSE:D) Joins Forces For Major Electric Grid Expansion In PJM Region

Reviewed by Simply Wall St

Dominion Energy (NYSE:D) announced its joint venture with American Electric Power and FirstEnergy to develop PJM Interconnection electric transmission projects, marking a significant move in enhancing energy infrastructure. This development may have influenced Dominion's stock move, contributing to its 2% rise over the past month. The market backdrop was tumultuous, reflecting tech stock volatility after Nvidia's report and tariff concerns, with major indexes like the Nasdaq down 5.5%. Dominion Energy has outlined plans to maintain its annual dividend and provided earnings guidance, keeping investor confidence stable amid earnings declines. While the broader market showed a 4.8% drop recently, Dominion's price improvement indicates investor confidence in its strategic projects and dividend policy, providing a counterbalance to the broader economic anxieties. Meanwhile, easing inflation hints offered some relief to investors, potentially supporting Dominion's modest price gain as it aligns with cautious optimism in the energy sector.

Get an in-depth perspective on Dominion Energy's performance by reading our analysis here.

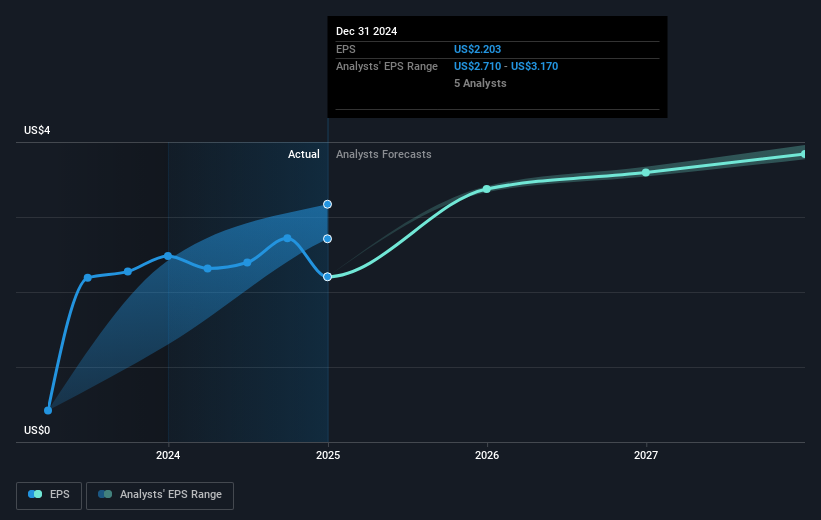

Over the past year, Dominion Energy's total shareholder return stood at 23.85%, surpassing the US market's 14.7% return. Despite negative earnings growth of 7.2%, the company's robust dividend yield and share price performance have been key contributors to its favorable total return. In this one-year timeframe, Dominion underperformed compared to its industry, which saw a 21.4% return.

The Coastal Virginia Offshore Wind project, reported on February 3, 2025, reaching 50% completion has demonstrated Dominion's commitment to renewable energy, enhancing investor sentiment. With the joint venture on PJM Interconnection projects announced on February 27, 2025, Dominion strengthens its future growth prospects. Additionally, consistent quarterly dividends, such as the one declared on January 24, 2025, underline the company's shareholder-friendly policy, further bolstering returns. Despite challenges, Dominion’s strategic project developments and financial performance provide a firm foundation for its stock's positive long-term performance.

- Get the full picture of Dominion Energy's valuation metrics and investment prospects—click to explore.

- Assess the potential risks impacting Dominion Energy's growth trajectory—explore our risk evaluation report.

- Hold shares in Dominion Energy? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dominion Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:D

Second-rate dividend payer with questionable track record.