- United States

- /

- Other Utilities

- /

- NYSE:D

Dominion Energy (D): Exploring Valuation After $1.25B Junior Notes Sale and Debt Focus

Reviewed by Kshitija Bhandaru

Dominion Energy is in the spotlight after announcing a $1.25 billion sale of junior subordinated notes. This move is aimed at streamlining its financial structure. Investors are watching closely as the company's debt profile takes center stage.

See our latest analysis for Dominion Energy.

This financing move comes at a time when Dominion Energy’s share price momentum has been muted, with sideways trading dominating the past year. The latest developments may contribute to shifting risk perceptions, but the one-year total shareholder return of just 0.10% highlights a period of stability rather than dramatic growth or decline.

If you’re looking for more ideas while the utilities space stays steady, now is the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With so much attention on Dominion Energy’s debt strategy and flat stock performance, investors have to wonder whether this is an undervalued opportunity or if the current price already reflects all future growth potential.

Most Popular Narrative: Fairly Valued

With Dominion Energy's most popular narrative setting fair value at $61.42 and the latest close at $61.09, analysts see little difference between expected and actual pricing. The narrative's fair price closely matches the current market value, reflecting consensus around a balanced outlook with neither a clear discount nor premium.

Large-scale investments in regulated renewables, especially the Coastal Virginia Offshore Wind (CVOW) project, position Dominion to benefit from the accelerating energy transition, earning stable regulated returns and expanding rate base, with a positive impact on long-term earnings.

Curious about which future projects and financial levers are behind this consensus target? The narrative rests on powerful forward assumptions, without sharing the playbook outright. There is more to the math than you might expect. Dive in to see what could tip the scales either way.

Result: Fair Value of $61.42 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory delays or escalating project costs could quickly shift the outlook. This makes cautious optimism essential for investors considering Dominion's future.

Find out about the key risks to this Dominion Energy narrative.

Another View: Discounted Cash Flow Offers a Different Perspective

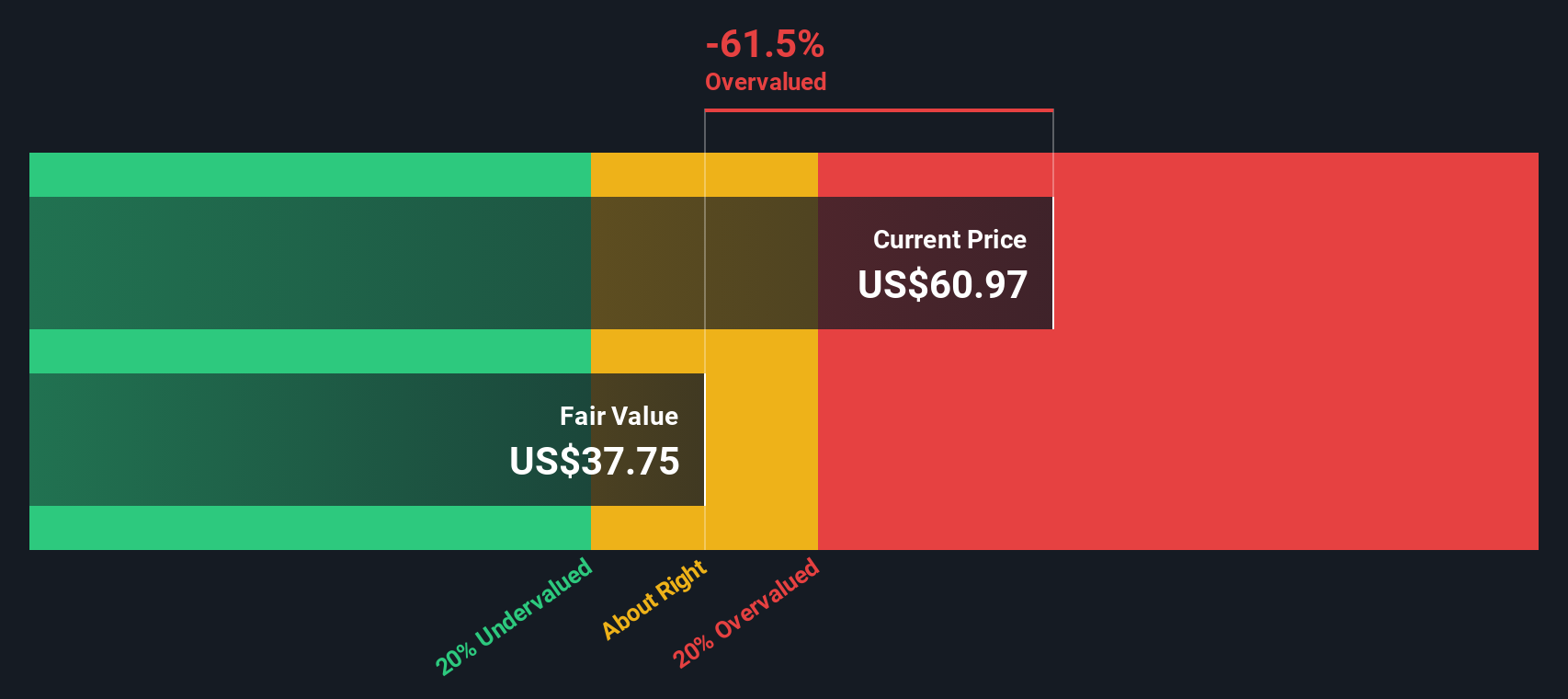

Taking a different approach, our SWS DCF model suggests Dominion Energy could be overvalued, with shares trading at $61.09 compared to an estimated fair value closer to $37.68. This model factors in projected cash flows but often provides a much more cautious picture than the multiples approach. Is the market overlooking something fundamental, or is the DCF too conservative for a stable utility like Dominion?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dominion Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dominion Energy Narrative

If you think there’s more to the story or want to challenge these conclusions, you can dig into the numbers yourself and build your own take in just a few minutes, then Do it your way

A great starting point for your Dominion Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to one opportunity when there’s a world of promising stocks out there? Level up your investing game with these hand-picked approaches:

- Spot high-yield opportunities sooner by sizing up these 19 dividend stocks with yields > 3%, which offers reliable returns above 3% and steady cash flows.

- Accelerate your growth strategy by tapping into the companies reshaping medicine and technology in these 31 healthcare AI stocks, where breakthroughs set the pace.

- Unlock rare value by searching through these 909 undervalued stocks based on cash flows, which is primed for potential and overlooked by the crowds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:D

Dominion Energy

Provides regulated electricity and natural gas services in the United States.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives