- United States

- /

- Gas Utilities

- /

- NYSE:CPK

Chesapeake Utilities (NYSE:CPK) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Chesapeake Utilities Corporation (NYSE:CPK) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Chesapeake Utilities

How Much Debt Does Chesapeake Utilities Carry?

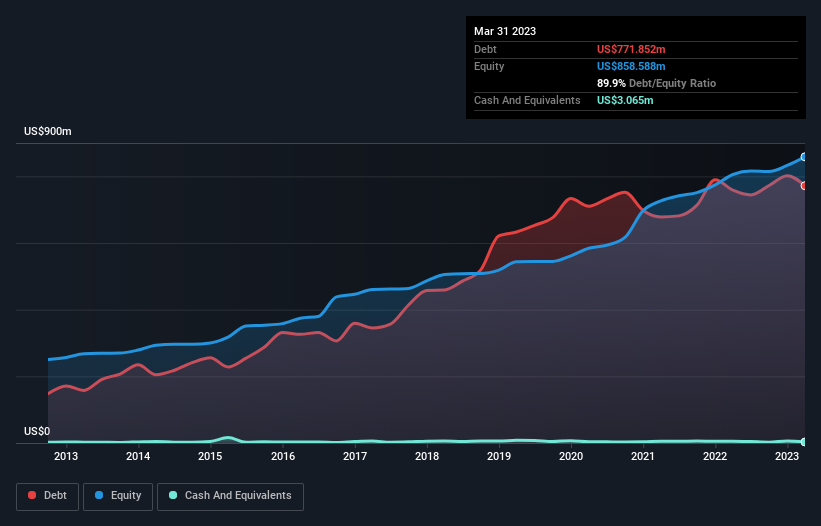

The chart below, which you can click on for greater detail, shows that Chesapeake Utilities had US$771.9m in debt in March 2023; about the same as the year before. Net debt is about the same, since the it doesn't have much cash.

A Look At Chesapeake Utilities' Liabilities

We can see from the most recent balance sheet that Chesapeake Utilities had liabilities of US$246.8m falling due within a year, and liabilities of US$1.09b due beyond that. Offsetting these obligations, it had cash of US$3.07m as well as receivables valued at US$86.5m due within 12 months. So it has liabilities totalling US$1.25b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Chesapeake Utilities is worth US$2.14b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Chesapeake Utilities has a debt to EBITDA ratio of 3.4 and its EBIT covered its interest expense 5.5 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. We saw Chesapeake Utilities grow its EBIT by 7.3% in the last twelve months. Whilst that hardly knocks our socks off it is a positive when it comes to debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Chesapeake Utilities's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Chesapeake Utilities barely recorded positive free cash flow, in total. While many companies do operate at break-even, we prefer see substantial free cash flow, especially if a it already has dead.

Our View

Chesapeake Utilities's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. But on the bright side, its ability to to grow its EBIT isn't too shabby at all. We should also note that Gas Utilities industry companies like Chesapeake Utilities commonly do use debt without problems. Taking the abovementioned factors together we do think Chesapeake Utilities's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Chesapeake Utilities is showing 3 warning signs in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CPK

Chesapeake Utilities

Operates as an energy delivery company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)