- United States

- /

- Other Utilities

- /

- NYSE:CNP

How Investors May Respond To CenterPoint Energy (CNP) Unveiling a $65 Billion Infrastructure and Growth Plan

Reviewed by Sasha Jovanovic

- CenterPoint Energy has announced a record US$65 billion capital investment plan through 2035, focusing on expanding and modernizing its electric and gas infrastructure to meet rising demand, especially in Texas from sectors like AI data centers, industrial facilities, and growing populations.

- This initiative is paired with an updated earnings outlook and new renewable natural gas agreements, positioning CenterPoint Energy to address both energy transition trends and long-term load growth.

- We will examine how CenterPoint Energy’s ambitious ten-year investment plan could impact its long-term growth and financial outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

CenterPoint Energy Investment Narrative Recap

For investors to be comfortable owning CenterPoint Energy today, the core belief centers on persistent grid demand growth and successful execution of its US$65 billion infrastructure plan, especially in Texas. The recent $500 million debt tender offers and fixed-income issuance are intended to support this strategy, but do not fundamentally change the most important catalyst, timely capital deployment to address surging electric demand, or fully resolve the biggest risk of regulatory delays and high debt-related costs. The impact of these transactions on near-term earnings potential and execution risk appears immaterial for now.

One recent development worth highlighting is CenterPoint’s new renewable natural gas agreement in Minnesota. This agreement expands the company’s clean energy offerings and further supports its broader load growth narrative, particularly as customer demand trends evolve in tandem with decarbonization and grid modernization efforts. How effectively these initiatives convert into sustainable financial and operational momentum remains closely linked to the speed and reliability of regulatory approvals for large-scale investments.

However, investors should keep in mind that the growing debt load brings added risk if...

Read the full narrative on CenterPoint Energy (it's free!)

CenterPoint Energy is projected to reach $10.5 billion in revenue and $1.5 billion in earnings by 2028. This outlook requires 5.4% annual revenue growth and a $564 million earnings increase from current earnings of $936 million.

Uncover how CenterPoint Energy's forecasts yield a $40.85 fair value, a 5% upside to its current price.

Exploring Other Perspectives

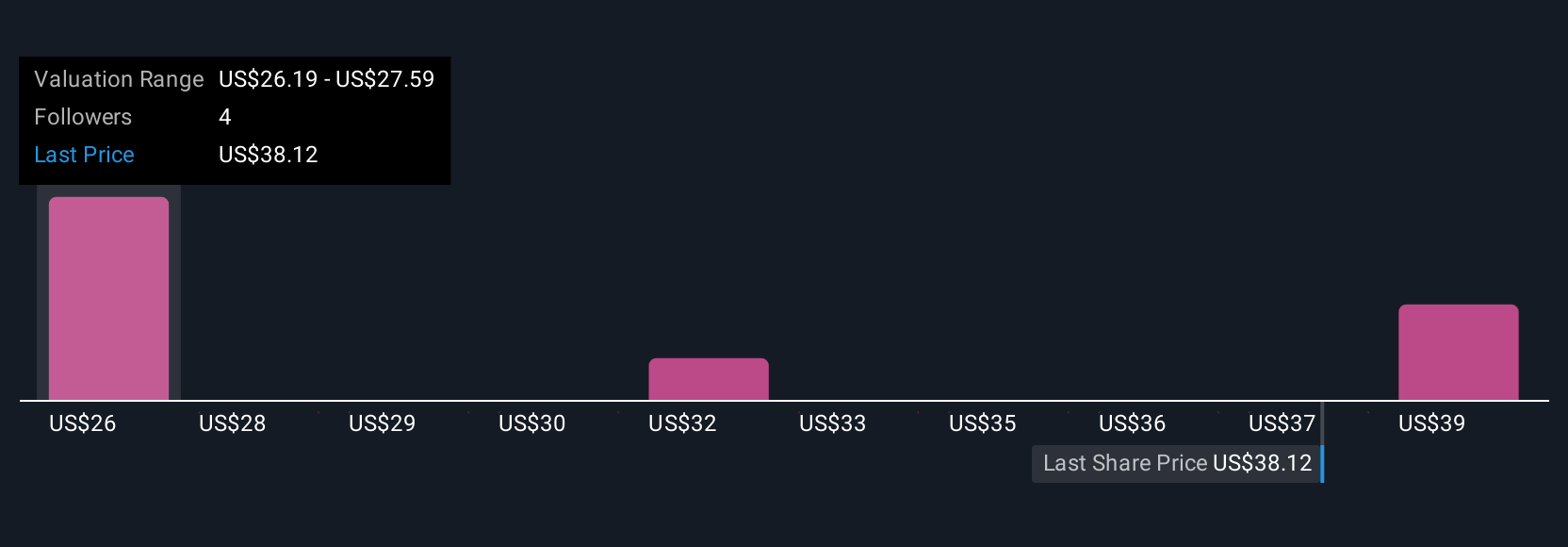

Simply Wall St Community members have set fair value estimates for CenterPoint Energy from US$26.25 to US$43 across 4 perspectives. Regulatory lag and debt-related risks still loom over execution, reminding you to compare a range of possible views.

Explore 4 other fair value estimates on CenterPoint Energy - why the stock might be worth 32% less than the current price!

Build Your Own CenterPoint Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CenterPoint Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free CenterPoint Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CenterPoint Energy's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Questionable track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives