- United States

- /

- Other Utilities

- /

- NYSE:CNP

CenterPoint Energy (CNP): Assessing Valuation After Joining Palantir’s Chain Reaction AI Infrastructure Platform

Reviewed by Simply Wall St

CenterPoint Energy (CNP) just stepped into the AI spotlight as a founding partner in Palantir’s new Chain Reaction platform, positioning itself at the center of how future data center power demand gets managed.

See our latest analysis for CenterPoint Energy.

That AI partnership comes on top of a solid year for the stock, with a roughly 22% year to date share price return and a 1 year total shareholder return of about 24%, suggesting momentum is quietly building as investors reassess CenterPoint’s long term growth profile.

If this AI angle has you rethinking where utilities fit in your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership for other compelling growth stories backed by committed insiders.

With shares up strongly and analysts still seeing upside to their price targets, investors now face a pivotal question: Is CenterPoint still trading below its long-term potential, or has the market already priced in its future AI-driven growth?

Most Popular Narrative Narrative: 10% Undervalued

With CenterPoint closing at $38.43 against a widely followed fair value of $42.60, the core narrative leans toward meaningful upside still on the table.

The company announced a $1 billion increase to its capital investment plan through 2030, driven by significant load growth in the Houston Electric service territory. This is expected to bolster capital expenditures and, consequently, long-term revenue and earnings.

Curious how a regulated utility earns a premium growth label in this narrative? The secret mix blends accelerating demand, rising margins, and a future earnings multiple usually reserved for faster moving sectors. Want to see how those assumptions stack up in detail and what they imply for long term upside?

Result: Fair Value of $42.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution and regulatory setbacks, including delayed cost recovery and higher financing costs, could quickly undercut the bullish growth and valuation narrative.

Find out about the key risks to this CenterPoint Energy narrative.

Another Lens on Valuation

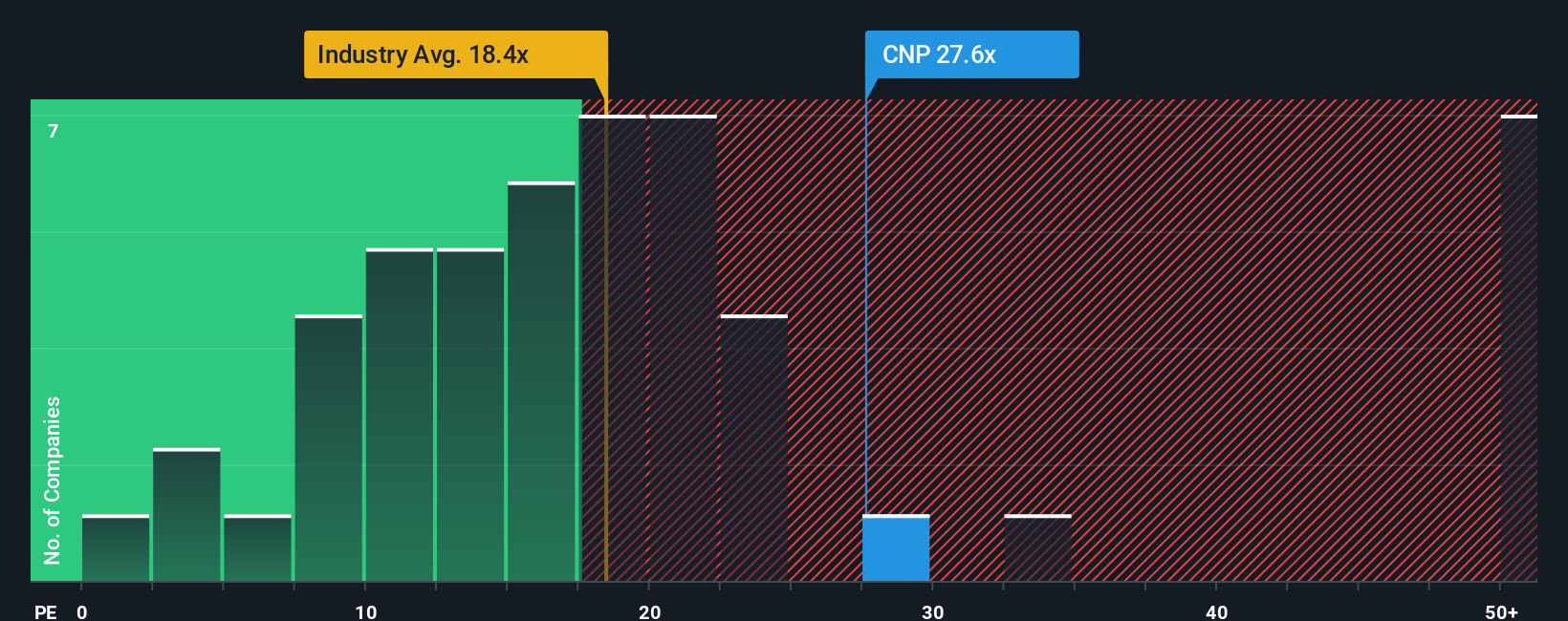

While the narrative suggests CenterPoint is about 10% undervalued on forward earnings assumptions, its current price to earnings ratio of 24.2 times looks stretched versus both the global utilities average of 17.8 times and a fair ratio of 23.8 times. That points to a thinner margin of safety than the story implies, so how comfortable are you paying up for regulated growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CenterPoint Energy Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your CenterPoint Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors continuously scan the horizon for the next opportunity. Use the Simply Wall Street Screener now or risk missing tomorrow’s standout winners.

- Capture potential multi baggers early by reviewing these 3573 penny stocks with strong financials that pair tiny market caps with surprisingly resilient fundamentals.

- Seek the next wave of intelligent automation by focusing on these 26 AI penny stocks positioned at the intersection of software, data, and technological innovation.

- Identify value before the wider market by targeting these 907 undervalued stocks based on cash flows that already generate solid cash flows yet still trade at what may be attractive discounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Solid track record unattractive dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026