- United States

- /

- Other Utilities

- /

- NYSE:CNP

CenterPoint Energy (CNP) Appoints Jesus Soto Jr As New Chief Operating Officer

Reviewed by Simply Wall St

CenterPoint Energy (CNP) recently appointed Jesus Soto, Jr. as Executive Vice President and Chief Operating Officer, signaling strategic moves in bolstering operational efficiency and safety within the company. Amidst these corporate adjustments, CenterPoint's stock reflected a 4.7% increase over the past month. This rise occurs as broader market indexes like the S&P 500 and Nasdaq faced slight declines amid a wave of corporate earnings reports. While the market context shows dynamic fluctuations, CenterPoint's dividend declaration and executive appointments may have provided positive sentiment to investors, complementing the company's relatively stable performance against market trends.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

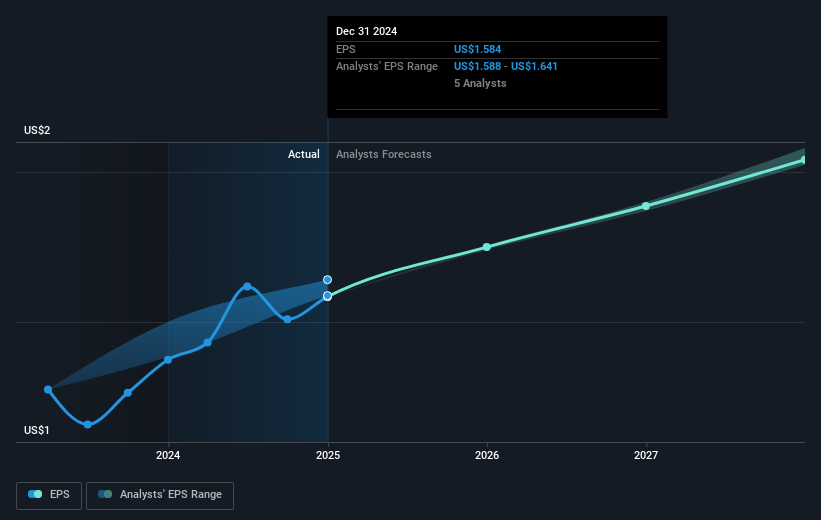

CenterPoint Energy's recent executive appointment of Jesus Soto, Jr. as Executive Vice President and Chief Operating Officer could influence the company's strategic direction towards increased operational efficiency and safety. This leadership change aligns well with the company’s focus on capital investments and grid automation to secure future resiliency. These initiatives point towards potential enhancements in revenue and earnings growth, in line with past forecasts of annual non-GAAP EPS growth in the mid to high end of a 6% to 8% range through 2030. CenterPoint’s stock performance, showing a 4.7% rise over the past month, aligns with these growth prospects amid market index declines, suggesting investor optimism possibly buoyed by recent leadership changes, fixed dividends, and strategic capital investment plans.

Over the past five years, CenterPoint Energy achieved a total return of 123.77%, reflecting its strong performance against the broader industry. In the past year, CenterPoint's return exceeded the US Integrated Utilities industry's return of 15% and the broader US market's 14.8% return, marking a relatively stable outlook. Analysts anticipate growth in revenue to US$10.3 billion and an increase in earnings to US$1.5 billion by 2028. However, with the current share price at US$37.42, the consensus analyst price target of US$38.65 reflects only a modest potential upside, suggesting that the stock is close to fair value based on expected earnings growth and market conditions. Investors might consider these factors when evaluating future investment decisions.

Review our growth performance report to gain insights into CenterPoint Energy's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Questionable track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives