- United States

- /

- Gas Utilities

- /

- NYSE:BIPC

A Piece Of The Puzzle Missing From Brookfield Infrastructure Corporation's (NYSE:BIPC) Share Price

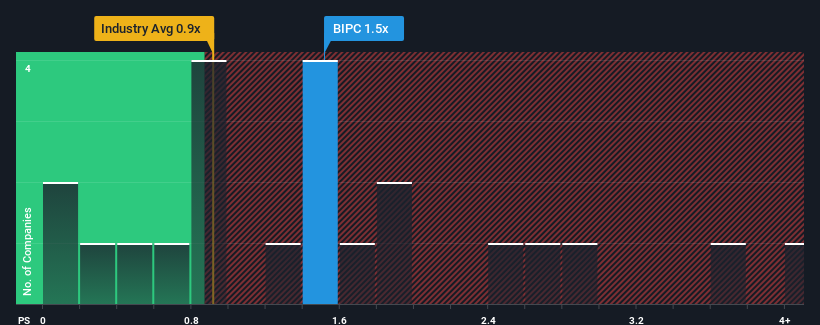

There wouldn't be many who think Brookfield Infrastructure Corporation's (NYSE:BIPC) price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S for the Gas Utilities industry in the United States is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Brookfield Infrastructure

How Brookfield Infrastructure Has Been Performing

Recent times have been advantageous for Brookfield Infrastructure as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Brookfield Infrastructure will help you uncover what's on the horizon.How Is Brookfield Infrastructure's Revenue Growth Trending?

Brookfield Infrastructure's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 75% last year. Pleasingly, revenue has also lifted 127% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 84% per year as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 20% per annum growth forecast for the broader industry.

In light of this, it's curious that Brookfield Infrastructure's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Brookfield Infrastructure's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Brookfield Infrastructure you should be aware of, and 1 of them makes us a bit uncomfortable.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Infrastructure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BIPC

Brookfield Infrastructure

Owns and operates regulated natural gas transmission systems in Brazil.

Good value unattractive dividend payer.