- United States

- /

- Water Utilities

- /

- NYSE:AWR

Reassessing American States Water (AWR) Valuation After Latest Profit and Revenue Growth

Reviewed by Kshitija Bhandaru

American States Water (AWR) recently announced higher quarterly revenue and net profit compared to last year, prompting fresh conversation about the stock’s valuation and growth prospects as investors weigh the company’s latest results.

See our latest analysis for American States Water.

American States Water’s latest financial results have drawn fresh attention after a year of mixed trading, with its share price recently improving to $74.46. While the 1-year total shareholder return remains negative at -10.63 percent, this week’s upward momentum suggests that optimism could be returning as investors digest better-than-expected profit and revenue growth.

If this renewed momentum has you rethinking your watchlist, it could be the perfect time to discover fast growing stocks with high insider ownership.

Yet with analysts still cautious and the share price trailing some price targets, the question for investors is clear: is American States Water undervalued at these levels, or is future growth already accounted for?

Most Popular Narrative: 8.6% Undervalued

Analysts’ consensus places American States Water’s fair value at $81.50, notably above the recent close of $74.46. This gap is driving debate on whether the company’s fundamentals and outlook are enough to justify upside from these levels.

Robust infrastructure investment, with $170 to $210 million targeted for 2025 and rate base growth authorized by recent CPUC rate case decisions, positions the company to earn higher returns on a growing asset base, contributing to long-term increases in both revenue and potential net margins.

Want to know the numbers baked into this bullish narrative? The fair value logic leans on ambitious earnings growth and sturdy profit margins that rival some of Wall Street’s favorites. Curious about which assumptions power the price target? Read the full analysis and see what could trigger the next leap.

Result: Fair Value of $81.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if regulatory changes stall or if California drought conditions intensify. This could potentially weaken American States Water’s earnings outlook in the coming years.

Find out about the key risks to this American States Water narrative.

Another View: Market Multiples Suggest a Premium

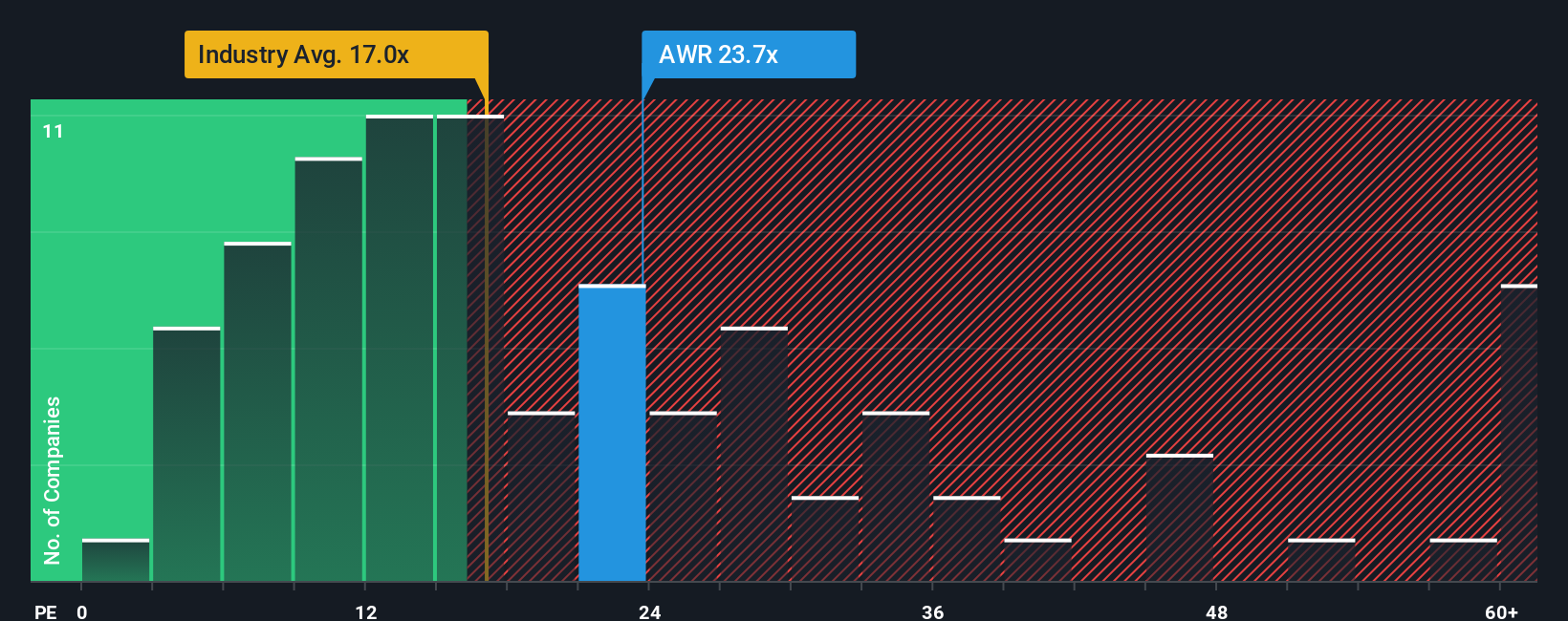

While the analyst consensus points to American States Water being undervalued, a look at its price-to-earnings ratio suggests otherwise. The company trades at 23.1x earnings, considerably higher than both the global industry average of 16.7x and a fair ratio of 17.6x.

This notable premium could signal valuation risk if growth does not accelerate to match expectations. Is the market building in optimism, or could there be a reality check ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American States Water Narrative

Not convinced by the latest outlook, or do you prefer to chart your own path? You can dig into the details and put together your own view in just a few minutes. Do it your way.

A great starting point for your American States Water research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always a step ahead. Don’t let the next breakout opportunity pass you by. Turn momentum into action with these standout strategies from Simply Wall Street:

- Tap into major growth potential with these 24 AI penny stocks transforming industries using powerful artificial intelligence and next-level automation.

- Fuel your income goals by checking out these 19 dividend stocks with yields > 3% that deliver reliable, high-yield returns regardless of market volatility.

- Position yourself in the future of finance by uncovering these 79 cryptocurrency and blockchain stocks on the leading edge of blockchain and digital asset innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWR

American States Water

Through its subsidiaries, provides water and electric services to residential, commercial, industrial, and other customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives