- United States

- /

- Water Utilities

- /

- NYSE:AWK

What American Water Works Company (AWK)'s Internship Expansions and Drought Response Mean for Shareholders

Reviewed by Sasha Jovanovic

- In recent days, American Water Works Company completed its 2025 Future Wavemakers Internship Program and launched its first Flow Forward high school internship in Pennsylvania, while also expanding its 2025 Firefighter Grant Program in Missouri and responding to drought watch measures in its Pennsylvania service area.

- These activities reflect American Water's emphasis on talent development, operational resilience, and community partnerships amid a period of renewed investor interest ahead of its third-quarter results announcement.

- We'll examine how American Water's expanded internship and drought response initiatives highlight operational priorities that may influence its investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

American Water Works Company Investment Narrative Recap

To be a shareholder in American Water Works Company, you need to believe that customer growth, robust infrastructure investment, and favorable regulatory environments will sustain long-term earnings despite ongoing capital needs and rising costs. The recent expansion of internship and community initiatives isn't expected to materially impact the main short-term catalyst, the upcoming Q3 results and updated earnings guidance, nor does it shift the principal risk, which remains securing timely regulatory rate relief to match cost escalation.

Among the latest news, American Water’s response to the drought watch in Pennsylvania is most relevant to key operational risks and investor interests. The company’s proactive measures, including customer outreach and preparation for potential water restrictions, directly address the impact of adverse weather and regulatory responses, both of which could influence near-term earnings and long-term margin stability.

By contrast, investors should also be aware of the ongoing challenge that delayed or denied rate relief across key service territories could...

Read the full narrative on American Water Works Company (it's free!)

American Water Works Company's narrative projects $6.0 billion revenue and $1.4 billion earnings by 2028. This requires 6.6% yearly revenue growth and a $0.3 billion earnings increase from $1.1 billion.

Uncover how American Water Works Company's forecasts yield a $141.11 fair value, in line with its current price.

Exploring Other Perspectives

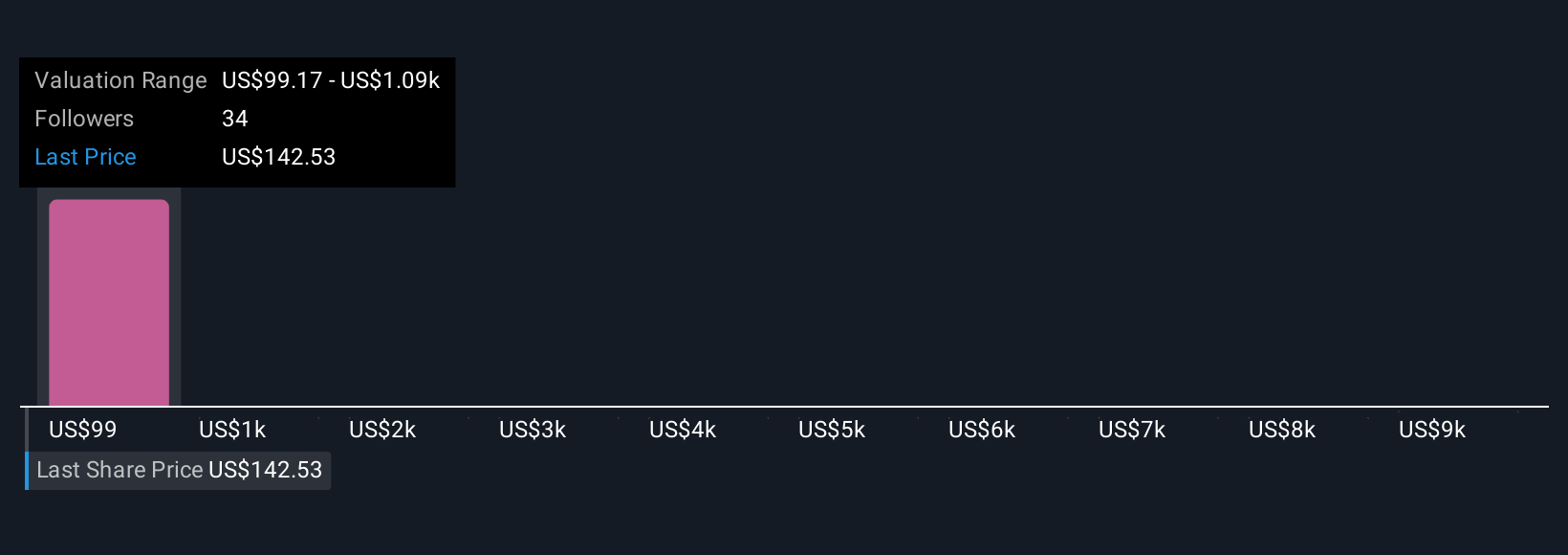

Four individual fair value estimates from the Simply Wall St Community range from US$99 to an outlier above US$9,999. You can see how differing assumptions about regulatory risk and earnings outlook shape these valuations and find more viewpoints to consider.

Explore 4 other fair value estimates on American Water Works Company - why the stock might be a potential multi-bagger!

Build Your Own American Water Works Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Water Works Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Water Works Company's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives