- United States

- /

- Water Utilities

- /

- NYSE:AWK

American Water Works Company (NYSE:AWK) Welcomes Raffiq Nathoo To Its Board Of Directors

Reviewed by Simply Wall St

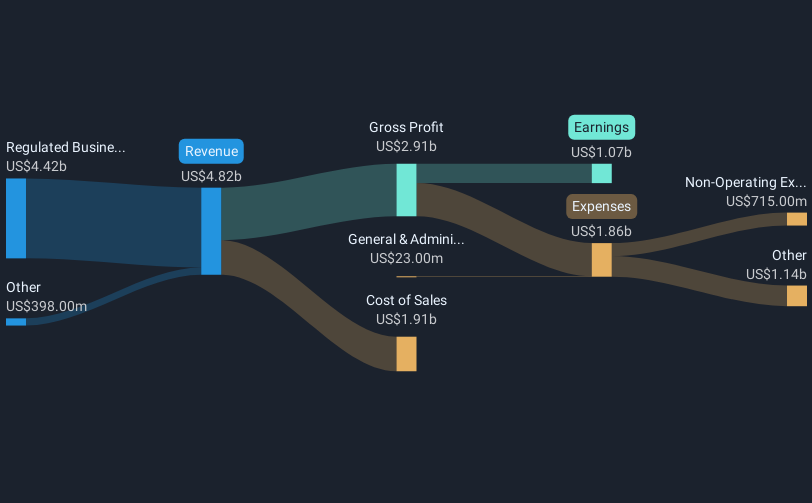

American Water Works Company (NYSE:AWK) recently appointed Raffiq Nathoo as an independent board member, enhancing its governance capabilities with his extensive experience in energy and investment management. While the stock price saw a 2% decline over the last week, the broader market experienced a 1.5% increase, buoyed by positive investor sentiment surrounding U.S.-China trade talks. The executive appointment may have added stability to the company amid these fluctuations but did not significantly counter the broader positive market trends. AWK's performance appears relatively stable, aligning with the sector’s overall movements rather than market volatility.

American Water Works Company's appointment of Raffiq Nathoo may bolster its governance, potentially enhancing operational effectiveness and aligning with the company's ongoing revenue and earnings stability goals. Over the longer term, AWK's total shareholder return, combining both share price growth and dividends, amounted to 18.74% over the past five years. This steady performance demonstrates a commitment to providing consistent returns to shareholders, although the company did underperform the US market over the past year, where returns were stronger.

With the current share price hovering around US$149.2 and the consensus price target set at US$143.5, there is a small discount, implying limited upside according to analysts. This suggests that while the executive appointment is positive for the company's future governance, it has not dramatically shifted immediate revenue and earnings forecasts. Nevertheless, ongoing investments and regulatory support as indicated in recent analyses could continue to shape financial expectations over time, even if short-term volatility persists. In conclusion, American Water Works' recent developments reflect a nuanced balance between tackling immediate challenges and ensuring steady long-term growth amidst an evolving industry landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives