- United States

- /

- Renewable Energy

- /

- NYSE:AES

What BlackRock’s $38B Takeover Talks Mean for AES Shares in 2025

Reviewed by Bailey Pemberton

If you’re holding shares of AES or thinking about jumping in, you’re not alone in watching this name right now. The past month has been a wild ride: AES shot up an impressive 10.5%, though it slipped a bit in the last week, down 3.5%. Even with those ups and downs, we’re talking about a stock that’s still down 14.0% over the last year and more than 30% over the last three years. Still, that kind of negative momentum can sometimes set the stage for opportunity, especially when there is takeover chatter in the air.

And that is exactly what has been swirling lately. Headlines have been dominated by reports that BlackRock’s Global Infrastructure Partners is in advanced talks to acquire AES in a potential $38 billion deal. For investors, this sort of blockbuster news can quickly change market sentiment, often leading to a spike in both expectations and risk perceptions. This might help explain the recent swings.

Now, let’s get to what everyone really wants to know: Is AES undervalued? On our scorecard, AES racks up a value score of 5 out of 6, meaning the company looks undervalued on nearly every front we analyze. But before we get too carried away, let’s unpack exactly how those valuation checks work, and why there might be something even more insightful than these traditional approaches.

Why AES is lagging behind its peers

Approach 1: AES Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates what a company is worth by projecting its future cash flows and discounting them back to today’s value. This allows investors to see what all those future dollars are worth in today’s terms, taking into account both growth and risk.

For AES, the DCF model begins with its current Free Cash Flow, which stands at negative $3.03 billion, highlighting the upfront investment demands of utilities and power producers. Analysts provide forecasts for the next several years, expecting Free Cash Flow to rise to $1.38 billion by 2028. Beyond that, projections through 2035 are extrapolated using reasonable growth rates and reach an estimated $1.65 billion in Free Cash Flow by 2035.

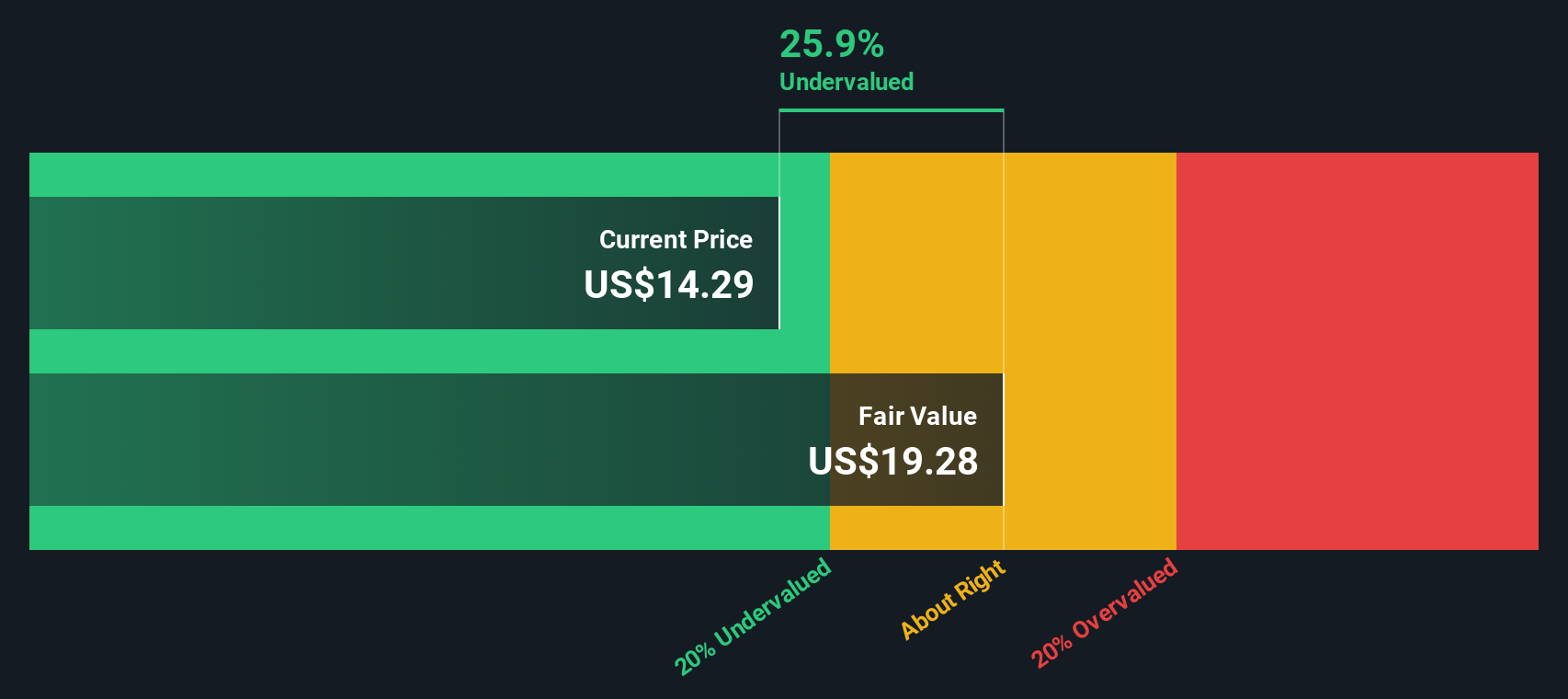

With this stream of future cash flows, Simply Wall St’s two-stage Free Cash Flow to Equity model calculates AES’s intrinsic value at $19.28 per share. This figure is 27.0% above the current share price, indicating the stock could be significantly undervalued if these cash flow expectations play out.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AES is undervalued by 27.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: AES Price vs Earnings

For companies that are generating profits, the Price-to-Earnings (PE) ratio is a go-to valuation metric. It gives investors a quick snapshot of how much they are paying for each dollar of earnings, which is useful for comparing similar companies across a sector. Generally, higher expected growth justifies a higher PE ratio, while higher risks or slower growth rates would bring that “normal” or “fair” PE down.

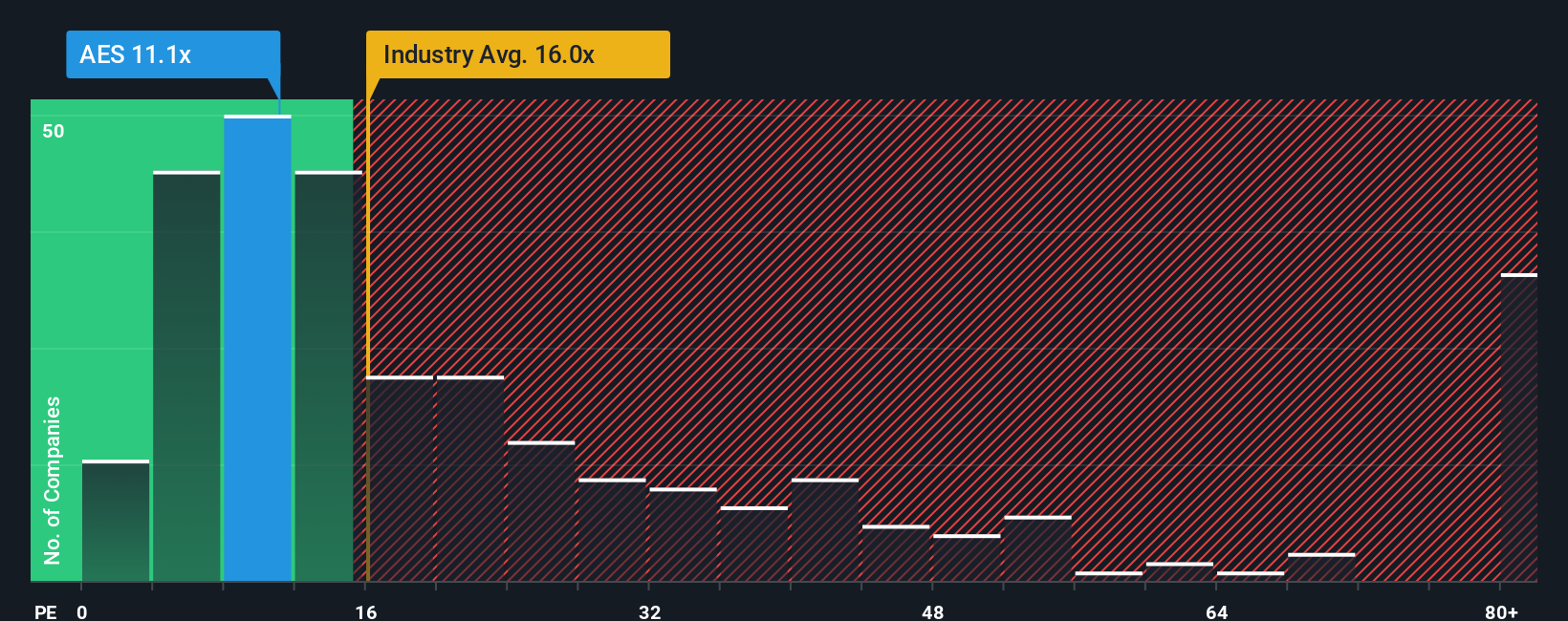

Looking at AES, its current PE ratio stands at 10.9x. To put that in perspective, the average PE ratio for companies in the Renewable Energy industry is 16.3x, while the peer group average is much higher at 56.2x. At first glance, this positions AES as cheaper than both its typical industry peer and the sector overall.

But simply lining up those averages does not tell the whole story. That is where Simply Wall St’s “Fair Ratio” comes in, a proprietary measure that considers not just what peers and the industry are trading at, but also AES’s earnings growth outlook, profit margins, market cap and specific risks. For AES, the Fair Ratio is calculated at 30.1x, reflecting a blend of these more tailored factors.

This Fair Ratio helps avoid the common pitfalls of raw comparisons, as it weighs variables like future growth, profitability and company size, offering a more nuanced benchmark than just looking at industry averages. The verdict? With AES priced at 10.9x, well below its Fair Ratio of 30.1x, the stock currently appears materially undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AES Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects the story you believe about a company—why it will succeed or struggle—with concrete financial forecasts and a resulting fair value, all in a single, easy-to-use tool on Simply Wall St’s Community page.

Instead of relying on static metrics, Narratives allow you to blend your own insights, expectations for revenue, profit margins, and future earnings into a personalized outlook, making investing more intuitive and dynamic. Millions of investors use this feature to clearly map out their reasoning, test scenarios, and see in real time how changes in news or company results update the fair value they see.

These Narratives empower you to compare your calculated Fair Value against the current price and quickly decide if now is the right time to buy or sell, even as the facts on the ground shift. For AES, for example, some investors, seeing long-term gains from renewables growth, have Narratives with price targets as high as $23.00, while others, focusing on debt and subsidy risk, set targets as low as $5.00. This shows just how different strategies and assumptions can be reflected using Narratives.

Do you think there's more to the story for AES? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AES

AES

Operates as a power generation and utility company in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives