- United States

- /

- Other Utilities

- /

- NYSE:AEE

A Look at Ameren's Valuation Following Executive Leadership Restructuring Announcement

Reviewed by Kshitija Bhandaru

Ameren has announced a major reorganization of its executive team, introducing a new group president position to oversee its utility operations. The revamped leadership lineup will take effect on January 1, 2026, and aims to support future growth.

See our latest analysis for Ameren.

Ameren’s recent leadership shuffle comes on the heels of strong financial momentum. Its year-to-date share price return sits at 17.1%, while the total shareholder return for the past year reached 22.0%. Positive sentiment has been underpinned by steady dividend declarations and ongoing expansion into renewable energy, signaling investor confidence that could carry through the next phase of the company’s growth story.

If you’re interested in broadening your investment search beyond utilities, now’s the perfect time to see what’s moving among fast growing stocks with high insider ownership.

But with Ameren’s stock closing just below analyst targets and recent gains reflecting strong financials, the question is whether today’s price still leaves upside for investors or if future growth is already priced in.

Most Popular Narrative: 3% Undervalued

With Ameren’s fair value estimate at $107.50 and the last close price at $104.23, the narrative signals a modest upside that could draw investor interest in the coming months. The market appears to be weighing several large growth drivers when arriving at this price target.

Rapid growth in data center demand driven by digitalization trends and an influx of hyperscalers seeking affordable, reliable electricity has resulted in 2.3 GW of signed construction agreements and a robust pipeline extending well beyond 2032. This positions Ameren for substantial sales and revenue growth from large-load customers over the next decade.

How does a growing pipeline of hyperscalers and grid upgrades factor into Ameren’s valuation? There is a blueprint here that hinges on margin expansion, ambitious revenue forecasts, and a future earnings multiple rivaling industry leaders. Don’t miss the bold assumptions that could tip this stock’s fair value.

Result: Fair Value of $107.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming regulatory changes or slower than expected demand growth could quickly turn Ameren’s promising outlook into a test of its execution and adaptability.

Find out about the key risks to this Ameren narrative.

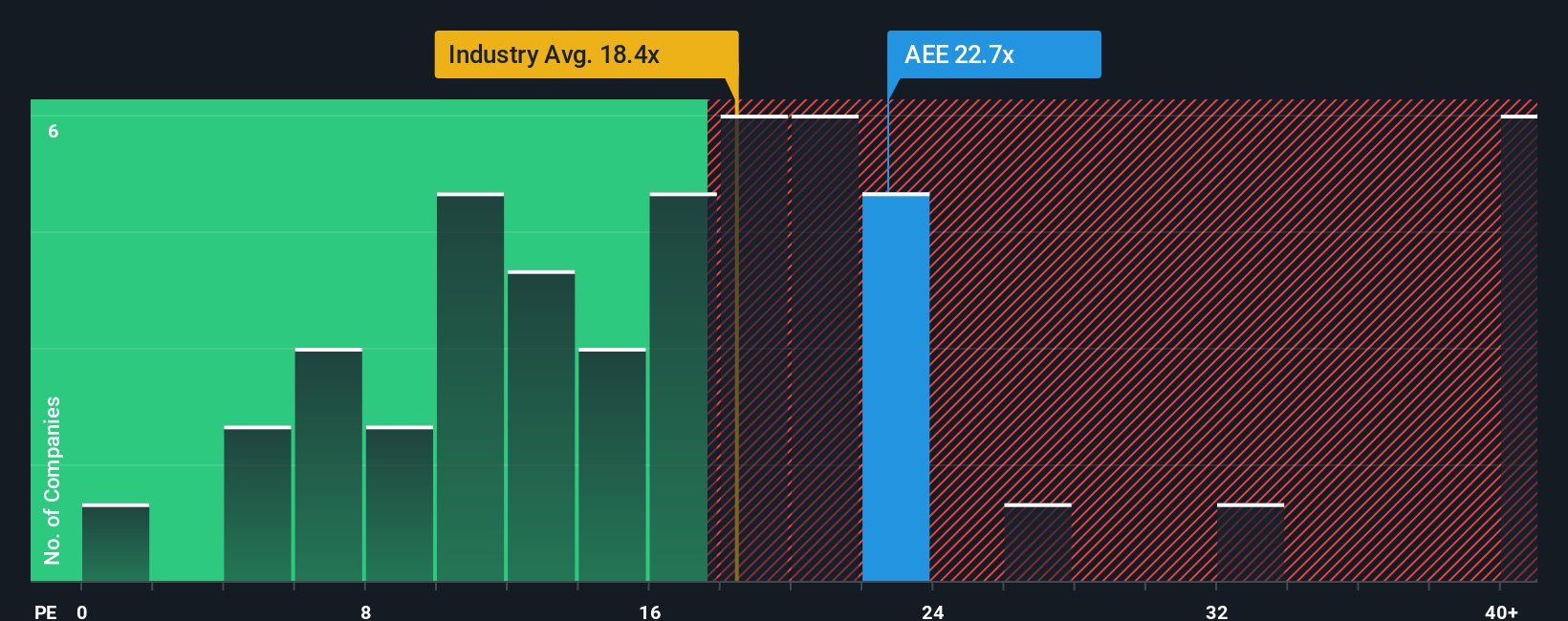

Another View: Multiples Tell a Different Story

Looking at Ameren through the lens of its price-to-earnings ratio, a different picture emerges. The stock is trading at 23x earnings, higher than both its industry peers (18.2x) and even above what would be considered a fair ratio at 21.4x. This suggests investors are paying a premium, potentially raising valuation risk if future growth falls short. Is optimism running a little too hot in the current price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameren Narrative

If you think there’s another angle to the story or want to put the data together yourself, it only takes a few minutes to craft your own perspective. So why not Do it your way?

A great starting point for your Ameren research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by while the market moves. The smartest investors stay ahead by searching for stocks that fit their own goals and timing.

- Uncover stocks quietly outperforming with cash flows by checking out these 881 undervalued stocks based on cash flows now.

- Boost your passive income potential by targeting companies offering robust yields through these 18 dividend stocks with yields > 3%.

- Take advantage of the disruptive momentum in digital assets and payments by evaluating these 79 cryptocurrency and blockchain stocks today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEE

Ameren

Operates as a public utility holding company in the United States.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives