- United States

- /

- Electric Utilities

- /

- NasdaqGS:XEL

Assessing Xcel Energy (XEL) Valuation After Its Recent Share Price Pullback

Reviewed by Simply Wall St

Xcel Energy (XEL) has quietly slipped about 3% over the past week and 9% over the past month, even as its one year total return still sits in double digits.

See our latest analysis for Xcel Energy.

At around $73.73, the recent pullback in Xcel Energy’s share price, including an 8.5% 1 month share price decline, looks more like fading near term momentum than a reversal of its solid longer term total shareholder returns.

If this kind of defensive name has your attention, it might also be worth exploring healthcare stocks for other resilient ideas that could complement a utilities heavy portfolio.

With shares now trading below analysts’ average target and growth in both revenue and earnings still solid, investors face a familiar dilemma: is Xcel Energy temporarily mispriced, or is the market already baking in years of steady expansion?

Most Popular Narrative Narrative: 16.6% Undervalued

With Xcel Energy last closing at $73.73 against a most popular narrative fair value in the high $80s, the case hinges on a powerful long term growth engine.

Analysts are assuming Xcel Energy's revenue will grow by 7.6% annually over the next 3 years.

Analysts assume that profit margins will increase from 14.9% today to 16.7% in 3 years time.

Curious how steady utility growth turns into a richer future earnings multiple and a higher fair value than today? The load growth story may surprise you.

Result: Fair Value of $88.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent wildfire liabilities and delayed regulatory approvals on Xcel’s sizable capex pipeline could pressure earnings and derail the undervaluation narrative.

Find out about the key risks to this Xcel Energy narrative.

Another View: Valuation Looks Less Generous On Cash Flows

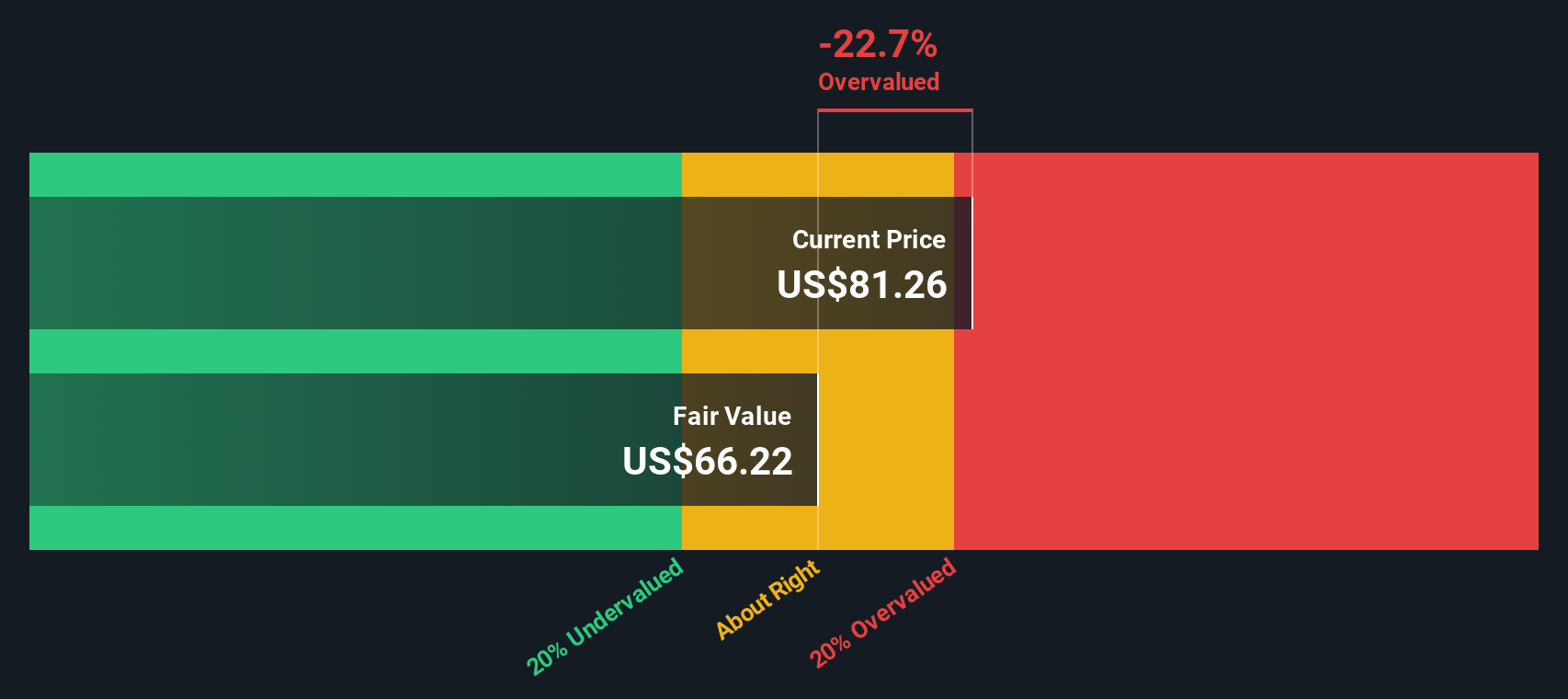

Our DCF model paints a cooler picture, suggesting Xcel Energy’s fair value sits closer to $65.71. That would make today’s $73.73 share price look overvalued rather than cheap. If future cash flows disappoint even modestly, how much downside room does that leave?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Xcel Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Xcel Energy Narrative

If you see things differently or would rather dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Xcel Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, explore your next opportunities by using the Simply Wall St Screener to uncover focused, data-driven stock ideas tailored to your strategy.

- Explore growth at the smaller end of the market by scanning these 3625 penny stocks with strong financials for emerging businesses with the financial strength to scale.

- Focus on the AI space by reviewing these 25 AI penny stocks that are involved in the next wave of intelligent technology.

- Seek income and potential stability by targeting these 13 dividend stocks with yields > 3% that provide regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XEL

Xcel Energy

Through its subsidiaries, engages in the generation, purchasing, transmission, distribution, and sale of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)