- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

What Talen Energy (TLN)'s Leadership Reshuffle And Dilution Controls Mean For Shareholders

Reviewed by Sasha Jovanovic

- Talen Energy recently realigned its executive ranks, keeping Mac McFarland as CEO while appointing Terry L. Nutt as President and Cole Muller as CFO, and extending new employment agreements through February 28, 2027.

- The decision to allow partial cash settlement of Emergence Awards and impose lock-ups on executive share sales aims to curb dilution and reinforce long-term alignment with shareholders.

- Next, we’ll examine how these refreshed leadership contracts and dilution-reducing incentives may influence Talen Energy’s investment narrative.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Talen Energy Investment Narrative Recap

Talen’s investment case rests on rising power demand from data centers, the AWS nuclear contract, and disciplined deleveraging, set against commodity and policy risks around its gas-heavy fleet. The new executive agreements and partial cash settlement of Emergence Awards look incremental rather than transformative for near term earnings, but they may slightly reduce dilution and improve visibility around leadership stability during a key execution phase.

Among recent announcements, the FERC and DOJ clearance for acquiring the Freedom and Guernsey gas-fired plants ties directly into this leadership update. As Talen integrates nearly 2.9 GW of new CCGT capacity to serve data center growth while managing higher leverage, investors may see the refreshed contracts and equity lock-ups as a governance backdrop for delivering on those integration and free cash flow targets.

Yet against this growth story, investors should be aware that if decarbonization policies accelerate faster than expected...

Read the full narrative on Talen Energy (it's free!)

Talen Energy's narrative projects $4.2 billion revenue and $1.1 billion earnings by 2028. This requires 25.1% yearly revenue growth and about a $0.9 billion earnings increase from $187.0 million today.

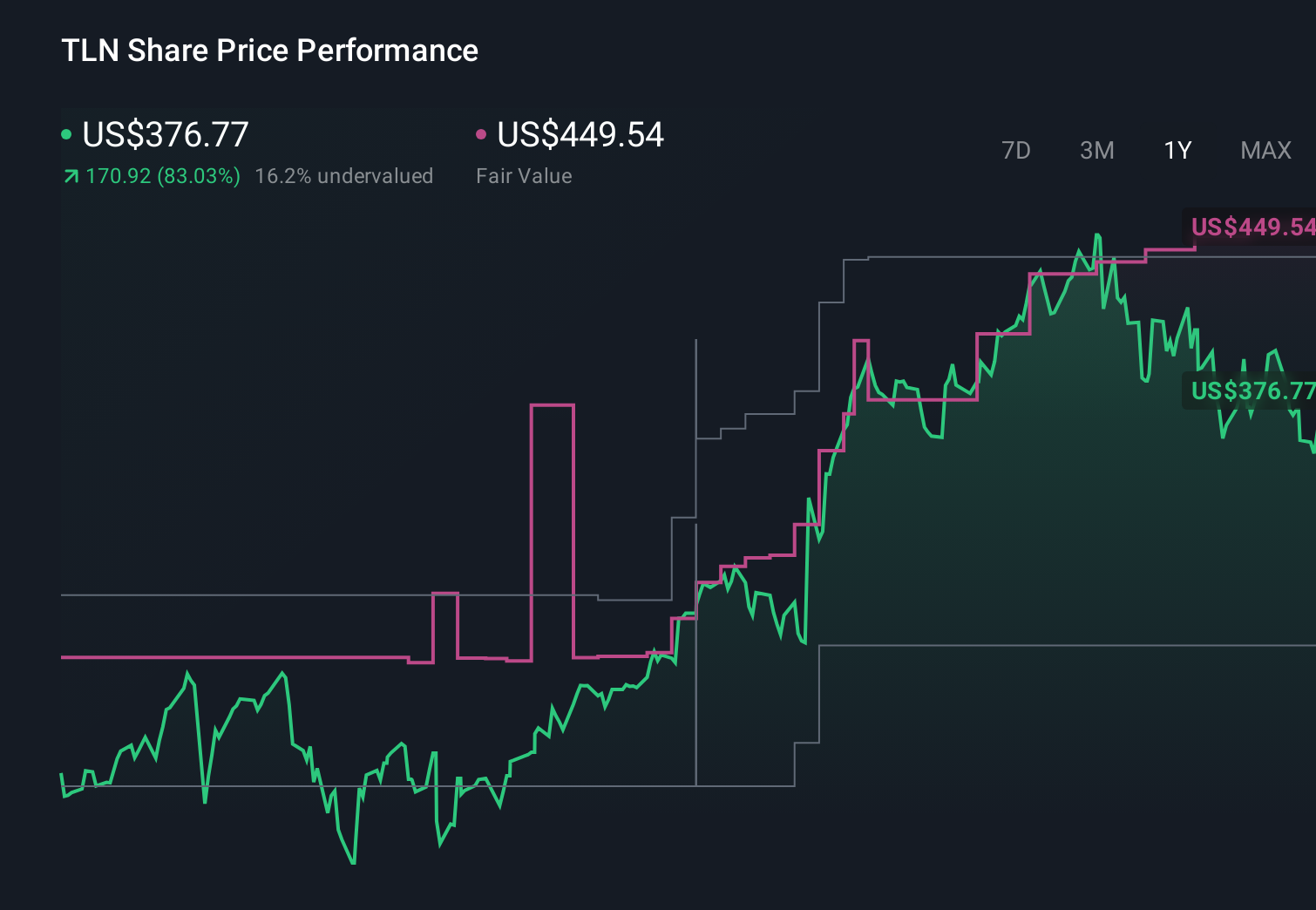

Uncover how Talen Energy's forecasts yield a $449.54 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for Talen span roughly US$300 to about US$1,091 per share, underlining how far apart individual views can be. You can set those opinions against the company’s reliance on fossil generation at a time when policy shifts or faster decarbonization could materially affect asset values and long term earnings power.

Explore 5 other fair value estimates on Talen Energy - why the stock might be worth over 3x more than the current price!

Build Your Own Talen Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talen Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Talen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talen Energy's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)