- United States

- /

- Electric Utilities

- /

- NasdaqGS:OTTR

Otter Tail (OTTR): Evaluating Value After Surprising Earnings Beat

Reviewed by Simply Wall St

If you’ve been following Otter Tail (OTTR), you might have noticed some extra buzz after its most recent earnings release. The company just posted results that beat expectations on both earnings per share and revenue, with EPS clocking in at $1.85 and revenue hitting $333 million. This kind of financial surprise is always worth a closer look, especially when it comes to rethinking whether now is the right time to buy, hold, or wait on the sidelines.

This upbeat earnings news lands on the heels of a respectable year for Otter Tail, with shares climbing nearly 9% in the last twelve months and 14% so far year-to-date. While the stock wobbled a bit during the past week, its longer-term momentum remains unmistakable, supported by a 154% total return over five years. Even against that impressive backdrop, growth in annual revenue hasn’t translated into a higher net income, which dipped this year.

So, does Otter Tail’s latest beat signal a bargain for investors, or has the market already priced in all that future growth? Let’s dig into the numbers and see where value really stands now.

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Otter Tail is considered fairly valued, with its current share price sitting nearly level with the analyst consensus price target. The numbers suggest the market has already priced in most near-term expectations for growth and profitability.

Ongoing and possibly intensifying environmental regulations, despite recent EPA reconsiderations, pose continued risk to Otter Tail's coal assets. This could lead to elevated compliance costs, unplanned capital expenditures, and stranded asset charges, compressing net margins and long-term return on equity.

Curious about which fundamental trends drive this razor-thin margin of fair value? The narrative hints at a mix of cash flow stability, shifting profit margins, and industry-beating investments at the core of its assumptions. Want to decode the real engine behind the price? The underlying projections might surprise you.

Result: Fair Value of $83 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, if Otter Tail secures large new electricity loads or successfully boosts returns from its diversified segments, earnings could grow faster than forecasts suggest.

Find out about the key risks to this Otter Tail narrative.Another View: Discounted Cash Flow Says Otherwise

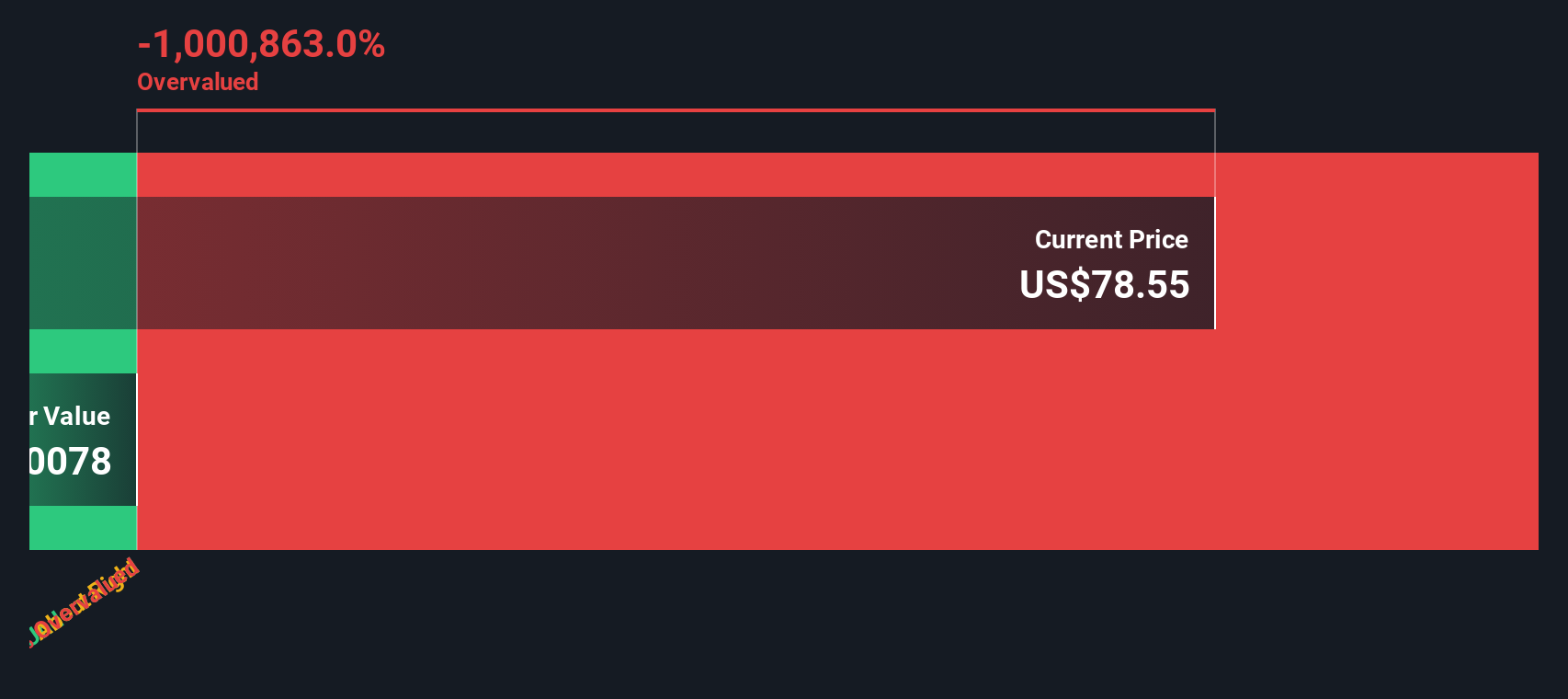

While the analyst price target says Otter Tail is trading close to fair value, our SWS DCF model estimates the stock is priced well above its intrinsic worth. When classic multiples and cash flow models disagree, which side do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Otter Tail Narrative

If you see things differently or want to dive deeper on your own, you can craft a custom narrative for Otter Tail in just a few minutes. Do it your way.

A great starting point for your Otter Tail research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready to Find Your Next Winning Investment?

Why stop at just one opportunity? Take charge of your portfolio by tapping into some of the market’s most exciting themes. Other investors are already using these powerful tools to get ahead.

- Uncover potential in little-known companies with solid fundamentals, using our penny stocks with strong financials to spot tomorrow’s standout performers in today’s overlooked corners of the market.

- Grow your passive income by targeting stocks boasting robust, high-yield dividends. Access them now through our dividend stocks with yields > 3% to put your capital to work smarter.

- Ride the wave of artificial intelligence breakthroughs. Check out our AI penny stocks for access to innovators shaping the next era of smart technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:OTTR

Otter Tail

Engages in electric utility, manufacturing, and plastic pipe businesses in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)